Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

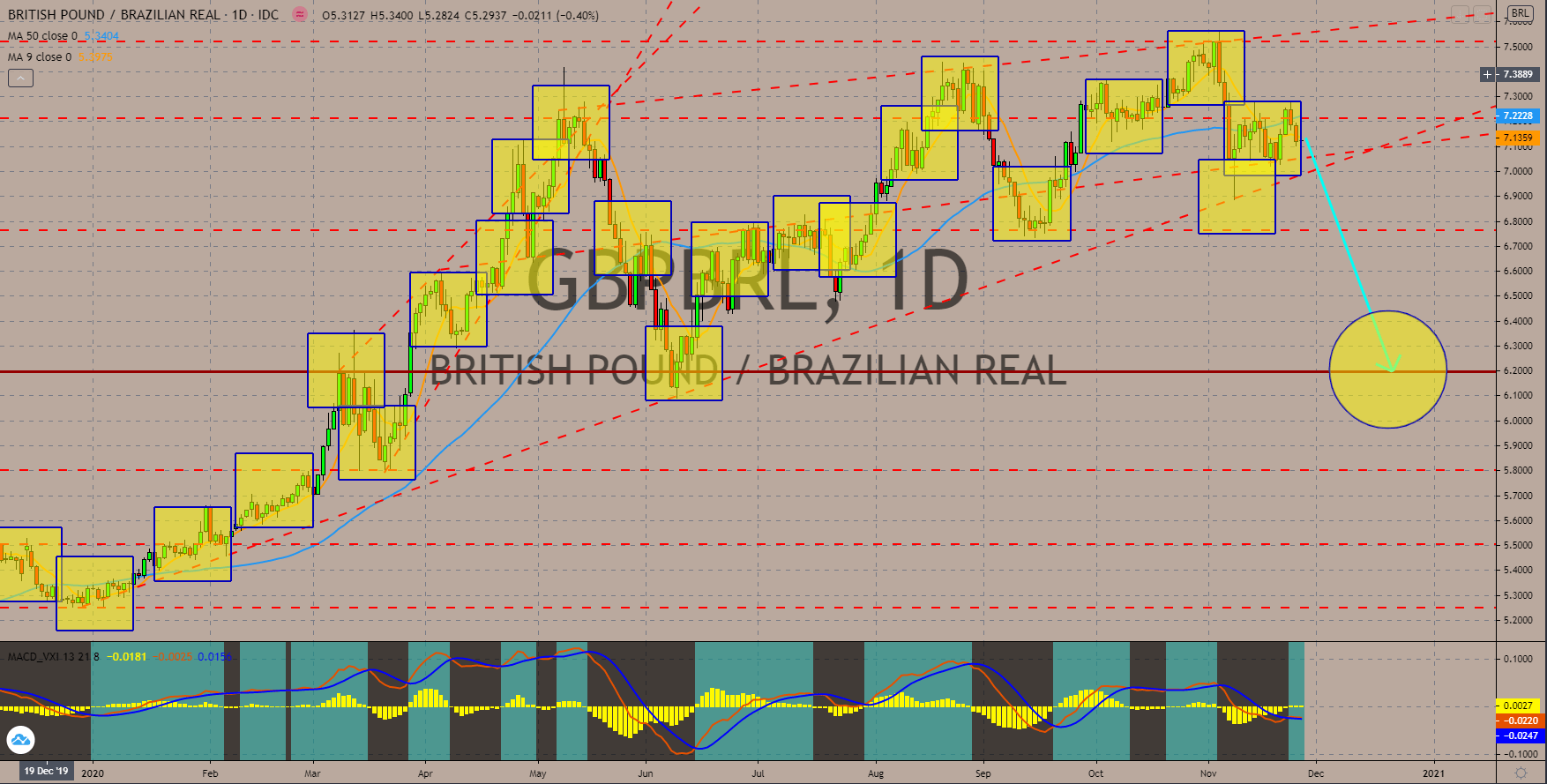

GBPBRL

The Brazilian government’s tax collection for the month of October increased by almost 30.0% to $153.90 billion. This was the highest recorded tax revenue over the course of the pandemic. Analysts said that this figure corresponds to the economic recovery in the country. On the other hand, the United Kingdom and the other European economies have been moving backwards due to the record-breaking new daily cases of COVID-19. Despite beating its peers in the EU for Manufacturing and Services PMI report, the UK still lags compared to other economies outside the region. Figures for the UK reports were 56.7 points and 57.7 points. Meanwhile, the third largest economy in the European Union, France, posted 49.1 points and 38.0 points, respectively. The moving averages are expected to continue to trend lower with the MACD supporting a break down for the GBPBRL in the coming sessions.

