Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

GBPCHF

Markets are expecting the UK Prime Minister Boris Johnson to compromise his proposed Brexit bill to meet halfway with the European Union, opening doors to an actual agreement before the exit’s deadliest deadline by the end of the year. The pair’s 50-day moving average is below its 200-day moving average, but it looks like the latter is about to cross downward soon. The move will put the sterling-franc market to a more assertive bullish pattern as the Swiss economy grows more uncertain throughout the rest of the year. The positive outlook for Switzerland’s end-year GDP is likely to dampen with worries that the coronavirus will take over the country too soon, which was ignited by the recent spike earlier this week. Stricter lockdowns are projected to bleed into its economic activity in the near term. Its government claimed that it’s prepared to take more drastic measures, a move that triggered further pessimism in the critical winter season.

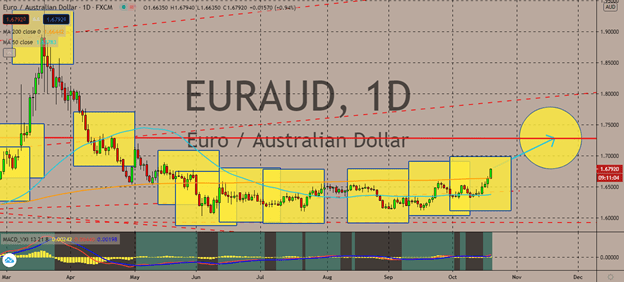

EURAUD

The Reserve Bank of Australia is in discussion for a possible benchmark interest rate cut that will be implemented within the year. This is going to be a historic low since it first initiated an emergency cut by 50 points to 0.25% in early March to curb the economic catastrophe brought by the coronavirus. The next cut would leave the rate down to 0.1%, or so the central bank expects, in order to help pump up its economy in the longer term. The pair’s 50-day moving average just curved slightly up against its stagnant 200-day moving average, showing signs that the pair could lift up soon. The long-awaited presidential elections in the US is also helping the eurozone lift against its riskier counterparts, as the gap between the Democratic and the Republican parties expand with the Democrats in advantage. This is despite the bloc’s conflict with the United Kingdom’s attempt to walk out of its trade relationship with the eurozone without a deal.

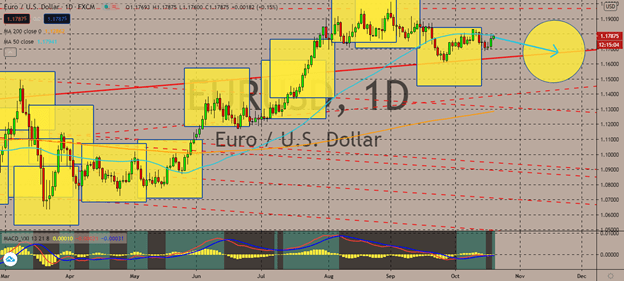

EURUSD

The European Central Bank is expected to pump out another quantitative easing program in the eurozone, a move that is expected to weaken the euro currency in the near term. Moreover, the market predicts that the eurozone will go through a steeper budget deficit than the United States at 976 billion euros, an equivalent of 8.9 percent of its gross domestic product. This nearly 1 trillion euro easing will be detrimental to the eurozone’s economy in the long-term, damaging the market’s outlook even in the nearer term. Although it’s important to note that its near-term trend is likely to be muffled by risk sentiment over the Democrats’ advantage over the Republican party in the US elections. The pair’s 50-day moving average recently curved downwards as its 200-day moving average continues to rise, which indicates that the bearish market might be preparing to pull the pair back down until the hype around the US election and the EU’s tension with Brexit subsides.

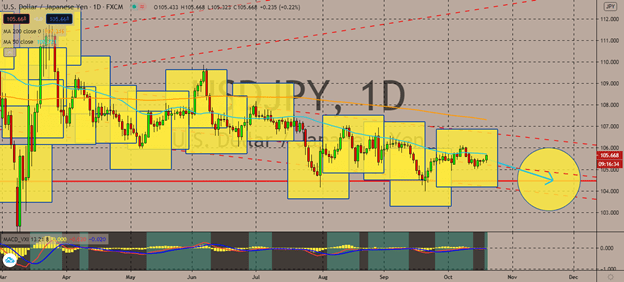

USDJPY

Improving markets in the Asian market is likely to push safety to the Japanese yen as the market remains assured of how the US could improve its relationship with China. US House Speaker Pelosi and Treasury Secretary are in talks for a stimulus deal before the presidential election on November 3. It looks like the markets are less optimistic about this pre-election deal than they are about the healing Asian markets – in fact, the pair’s 50-day moving average is still moving downward, even as it remains below its 200-day moving average. It’s likely that the pair will experience a more volatile decline after the said election, or if Japan’s Suganomics blows up. Notably, it looks like Prime Minister Yoshihide Suga’s plan to continue the economic package will help Japan cope with the pandemic, and his improving relationship with Southeast Asia should help the market engaged in its economy’s improvement with it.

COMMENTS