Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

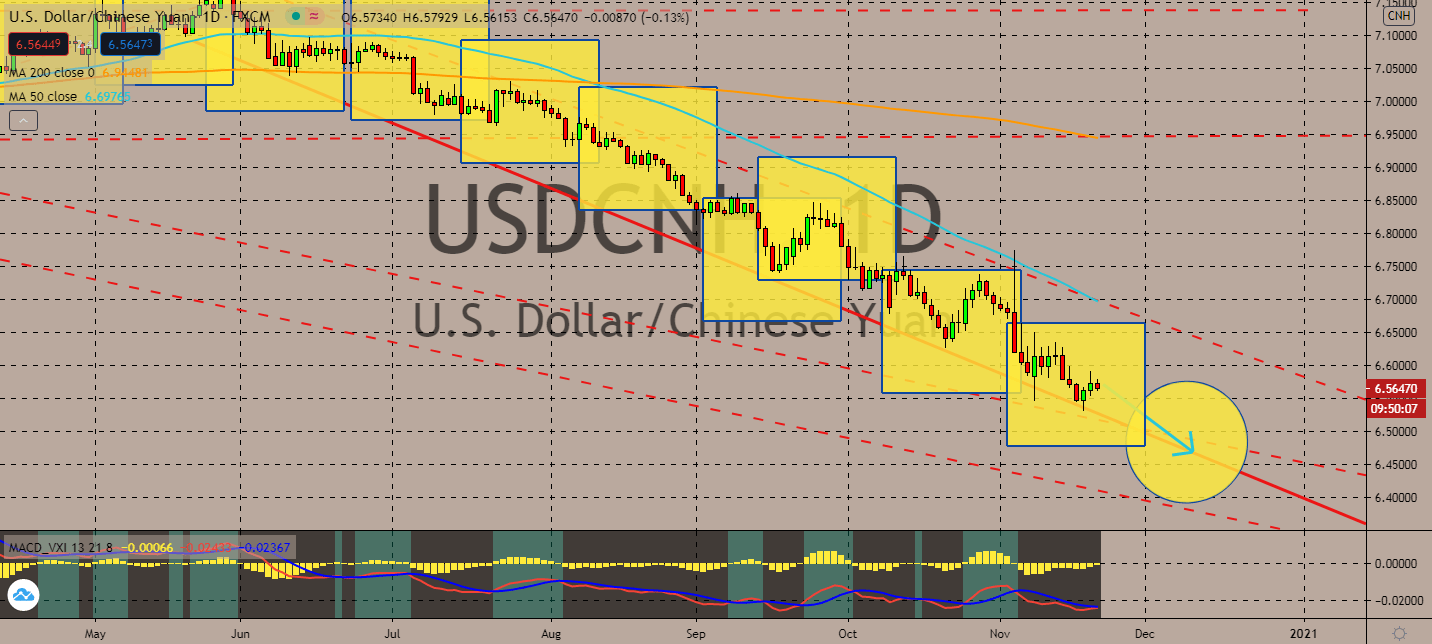

USDCNH

Treasury Secretary Steven Mnuchin recently sent a letter to the Federal Reserve urging the central bank to give back 455 billion US dollars in its emergency budget for the coronavirus. The Trump administration now intends to use the funding for other programs in Congress, claiming that the CARES Act in March had achieved its objective despite the surging coronavirus cases in the country. As tensions rise between the two major powers, the greenback will more likely fall against its Chinese opposite in the near-term. After all, the pair’s 50-day moving average is still far below its 200-day moving average. Interestingly enough, China is continuing to show key improvements in its economy. Industrial production grew by 6.9 percent in October year-on-year, retail sales grew by 4.3 percent, and fixed asset investment saw a growth of 1.8 percent year-to-date. The rate is expected to continue as normal for the rest of the year.

