Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

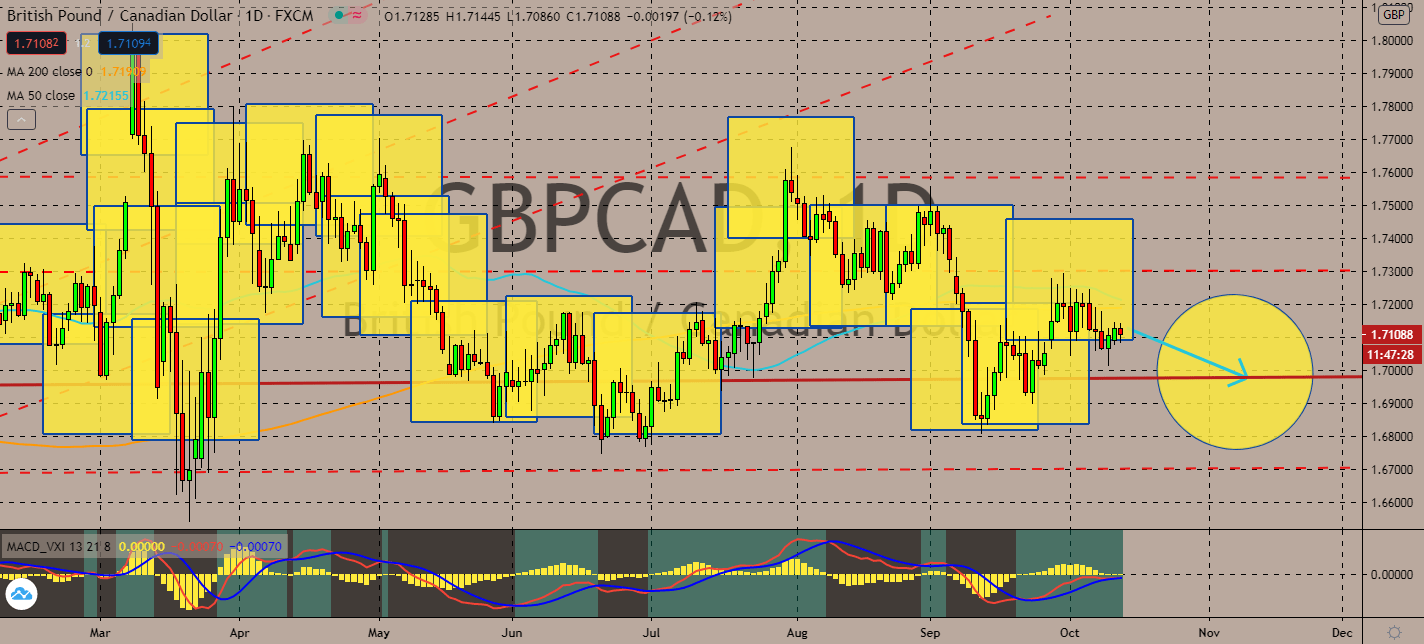

GBPCAD

The UK economy might experience a devastating winter, judging by the slowing economy seen in August. The Office for National Statistics said in a statement that the UK grew by not more than 2.1% in August, down from expectations of 4.6%. This was the fourth consecutive timid economic growth in the UK after it first contracted by 20% in April. Moreover, it looks like its most recent growth was the slowest after April. The slowdown is expected to continue as it continues the winter season with restrictions implemented in September. The pair’s 50-day moving average recently curved down toward its 200-day moving average, a sign that the pair could meet a bearish market in the longer-term. This is considering the recent uptick in employment rates in Canada in September, which rose from 2.1% from 1.4% in August. As this rate increases from rising immigration rates, uncertainty around Brexit will pull the Pound down.

