Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

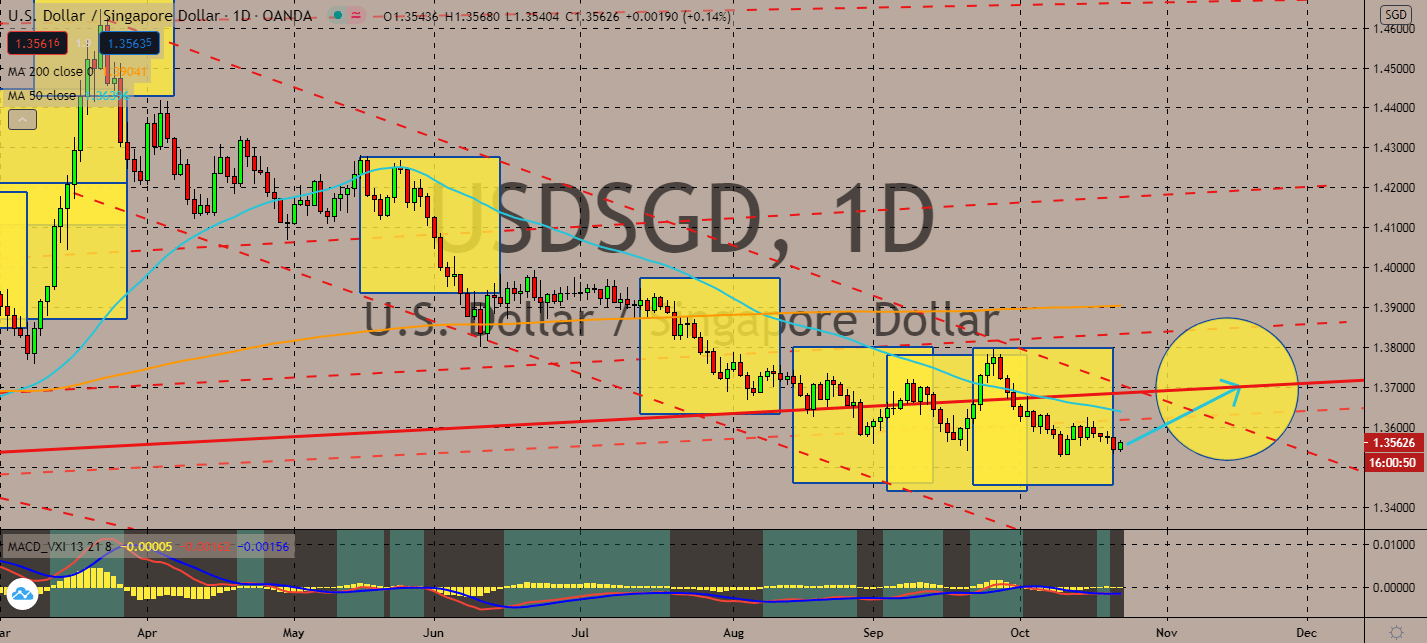

USDSGD

It’s another day for weekly jobless claims figures and existing home sales figures for September. The US dollar is likely to benefit from optimistic expectations for the figure. Moreover, the market seems to be having a difficult time waiting for any stimulus packages from the Federal Reserve. This is projected to lift the US dollar with risk aversion in the near-term. The pair’s 50-day moving average has been gliding below its 200-day moving average, but the pair could likely benefit more from risk aversion led by the rising tension in US politics. But that’s not to say Singapore doesn’t have its own advantages, either. Employment rates and wages have been improving across the country after 1,900 jobs opened up between April and September, with many still on offer. The majority of these posts were from across 130 companies. But it’s important to note that any progress or loss for the stimulus in the US will be the major driver for the pair.

