Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

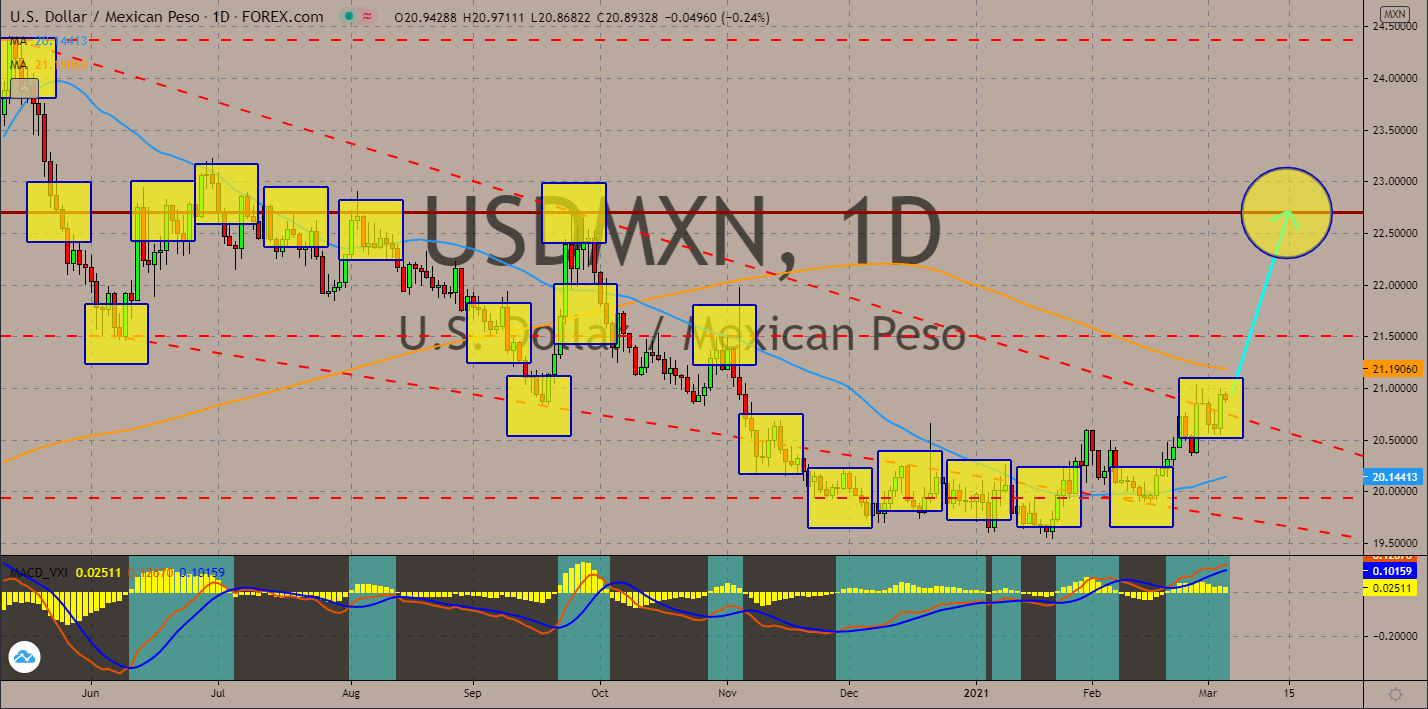

USDMXN

Investors has been shifting their portfolio allocation from the Mexican peso towards the local equities. This was following the interest rate cut by Banxico of 25 basis points to 4.0%. The bullish expectations on the stock market were further intensified by the optimistic outlook on Mexico for fiscal 2021. The country’s central bank sees a 4.8% economic expansion during the period followed by 3.3% growth in 2022. These figures were major revisions from the prior expectations of 3.3% and 2.6%, respectively. This was despite the ratification of the social security benefit count from 150,000-500,000 to 250,0000-570,000. In the final quarter of 2020, gross domestic product (GDP) increased by 3.3%. The MACD Signal lines showed a continued bullish movement for the USDMXN pair. Meanwhile, Histogram bars are stable. Also, 50 and 200-day moving averages are showing a possible bullish crossover this month after prices bounced back from 50-MA.

