Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

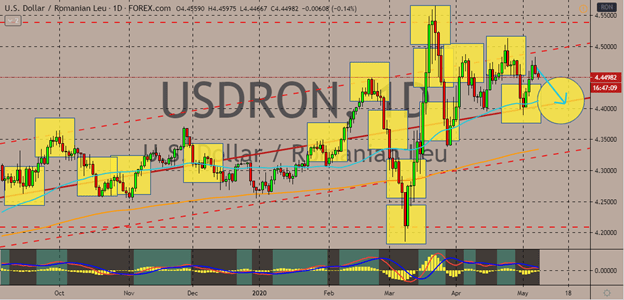

USDRON

The Romanian leu takes advantage of the weakening dollar and makes way for recovery. The US dollar to Romanian leu exchange rate is bound to hit its support level in the coming sessions as the greenback eases thanks to economic concerns. Bullish investors aren’t feeling as confident as before thanks to the evident impact of the novel coronavirus brought lockdowns to the American labor force. Recent reports from the US private sector’s nonfarm employment change and initial jobless claims earlier this week have strained the buck. And to make matters even worse, the upcoming nonfarm payroll due later is believed to be one of the harshest in history. See, all this could sound good at first as it will raise the safe-haven security of the greenback. However, it could ultimately lead to more stimulus from the US authorities which could really be detrimental to the greenback’s strength. Also, talks of negative rates are now in the table thanks to pessimistic news.

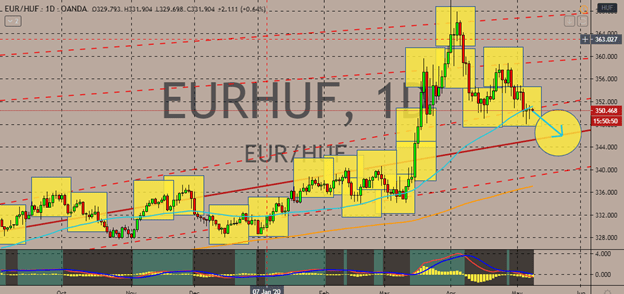

EURHUF

The euro struggles to hold on to its gains against the Hungarian forint. And looking at the forint’s performance in the forex market, it’s doing considerably well and is even on track to gradually recover against the single currency. Bullish investors are still quite concerned about the recent news about Germany’s highest court took aim at the quantitative easing program of the European Central Bank dubbed as the Public Sector Purchase Programme. However, it’s worth noting the Hungarian forint’s movements aren’t as seen in previous sessions. Perhaps the news that the Hungarian economy is now projected to contract for at least 3% to 5% thanks to the lockdowns brought by the pandemic. It’s worth noting that the Hungarian economy was the second fastest-growing economy last year prior to the pandemic as it recorded a growth of 4.9%, falling just short behind Malta. Hungary’s economy is also significantly above the average EU inflation of 1.5%.

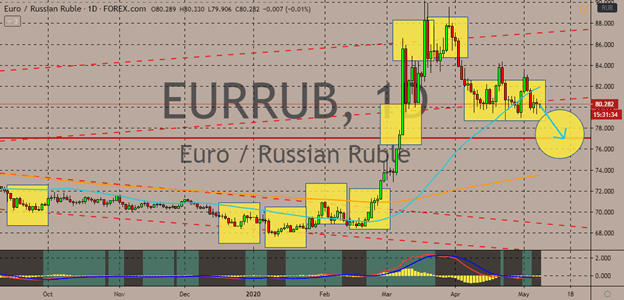

EURRUB

The euro to Russian ruble trading pair is heading to its support levels thanks to the bearish support from the stabilizing crude market. It appears that crude prices are still fighting to hold their current levels and not crash once again, such news has supported the Russian ruble. The commodity-linked currency is also supported by the reported improvements in the Russian economy. Yesterday, the Russian Federation Federal State Statistics Service reported that the yearly consumer price index grew from 2.5% to 3.1% last month as expected. The improvements are noted by investors as it indicates that Moscow’s economy is recovering amidst the pandemic. The positivity in the country has buoyed the Russian stock market slightly yesterday and has fortified the Russian ruble against the faltering euro. Aside from the news about Germany’s highest court, the bloc’s single currency is also weight by the latest economic projections of the European Commission.

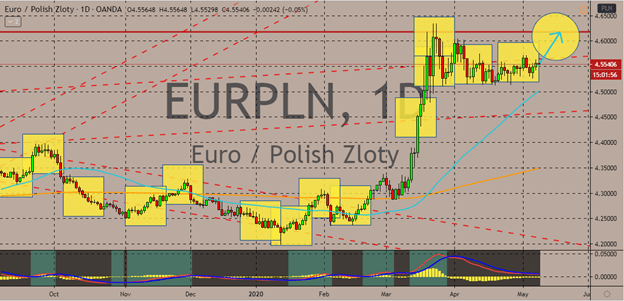

EURPLN

The EURPLN may have steadied today, but signs say that the pair won’t be able to gain strong bearish momentum. The Polish zloty is widely considered now as undervalued thanks to the rate cuts from the Polish central bank earlier this year. Experts say that the rate cut wasn’t really necessary and now, it has greatly contributed to the weakness of the Polish zloty. Poland’s central bank has already slashed its interest rates twice this year in efforts to counter the impact of the novel coronavirus to the economy. However, perhaps it may have been overdone as it has brought immense pressure to the zloty. The country’s benchmark rate now stands at its all-time lows at 0.5% thanks to the two rate cuts. The single currency to Polish zloty exchange rate is on track to climb to its resistance once again in the coming sessions. Although bullish investors will also have a rough time as the euro is also pressured by several factors.

COMMENTS