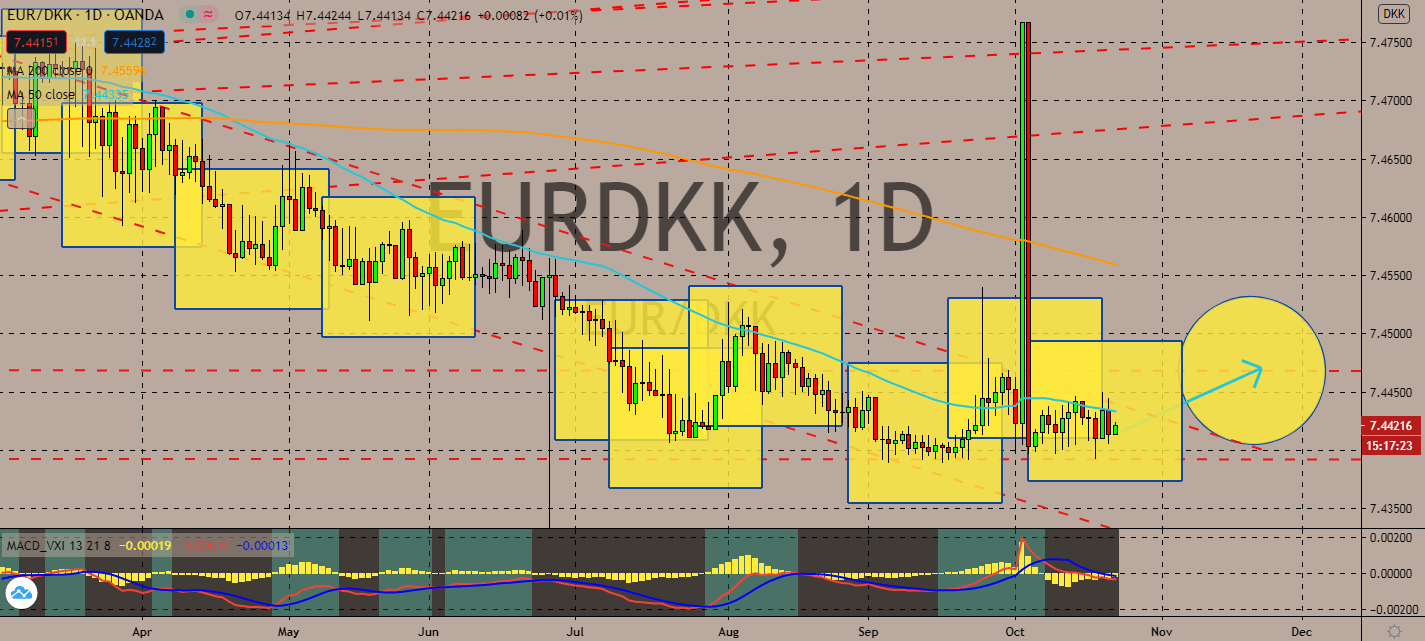

EURDKK

It’s going to be a relatively quiet day in the European economic calendar, but investors are waiting for a report on CBI Industrial Trend Orders later this afternoon. The exchange, in particular, is likely to be sensitive towards economic data in the eurozone as Brexit progress remains on hold. The pair’s 50-day moving average has been moving far below its 200-day moving average, indicating that the bears have a bigger chance of keeping the pair’s trend going lower in the near future. That said, the crown’s advantage is projected to be hesitant as the market awaits the eurozone’s trade agreement with the United Kingdom. This is largely because Denmark’s central bank had recently confirmed that the country’s economic recovery from the coronavirus would be worse than it initially anticipated: Denmark is projected to report an economic growth of about 3.5% next year, which is slightly lower than the 3.8% seen prior.