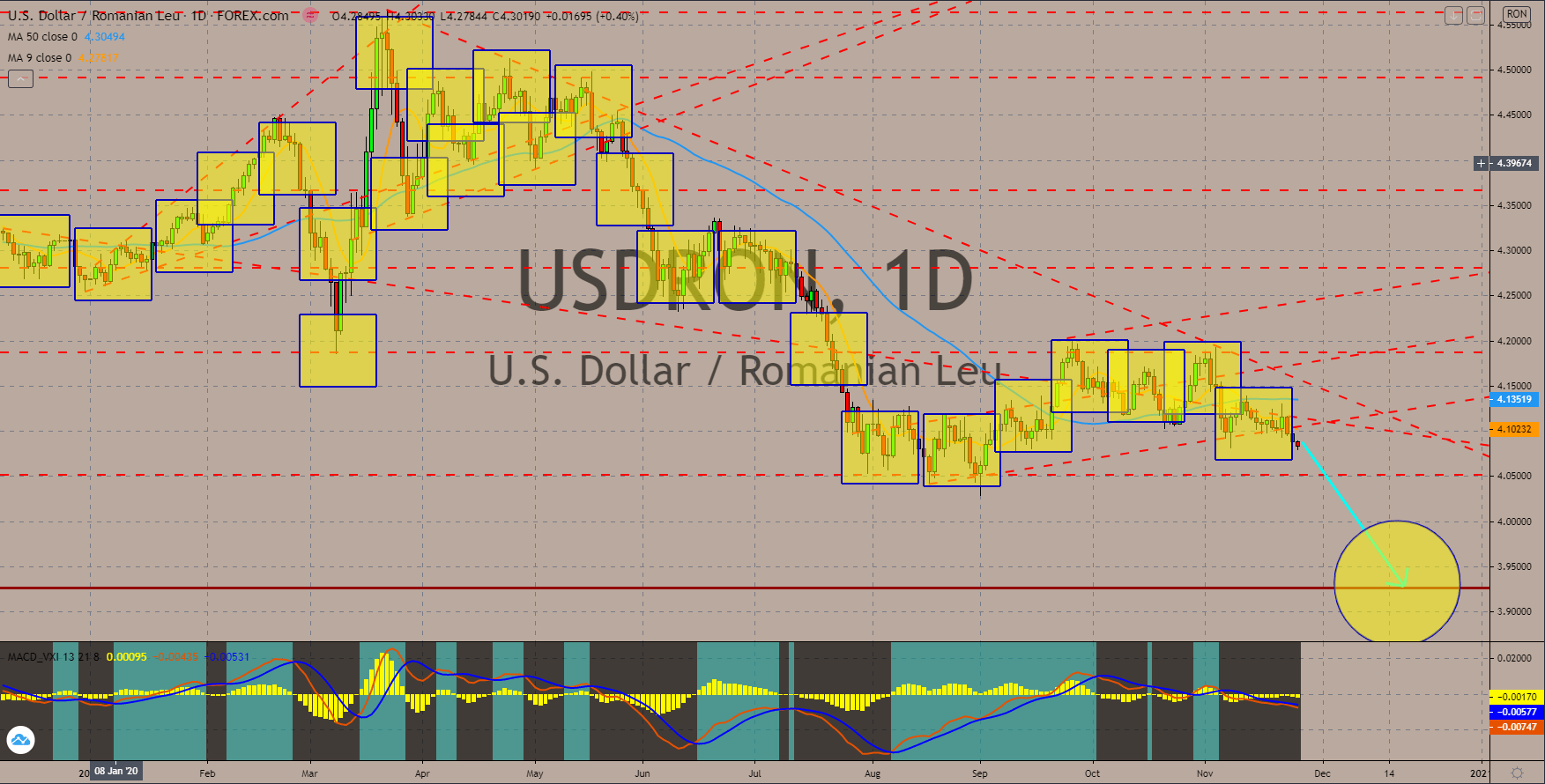

USDRON

The hopes by investors of recovery for the US dollar had vanished following the bleak data from the initial jobless claims report. On Wednesday, November 26, the US recorded 778,000 individuals who filed for their unemployment benefits. The rise in the number of claimants corresponds to the increase in the number of COVID-19 cases in the country. America is still on the number spot in the list of countries with the highest COVID-19 cases. The recent report can result in a higher stimulus bill from the House of Representative. Currently, there is a $2.2 trillion package that is still pending. Since the coronavirus became pandemic in March, the US government and the Federal Reserve cumulatively injected $6.6 trillion. Meanwhile, the US central bank slashed 150 basis points on the country’s benchmark interest rate. The 50 and 200 moving average is back to a bearish crossover while MACD continues to move lower.

