Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

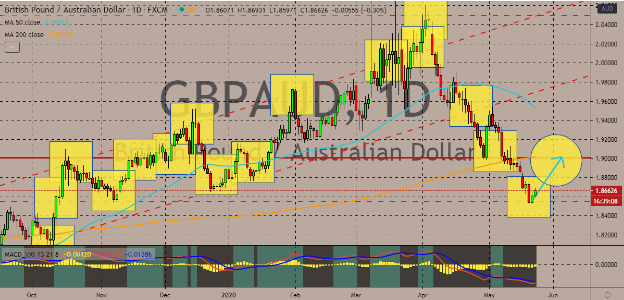

GBPAUD

Trade tensions between the United States and China have prevented the Australian dollar from further pushing the GBPAUD pair lower. Instead, the trade tension gave an opening for the British pound to overtake the antipodean currency. The Aussie suffered losses when the US Senate approved a bill that could ban Chinese technology giants such as Alibaba and Baidu from US stock exchanges. The approval of the bill marks as an escalation for the prolonged trade tensions between the two economic giants. The news gave an opportunity for bullish investors to regain their footing and prevent the 50-day moving average to come crashing against the 200-day moving average. Meanwhile, another factor that’s supporting the British pound is the broader weakness of both the Japanese yen and US dollar that was mainly due to the recent announcement of a coronavirus vaccine by the US biotechnology company Moderna Inc. earlier this week.

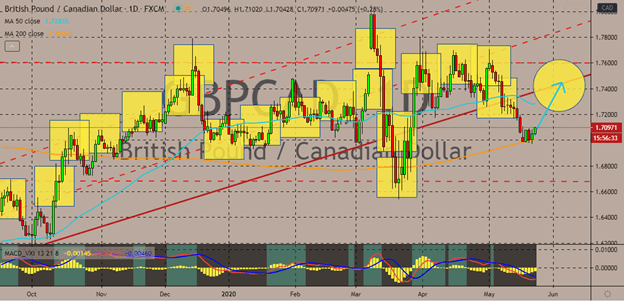

GBPCAD

The main reason for the pair’s sudden turn to green territories is the rising trade tension between Washington and Beijing again. The Canadian dollar weakened against the British pound yesterday as investors weigh on the current sentiment. The sudden weakness of the Canadian dollar could be used by bullish investors to prevent the 50-day moving average from tumbling lower against the 200-day moving average. See, the Canadian dollar is mainly driven by the commodity market. Canada is currently running an account deficit and is one of the major exporters in the commodity market. The heightened trade tensions could tip the fragile balance of the commodity market which, in fact, has just steadily been stabilizing since the epic plunge in prices last month. Just recently, Governor Stephen Poloz of the Bank of Canada said that the world is at a time where interest rates are at relatively low levels and may not tighten yet thanks to the economic slump.

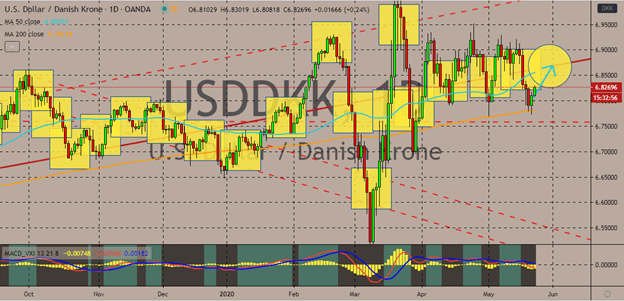

USDDKK

The US dollar gets back up on its feet and is now working to force the USDDKK pair towards the resistance level. The greenback received support yesterday as investors once again weigh on the impact of the global economic lockdowns and the recent bill that may have boosted the safe-haven appeal of the greenback once again. The rise of the US dollar also came in as the number of Americans filing for unemployment continues to rise. This leaves speculations as to whether bulls will have enough gas in their tanks to push beyond the resistance or the pair would only bounce off it. Of course, central bank interventions and stimulus packages from the United States government could once again drain the greenback, preventing it from running away with gains. Another thing worth noting is the gradual reopening of Denmark’s economy which could strengthen the Danish krone in the coming sessions if another wave is successfully avoided.

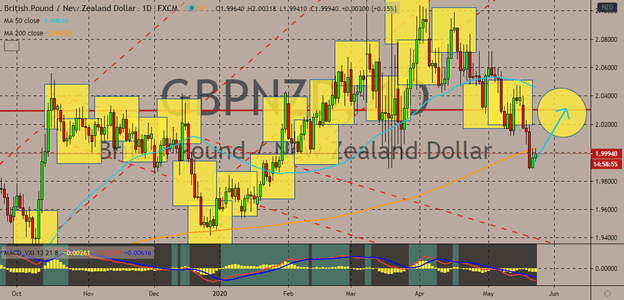

GBPNZD

The British pound’s gains have been limited due to the poor retail sales figures from the United Kingdom. However, the trade tension between the United States and China have also slowed down the New Zealand dollar. Meaning that the pound to kiwi trading pair could still acquire gains and prevent the 50-day moving average from falling down and getting near the 200-day moving average in the coming sessions. The exchange rate is expected to climb towards its resistance by the first few days of June. Although speculations about negative interest rates from the Bank of England could actually be a great hindrance to the Pound sterling’s health in the foreign exchange market. and if the BoE unleashes negative rates, it could be detrimental to the performance of bullish investors of the GBPNZD pair. On the other hand, the trade war between the two greatest economies once again caused the risk appetite in the market to falter, weakening the kiwi.

COMMENTS