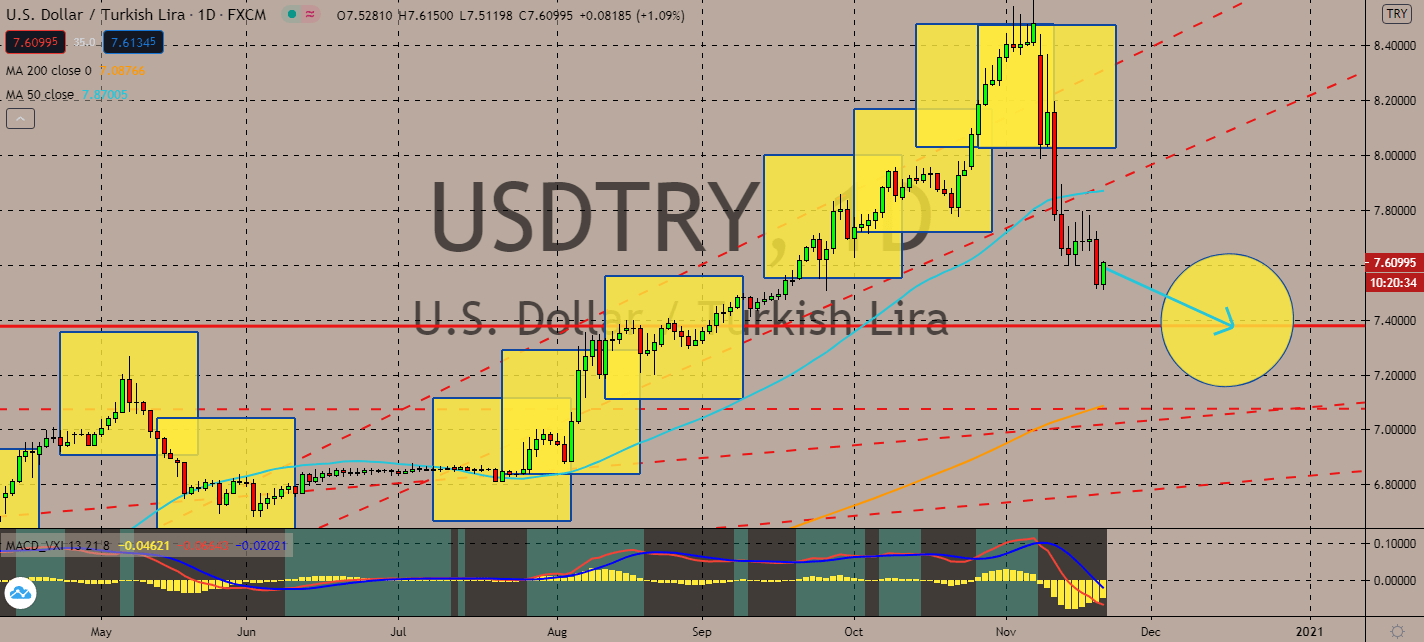

USDTRY

Soon after President Recep Tayyip Erdogan hired a new governor for Turkey’s central bank, the agency raised its key interest rates by a whopping 475 basis points to 15 percent on Thursday. The move was part of the government’s approach to lower the emerging market’s inflation rates with a pledge to keep the rate at this height until inflation had permanently crashed from its double-digit level. The move is projected to ignite a bearish trend for the USDTRY pair despite having its 50-day moving average above its 200-day moving average, considering that the latter measurement had stilled because of the news. Meanwhile, US Treasury Secretary urged the Federal Reserve to return some of its borrowed 455 billion US dollars, which were part of the budget for businesses that were used to help businesses stir away from collapsing in the coronavirus pandemic. Investors are projected to panic over the move in the near-term, bringing the greenback lower.