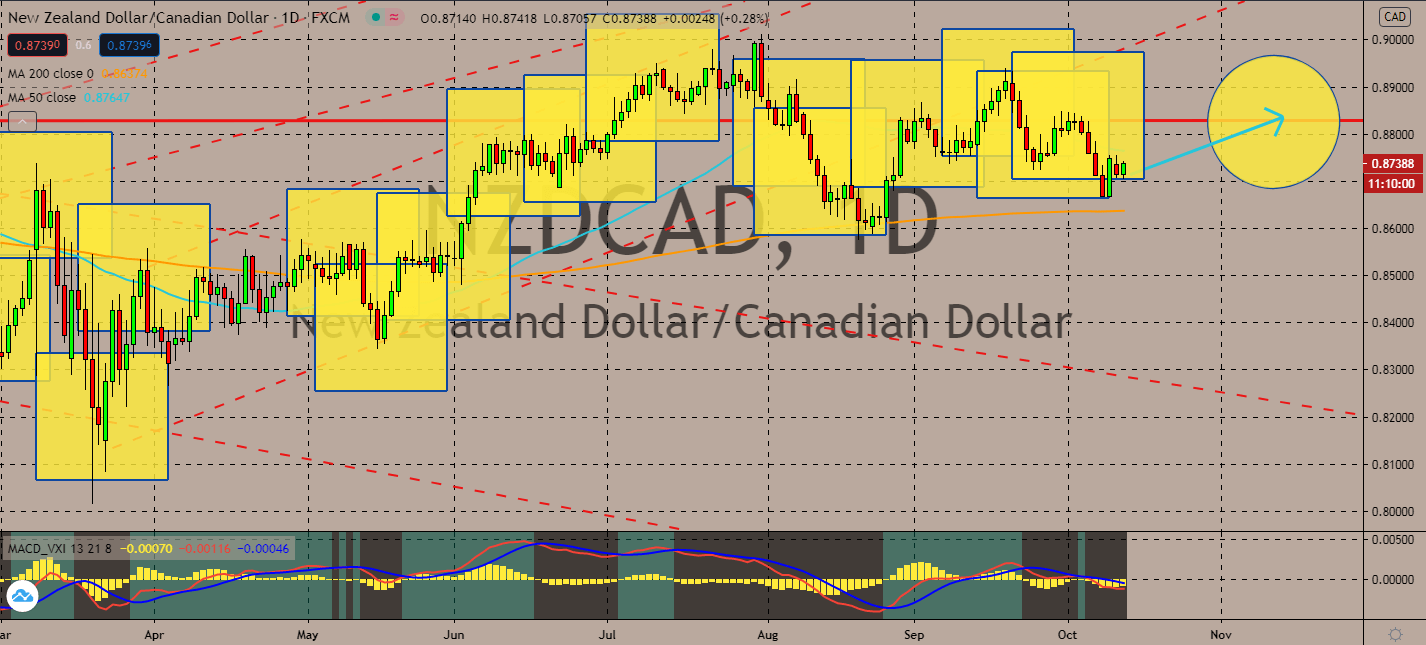

NZDCAD

With the current Prime Minister projected to win New Zealand’s current election, investors are projected to root for the safety of the kiwi dollar near-term. The pair’s 50-day moving average is still above its 200-day moving average, showing that the pair is likely to rise near-term after the latter curved up again in recent days. The optimism came from the World Health Organization’s claim that the NZ government is one of the few that has worked well with a cooperative community while effectively communicating what needs to be done. Now that the country had officially wrapped up its second coronavirus lockdown, investment in the NZ government is likely to boost despite the recent progress in Canada. The uncertainty around the stagnant Canadian economy will likely be an advantage for the safe haven kiwi, which will likely change if its tourism industry struggles to recover under the new, or continuing, Prime Minister.