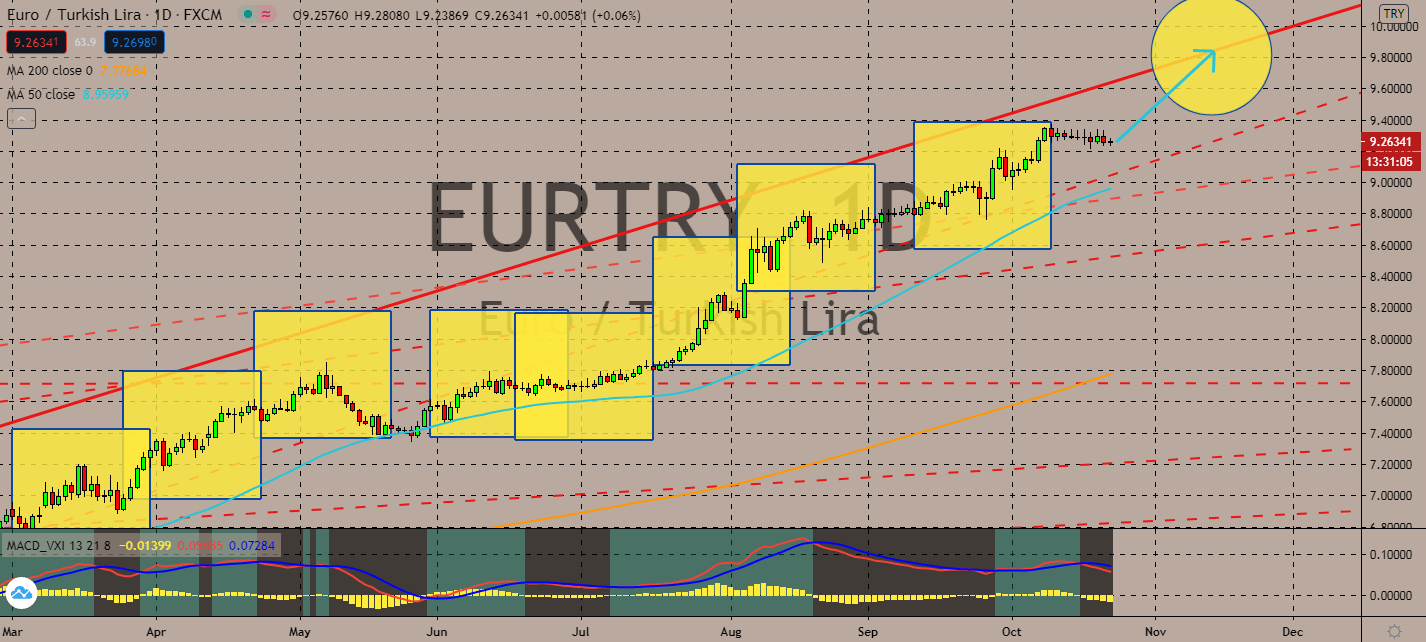

EURTRY

Although timid, risk aversion is likely to lift the euro currency against its Turkish counterpart. The current Brexit deal has been stagnant since yesterday’s agreement. The Brexit deal has been stagnant since Michel Barnier said that both economies are likely to compromise within the next few weeks to reach an agreement. The lingering optimism from yesterday’s claim will help push the euro up against the lira as Turkey’s currency continues to weaken against its safer peers. The pair’s 50-day moving average has been surging up against its 200-day moving average for the past three months, which led to the pair’s long-term increase. The current trend doesn’t seem like it’s going to end anytime soon. The lira will also continue to suffer over geopolitical tensions, such as its conflict between Armenia and Azerbaijan and the tension between Ankara and Athens over maritime negotiations in the eastern Mediterranean.

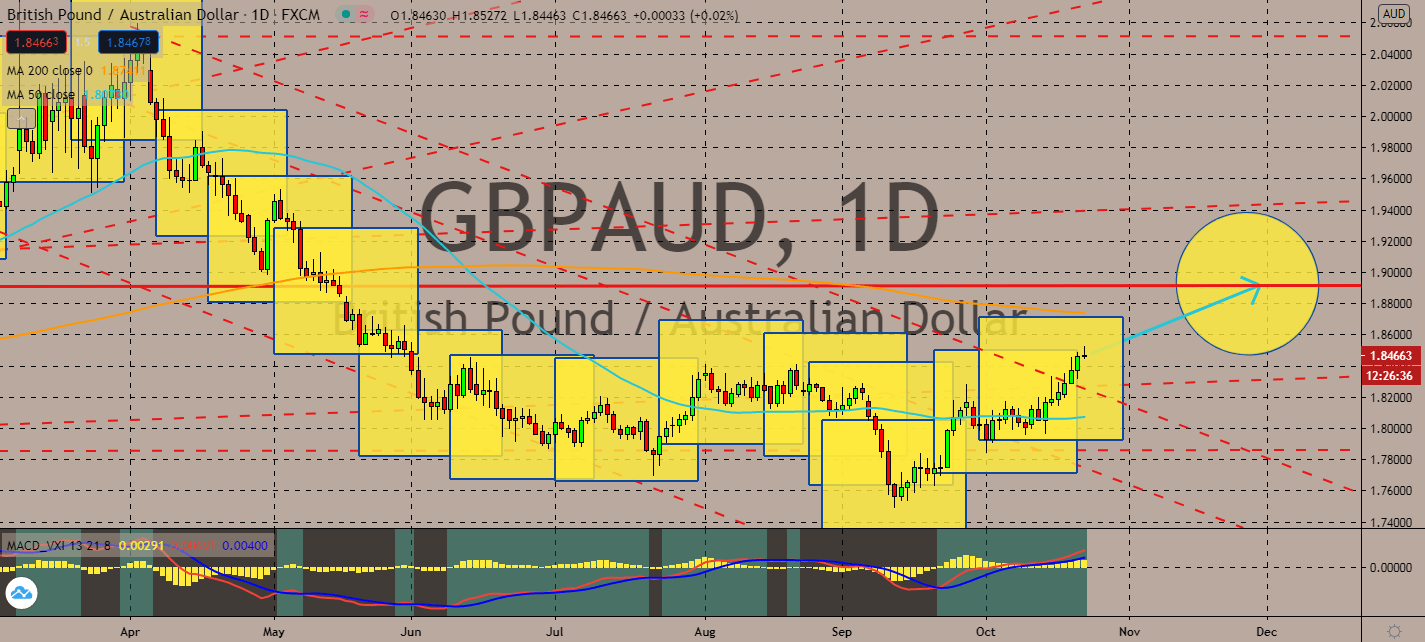

GBPAUD

Brexit is in a stalemate, but Australia is bound to fall deeper. Another discussion is on hold between the European Union and the departing United Kingdom regarding certain trade and travel boundaries. Negotiator Michel Barnier claimed that he seeks to implement the necessary compromises on both sides in order to reach an agreement for the economies, promoting the pound sterling against its Aussie counterpart. This comes with the pair’s declining 200-day moving average, although it remains above its 50-day moving average counterpart, due to the recent uncertainties revolving around the future of the Australian economy for the next two years. Rising geopolitical tensions with China has also been harming the Aussie’s agricultural sector, largely because Australia isn’t China’s main source for its commodities. Further harm between their relationship could lead to an even uncertain Aussie dollar.

COMMENTS