Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

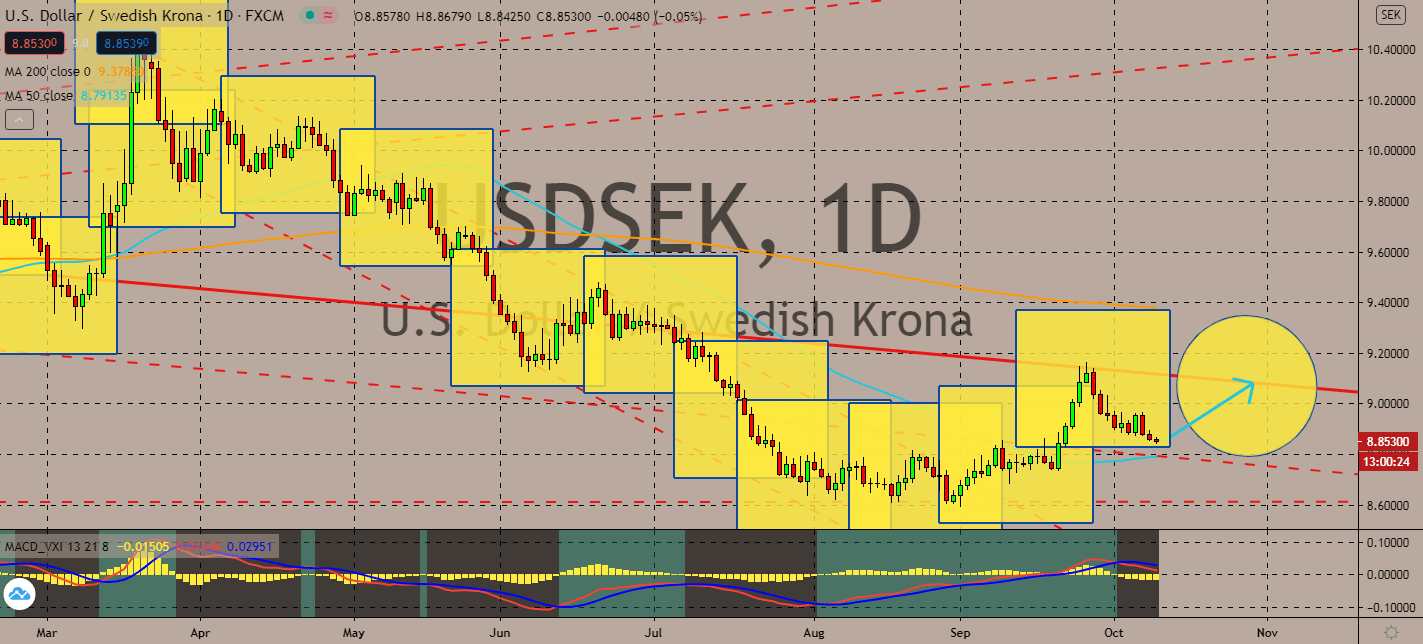

USDSEK

In the roller coaster this week, sources claim that US President Trump is actually interested in reopening talks for a new stimulus package for the country’s economy. Although uncertain, investors are optimistic, since the Democratic package could still be implemented whether or not he wins the next presidential elections in November. Although the pair’s 50-day moving average is still way under its 200-day moving average counterpart, the news could more likely lead the market to the US dollar near-term. Moreover, it looks like the Swedish approach towards the pandemic is still highly uncertain – the recent resurgence in coronavirus cases throughout the eurozone has been affecting Sweden’s exports. Its central bank currently expects its economy to shrink about 3.5% by the end of the year, although considerably milder than its peers, the rate could continue by at least three years driven by the coronavirus.