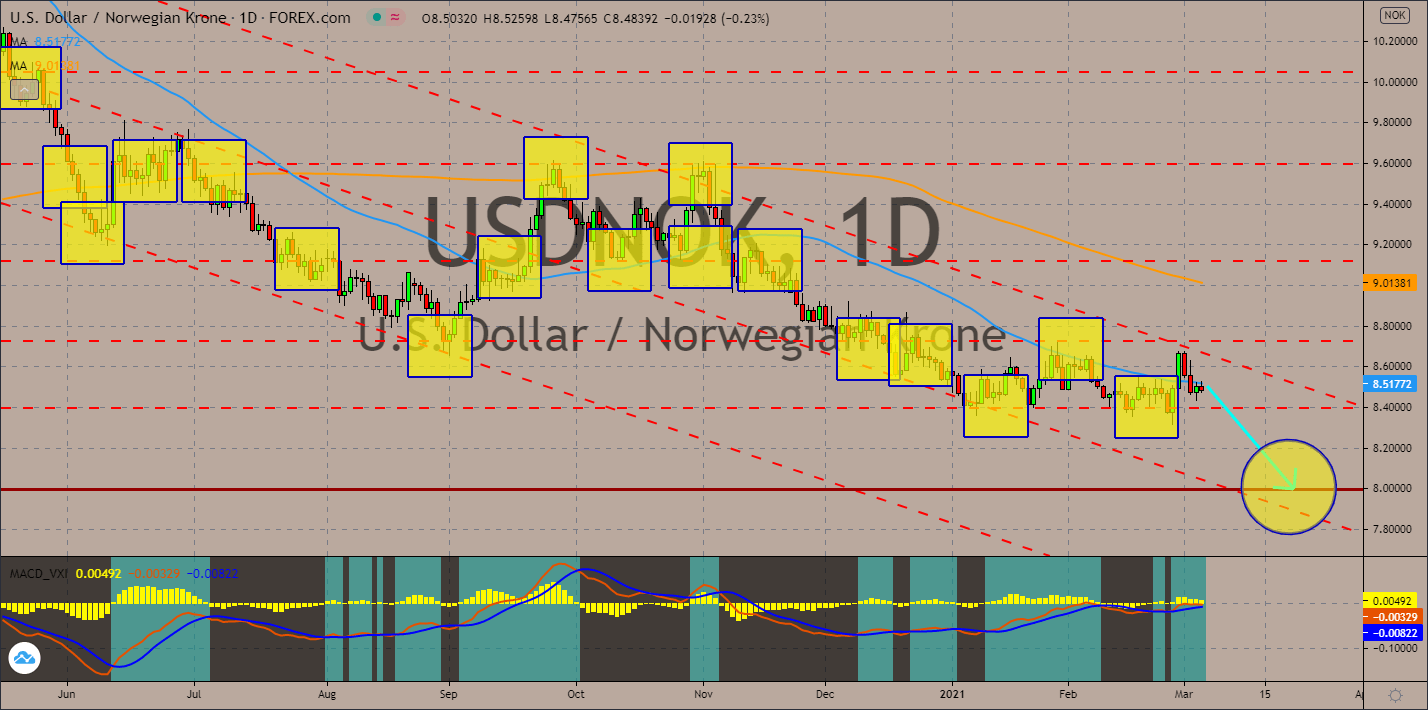

USDNOK

Norway’s House Price Index rose to a 4-year high on Wednesday, March 03. This was after figures came in at 9.70% for the month of February, beating the previous record of 8.60% for the first month of fiscal 2021. The increase in the report will affect the inflation data, and with high inflation comes the risk of decline in the local currency. Analysts believe that the central bank will step up to raise interest rates if needed. Adding to the attractiveness of the Norwegian krone is the possibility of increasing restrictions in the country due to the fourth wave of the coronavirus pandemic. On Monday, March 01, Oslo recorded its highest daily infections this year at 729 new cases. In total, COVID-19 cases in Norway is at 72,923 with 632 deaths. The infected individuals represent 1.33% of the entire population. Prices are currently trading below the 50-bar moving average while the MACD indicator shows a bearish momentum for the USDNOK pair.