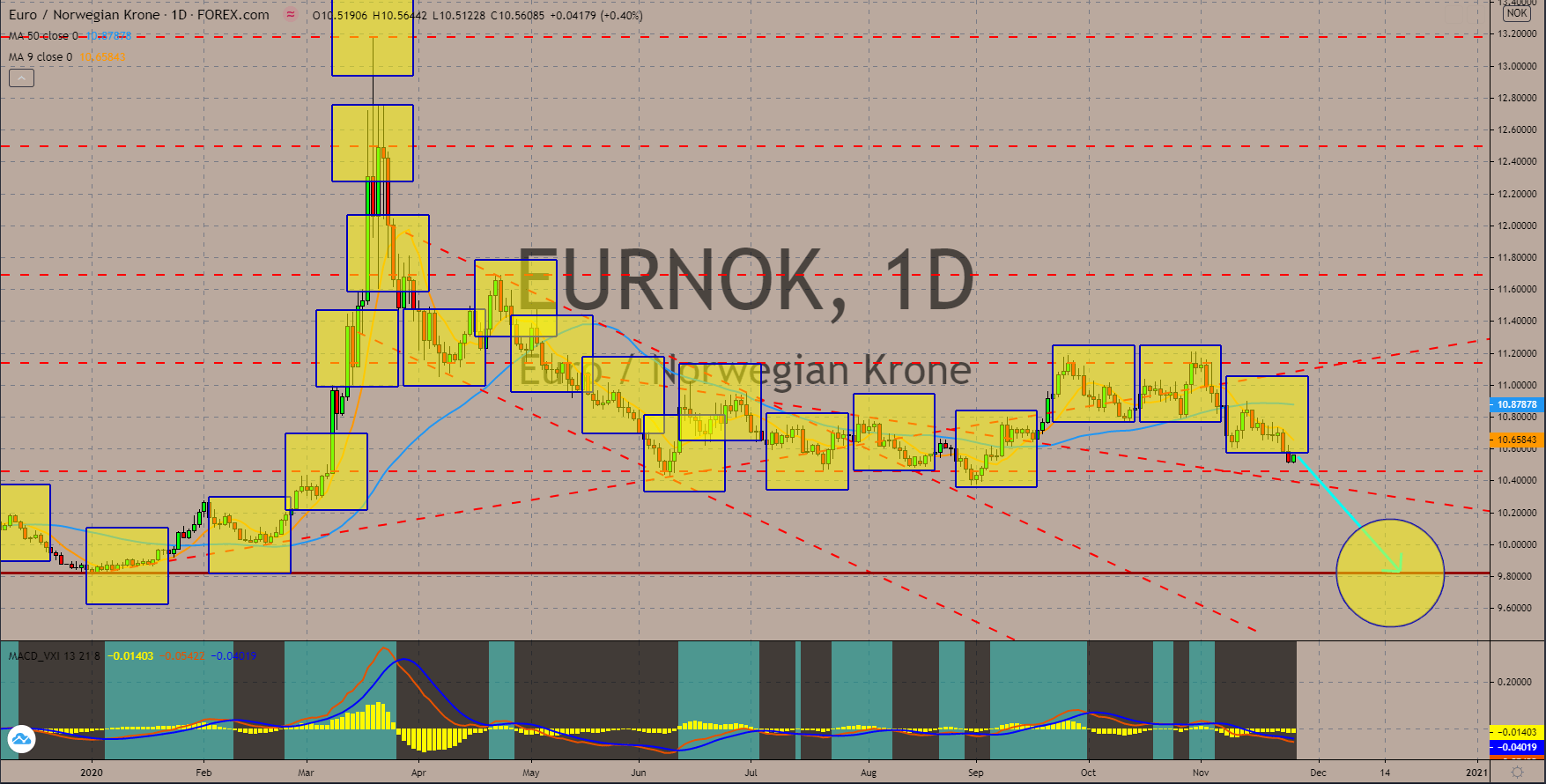

EURNOK

Following the disappointing results for the EU and its member states’ PMI results, reports that measures business and consumer confidence turned bleak. On Thursday, November 26, Germany’s Gfk Consumer Climate dropped anew at -6.7 points for December following last month’s result for November at -3.2 points. Also, confidence by French consumers declined to 90 points from 94 points in the prior result. Producer Pride Index (PPI) in Spain also dropped. Figure came in at -4.1% from -3.3%. Aside from these disappointing results, investors of the single currency must also face the possible impact of the UK’s withdrawal from the bloc. The United Kingdom is the EU’s second largest economy next to Germany. At the same time, it also ranks second on the list of countries with the biggest contribution to the EU funds. On November 12, the 200 and 50 moving averages successfully formed the “Death Cross”.