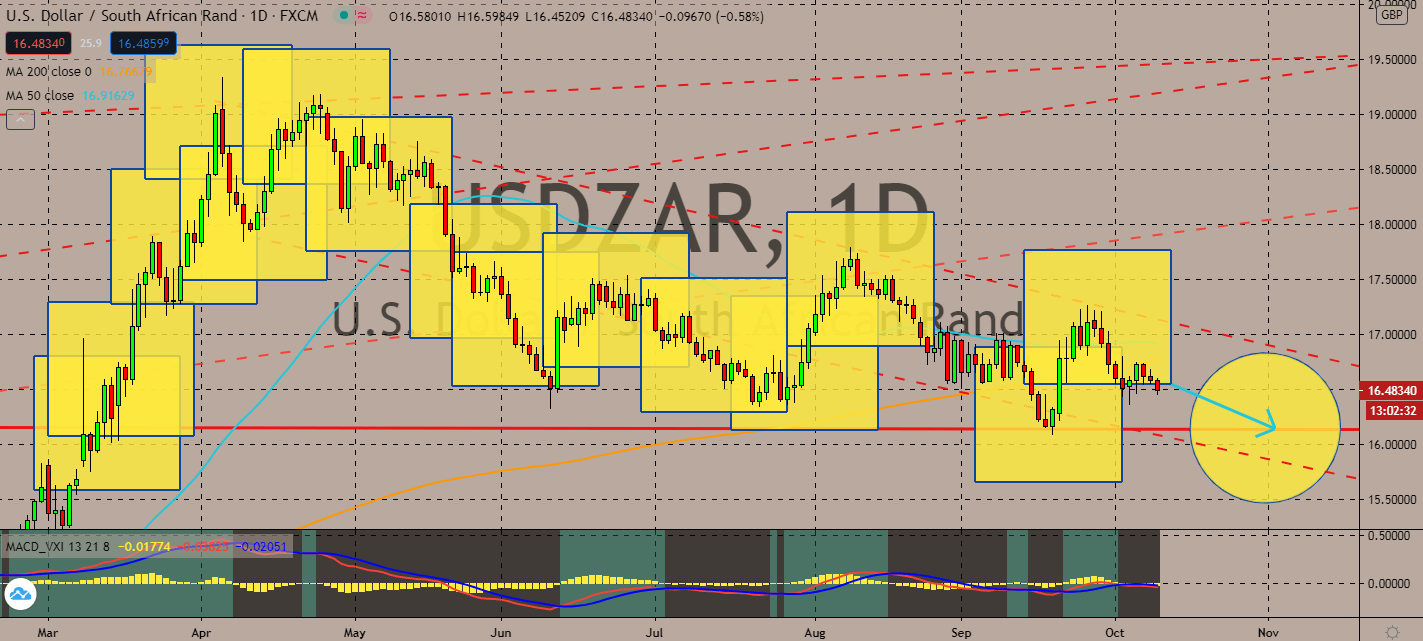

USDZAR

The weakening dollar is projected to strengthen emerging markets like the rand. South Africa remains confident in its aggressive monetary policy easing from earlier this year, having cut its interest rates by 275 points year-to-date. According to the Reserve Bank’s announcement earlier this week, the cuts helped boom house purchases in the country, even while labor unions and economists had been criticizing the move since March. For now, the rate will stay at 3.5% until next year when the economy feels its full-blown effects. The pair’s 50-day moving average is also proving the pair’s downward trend with a decline approaching its 200-day moving average, indicating a decline in confidence for the US dollar against the rand. Rising uncertainty around President Trump’s attitude towards economic stimulus as well as the spike in daily coronavirus cases in the United States are projected to pull the greenback down near-term.