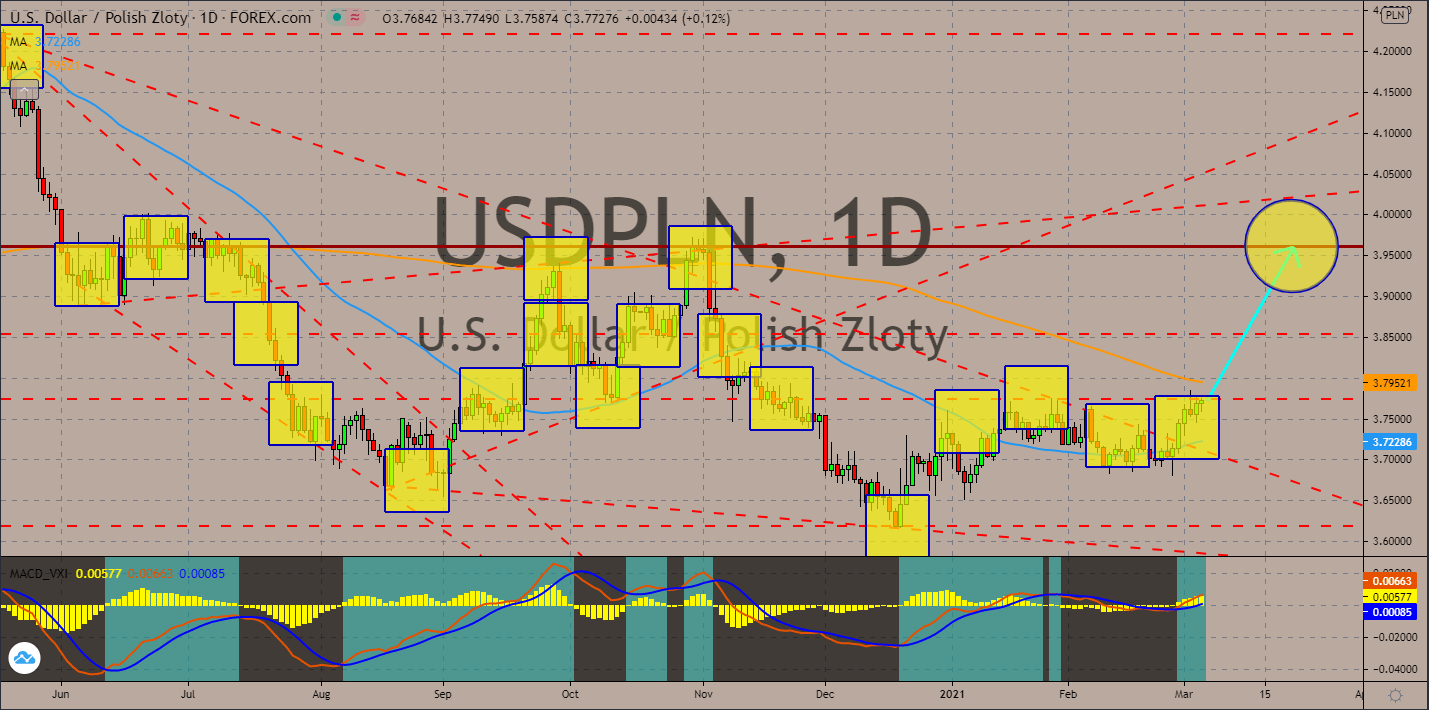

USDPLN

The Polish central bank left its interest rate of 0.10% unchanged on Wednesday, March 03, despite the continued risk of rising inflation and the optimistic projection for 2021 and 2022 GDP growth. According to the country’s central bank, Poland will remain as one of the fastest growing economies in the EU with fiscal 2021 GDP expectations between 2.6% to 5.3%. Unlike a slowdown anticipated in 2022 among several economies, Poland will likely surpass the 2021 forecast with an upper range projection of 6.9%. Meanwhile, inflation is anticipated between 2.7% and 3.6% range in 2021 and a median 2022 data at 2.8%. These optimistic projections were further boosted by the recent comment by Tadeusz Koscinski, Poland’s finance chief. The finance minister said that the V4 nations will likely propel the growth in Europe as major economies like Germany, France, and the UK are facing trouble with their finances and rising COVID-19 cases.