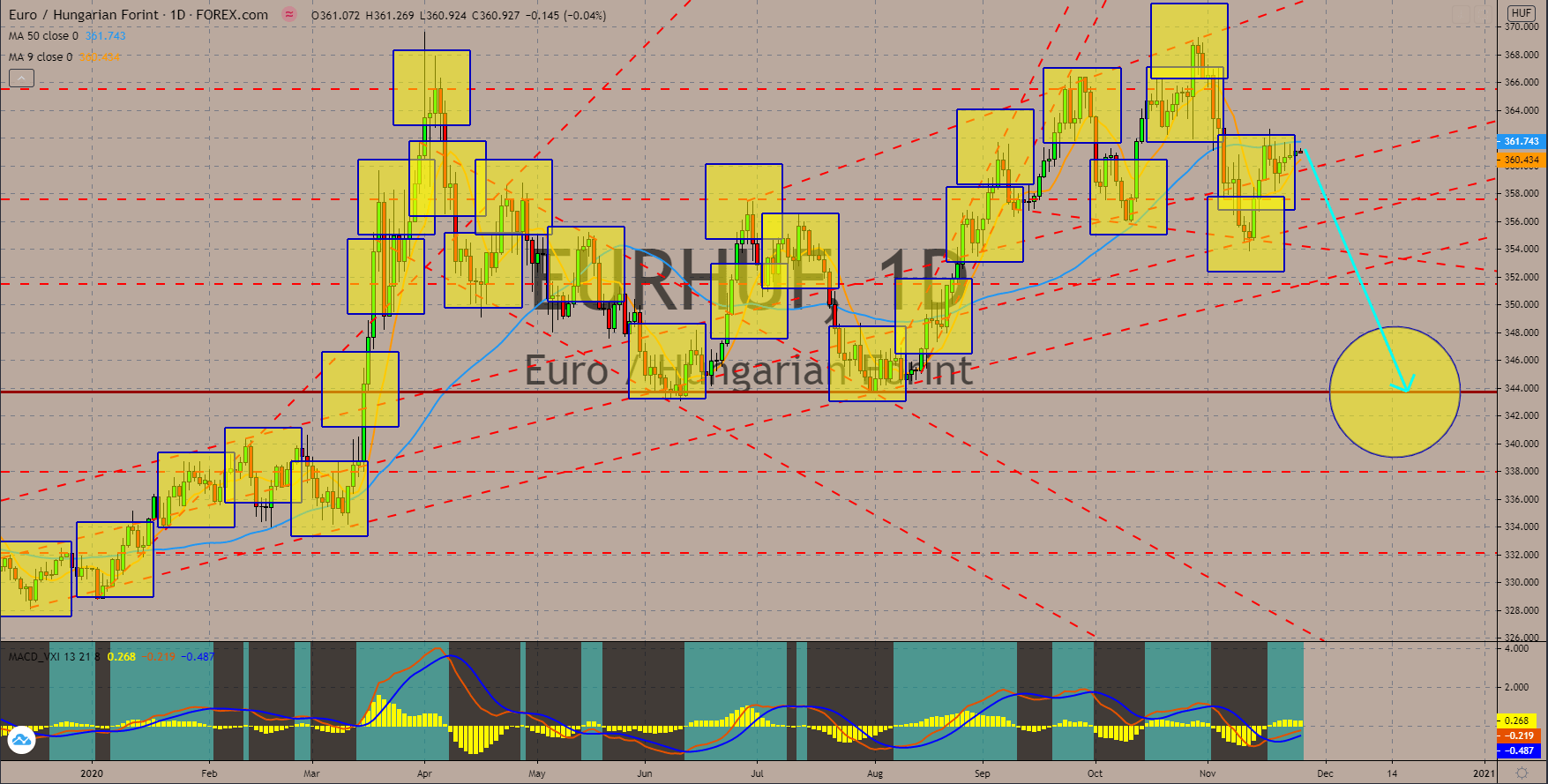

EURHUF

The European Union is losing on all fronts. In the East, the ASEAN and its five (5) free trade partners founded the RCEP (Regional Comprehensive Economic Partnership), which includes China and Japan, the second and third largest economy in the world. Together, they account for a third of the global economy. The United Kingdom is also set to officially withdraw from the EU bloc by 2021. Meanwhile, its member states, Hungary and Poland, vetoed the $2.15 trillion 2021-2027 budget. Moreover, the recent report from France of 49.1 points and 38.0 points for its Manufacturing and Services PMI signal a possible double-dip recession in the country. It could also drag the Eurozone, which, in turn, will lead to a decline in the single currency’s value. The moving averages are near to forming a “Golden Cross”. However, chart history tells another story. The 50 and 200 MA can no longer take the prices higher despite the bullish formation.

COMMENTS