Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

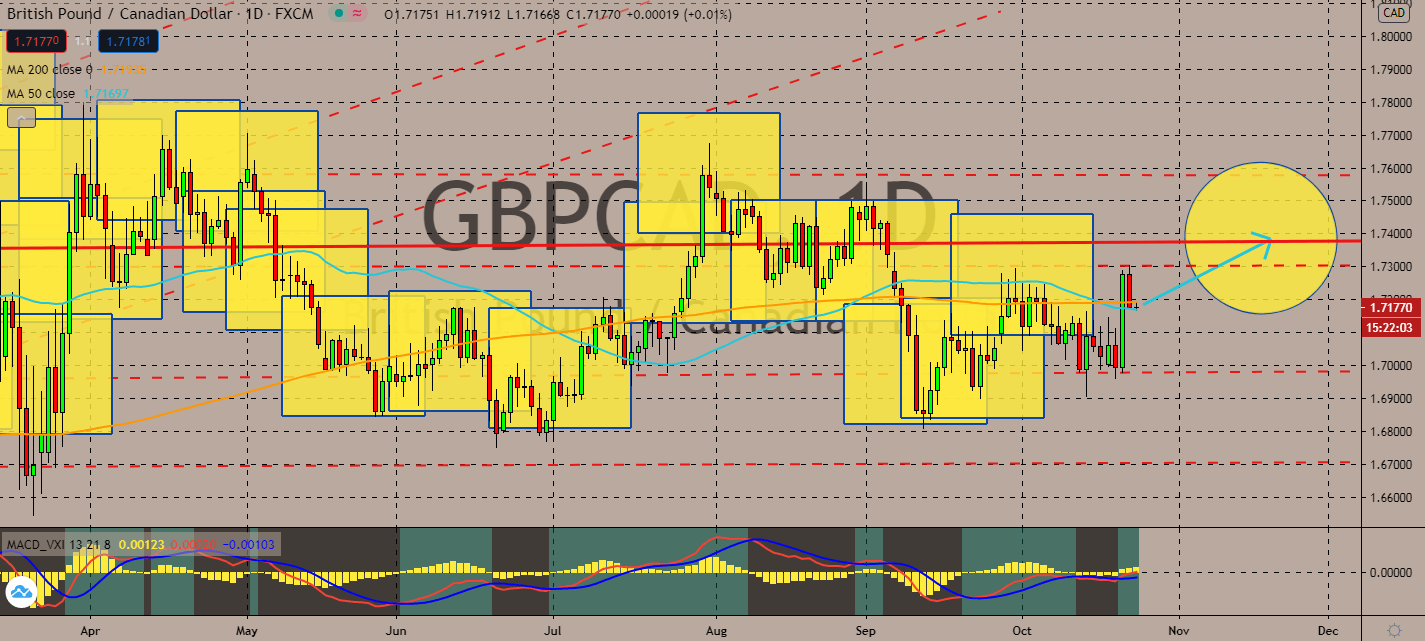

GBPCAD

The United Kingdom seems to have been dangling the Brexit deal over investors’ heads, and it’s working. Brexit talks resumed on Thursday after negotiations halted last week, boosting the sterling against most of its riskier counterparts like the loonie. The pair’s 50-day moving average just crossed its 200-day moving average and touched the current levels, indicating that the pair could soon test its current trend. However, risk aversion is likely to prevail, despite the uncertainties around the approval for Brexit by the end of the year. The Canadian economy hasn’t been doing well as of late, too – economists claim that the country will suffer greater than initially expected as the second wave increased the chances of a severe health and economic crisis. After it managed to recover quicker and more effectively during the first three quarters of the year, polls claim that its economy could slow to about 5.0% and 5.2% in Q4 2020 and Q1 2021, respectively.