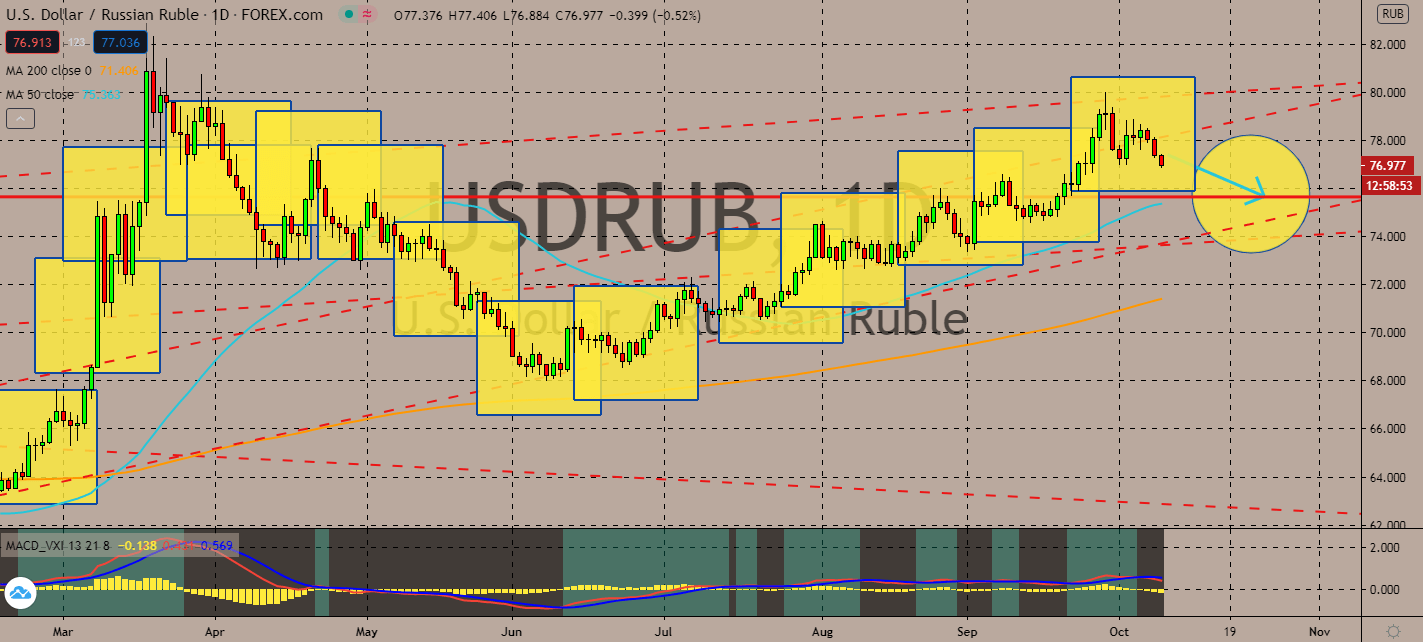

USDRUB

The world’s largest energy producer Gazprom just began a study for its next massive pipeline that will be built across Russia and China. The construction will be part of Russia’s “Pivot to the East” amid its conflict with the US and its improvement relationship with China. More news about the direct link between China and existing infrastructure in Russia could help both countries in the long run. As China’s economy improves, Russia’s economy and ruble could increase in the longer term. Optimism toward its production is projected to lift the currency against the US dollar, which is currently facing an uncertain pre-election phase while investors keep their focus on stimulus packages in the US for near-term trends. The pair’s 200-day moving average has also been curving upwards as of late, which is projected to catch up on its 50-day moving average soon. As risk sentiment increases, the ruble can only increase against the now-volatile greenback.

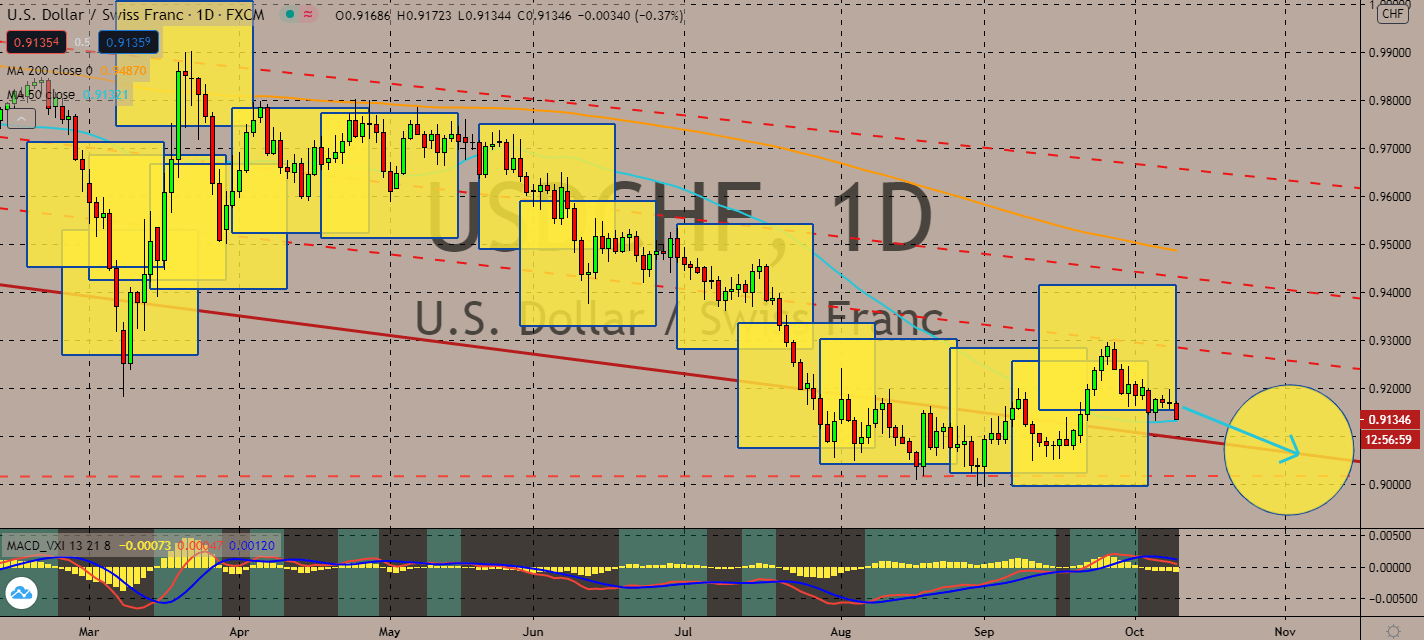

USDCHF

According to the Swiss Economic Institute (KOF), Switzerland is still on track for a V-shape economic recovery. The news came a month after it experienced what they called a historic slump in economic activity. This came with the upgrade on its economic outlook, which now expects a 5% slump instead of the 6% seen prior. Moreover, economists claim that this end-year slump would be relatively shallow in comparison to most of its peers. This optimism is projected to assist the Swiss franc up against the wary greenback as more daily coronavirus cases take over the country, and a stimulus package remains tentative until the presidential elections on November 3. The foreign exchange’s 50-day moving average had also slumped recently, even as it remains far below its 200-day moving average. This indicates that the pair could still decline near-term while risk appetite is still running hot in the forex market.

COMMENTS