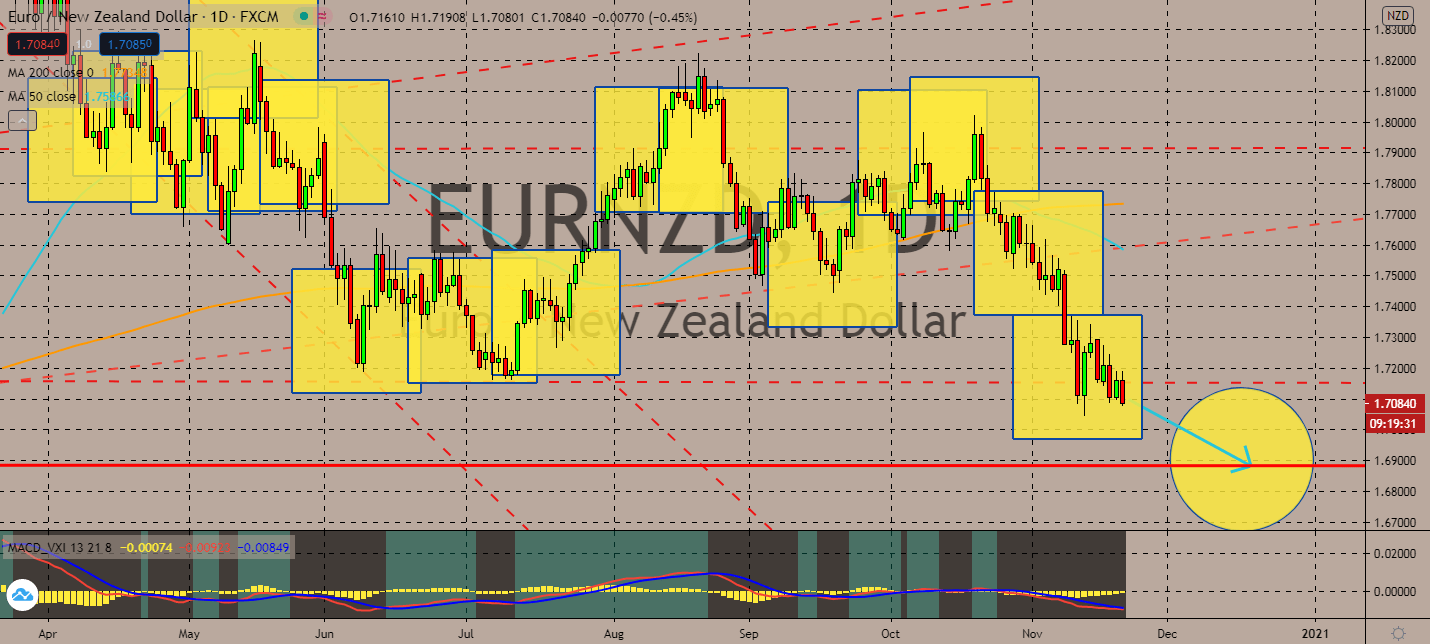

EURNZD

Despite having escaped the threat of the coronavirus, New Zealand is still in an economic recession. The government is currently trying to spend its way through with bond-buying to help lift its economy, as well as its jobs. The Reserve Bank of New Zealand confirmed its plans to lower their interest rates if need be, although economists claim that it will only cause overinflation in the property market. But with that said, the pair’s 50-day moving average is still falling below its 200-day moving average, indicating that investors are paying more attention to the pressing deadline for the European Union’s trade agreement with the United Kingdom, which has been rapidly approaching its deadline while the bloc is forced to deal with its current conflict with Hungary and Poland. The region is still having a difficult quarter, now that it has to deal with half of the total coronavirus cases in the world, a feat that will pull the single currency down near-term.

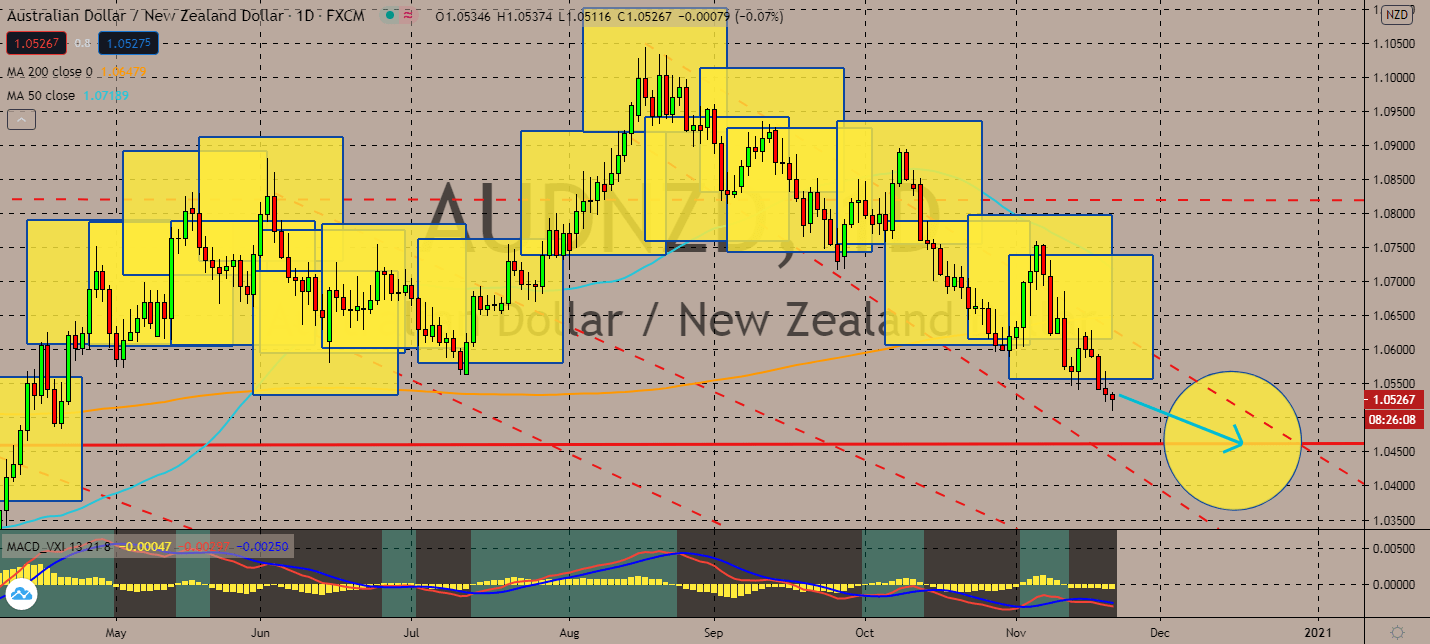

AUDNZD

Investors are projected to react poorly to Australia’s stock exchange in the near-term. An entire session was lost earlier this week as they were faced by a number of other operational systems. The Reserve Bank of Australis said it would look into whether there were systematic underlying issues for exchanges operated by the ASX Ltd. The Aussie dollar will suffer while the market waits for any updates. The pair’s 50-day moving average is still above its 200-day moving average while the exchange falls to low lows, indicating that the bears could take advantage of the situation. Meanwhile, worries that the Reserve Bank of New Zealand would decrease its interest rate is becoming unlikely despite going through an economic recession. The central bank claims that there is no particular reason to use the strategy, and it would only inflame the already overheated property market. The claim should keep the kiwi dollar up against its Aussie opposite.

COMMENTS