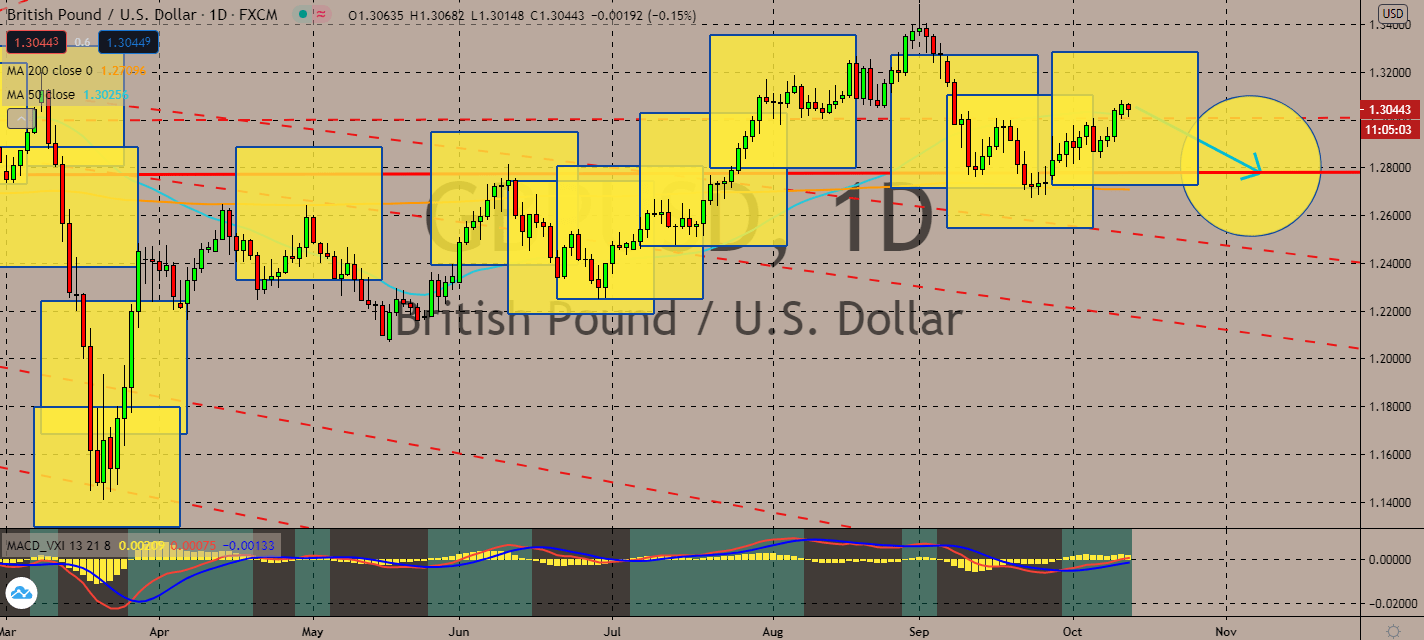

GBPUSD

The pair is likely to fall over fears that the UK economy isn’t doing well as it initially was. Output had slowed for the fourth time in a row in August, and it looks like it wouldn’t go back up to pre-coronavirus levels before next year. A Brexit deal is becoming increasingly uncertain despite both economies needing a trade agreement, especially after the UK prime minister said the City was ready to walk away without a deal. The pair’s 50-day moving average is still above its 200-day moving average, but it looks like the recent news will likely pull sterling down. Although consumer spending has been helping the UK economy lift for the past few months, analysts worry that this wouldn’t be enough to help buoy activity enough to reach its growth goal for the entire year. As the US approaches its presidential elections in November, the likelihood of a stimulus bill is going to help lift the dollar and begin another longer-term bearish market for the pair once again.

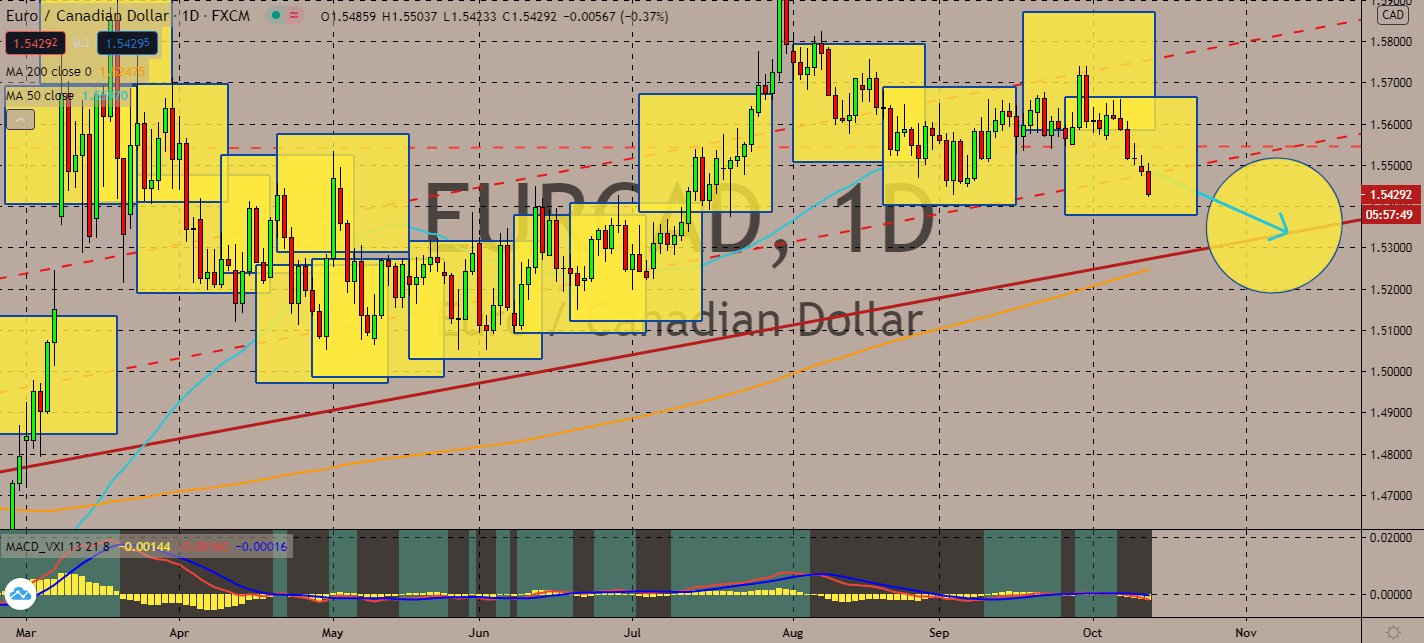

EURCAD

Economists’ optimism towards Canada’s immigration efforts will lift its currency up in the near-term. Canada added 378 thousand jobs in September, which brought its employment to lift around 720,000 of its pre-coronavirus levels. Economists expected a 156,600 increase for the month, instead. The rise brought its unemployment rate to drop for the fourth month in a row, having dropped from 1.2 percent to 9 percent. The eurozone’s single currency is likely to fall as the deadline for the Brexit trade deal approaches, leaving the European Union with no choice but to meet halfway with the United Kingdom’s demands before the UK’s Prime Minister Boris Johnson walks out of their negotiations. Now that the pair’s 200-day moving average is catching up to its 50-day moving average, and that the latter has been continuously touching its current levels, the pair is likely to break down to levels last seen around July.

COMMENTS