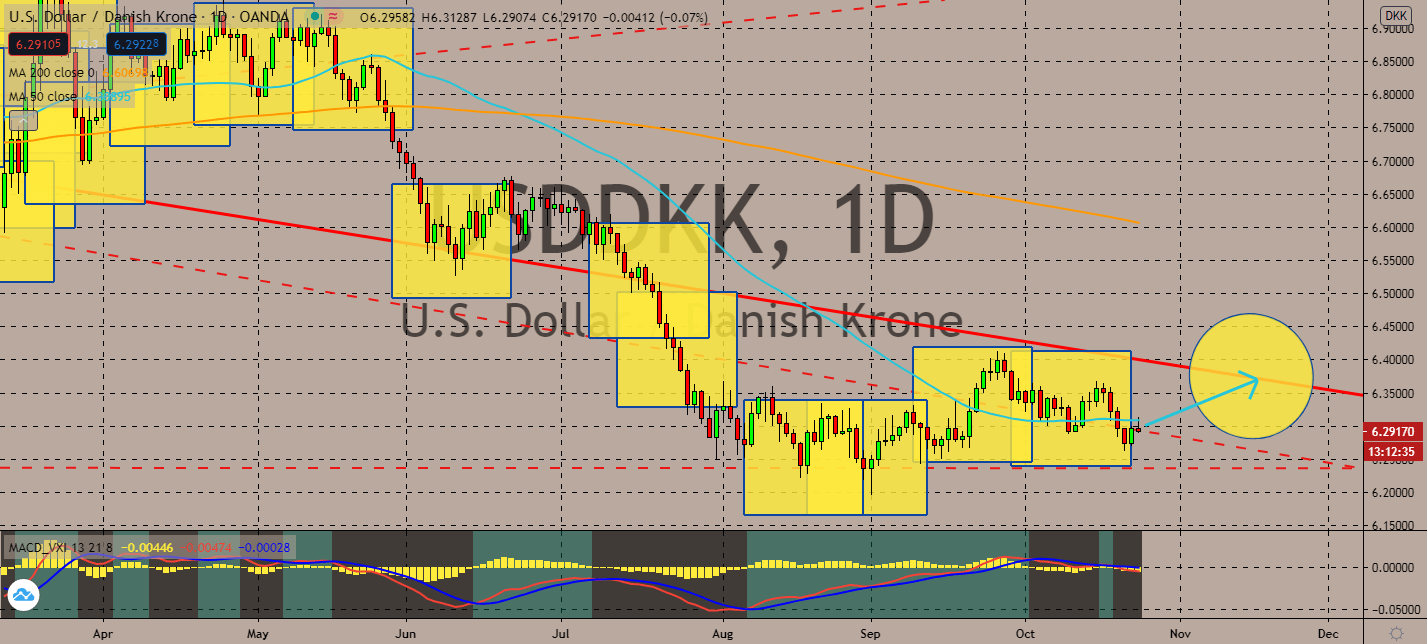

USDDKK

Denmark’s economic recovery has relatively been quick for the past few months, in comparison to its European peers. This led to the central bank’s claim that it should ease fiscal spending restrictions to give the government more room to make movements to counter more negative effects of the coronavirus. Although the implementation of allowing a deficit of 1% of GDP is risky to is market, investors are more optimistic over the bold statement. The bank had claimed that there’s no need for pressing concern thanks to healthy government finances. The pair’s 50-day moving average has been moving lower since it fell low in mid-September, while its 200-day moving average has only been slowly declining above it. The pair is now projected to continue its decline in the near-term after Federal Reserve Governor Lael Brainard said that too many factors could hold back the United States’ own recovery.