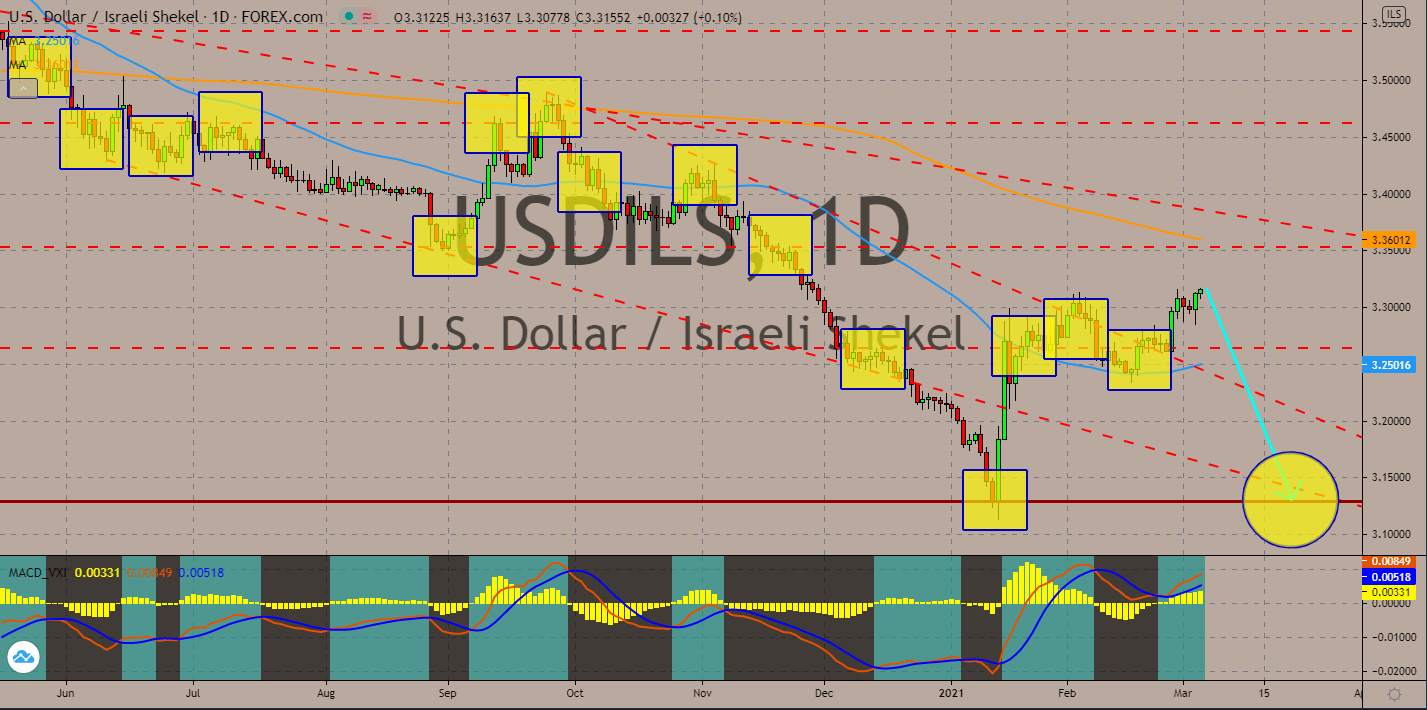

USDILS

The pair will reverse back as Israel is set to reopen its economy on Sunday, March 07, as ministers gave a 7 to 10 grade on the easing of restrictions. The leisure activities will be available only for individuals who have been inoculated against COVID-19. Other countries are also exploring this option on what was famously known as “COVID-19 Passport”. Gatherings are now available for 50 individuals, up from the 20 people previously allowed. Prime Minister Benjamin Netanyahu is also planning to open schools next week. In addition to this, the Israeli leader sets a target of April 5 for the total reopening of the economy when all its population are able to receive at least 1 jab of coronavirus vaccine. The news will lift all Israeli asset classes including the shekel. Prices are expected to reverse back in coming sessions after hitting the 200-day moving average. On the other hand, MACD indicator is expected to retreat and show bearish momentum to support price action.

COMMENTS