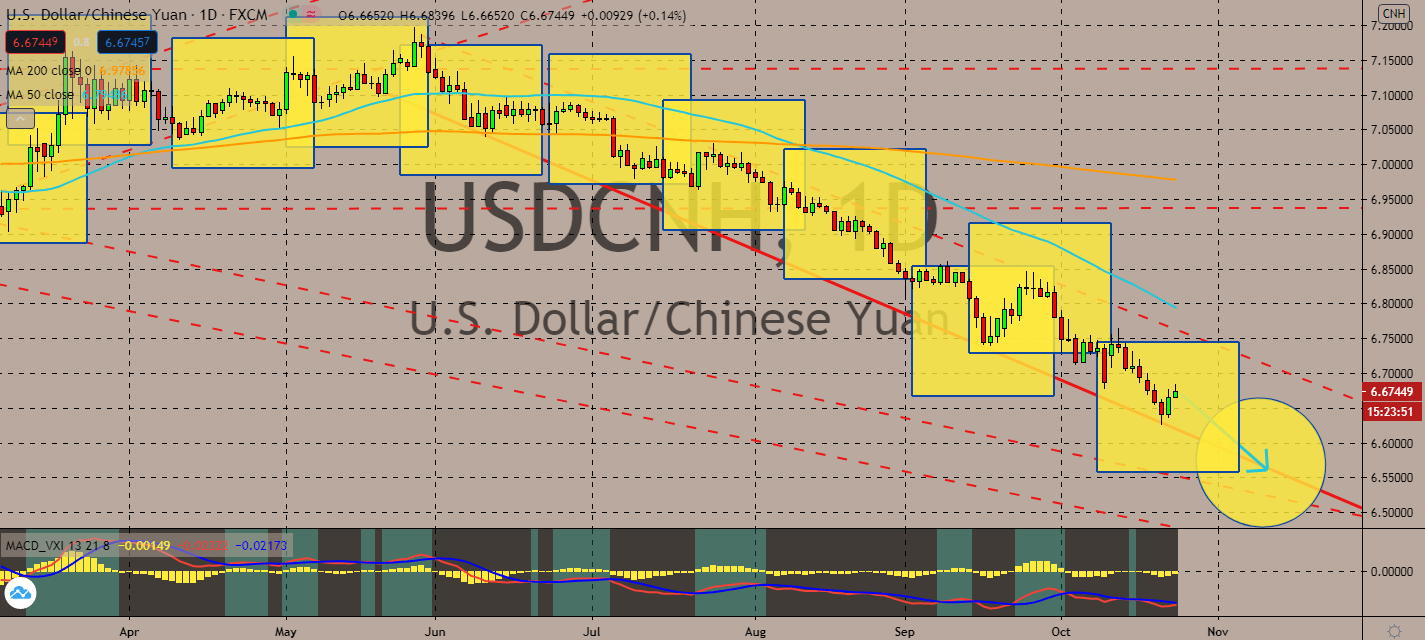

USDCNH

The yuan could experience a hesitant outperformance over most of its basket in the near-term. China’s economic recovery from the coronavirus showed a limited improvement in its credit growth in the coming months, but it looks like it could still benefit from the record growth it already experienced. In fact, the country had grown much better than expected: gross domestic product accelerated by 4.9% in the quarter ending September, which is timid if not for the fact that it was a yearly increase. Although uncertain, the second-largest economy is projected to continue growing in the fourth quarter, and so would its currency. The pair’s 50-day moving average has been stooping much lower as of late, even as it remains below its 200-day moving average. It looks like USDCNH will have a volatile quarter led by the presidential elections, US stimulus packages, and further developments in their relationship post-election.

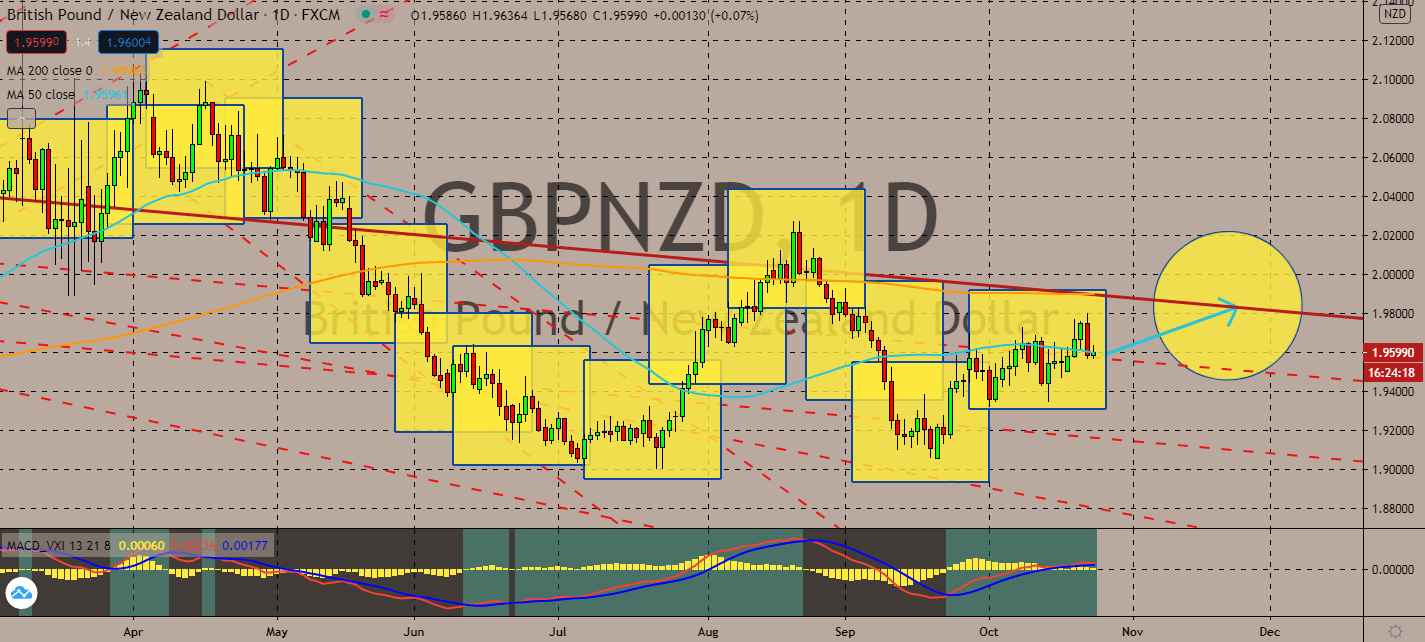

GBPNZD

New Zealand’s consumer prices increased thanks to lockdown easing held in the third quarter. However, investors are projected to focus on the fact that the increase fell short of expectations. It turns out that the increase effectively showed an uptick to 0.7%, reversing the 0.5% fall during the June quarter. But this was much lower than the Reserve Bank of New Zealand’s forecast of a 1.1% increase, as per its announcement in August. Economists worry that this could lead to another near-term stimulus package, raising the possibility that the country could actually suffer the double-dip recession after the coronavirus fades away. The pair’s 50-day moving average is considerably below its 200-day moving average, but it looks like the pair could test its current trend soon. After all, Brexit talks have resumed a week after it was halted, and the deadline for their trade and travel deals is fast approaching. Any progress in this discussion will be better for Sterling.

COMMENTS