Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

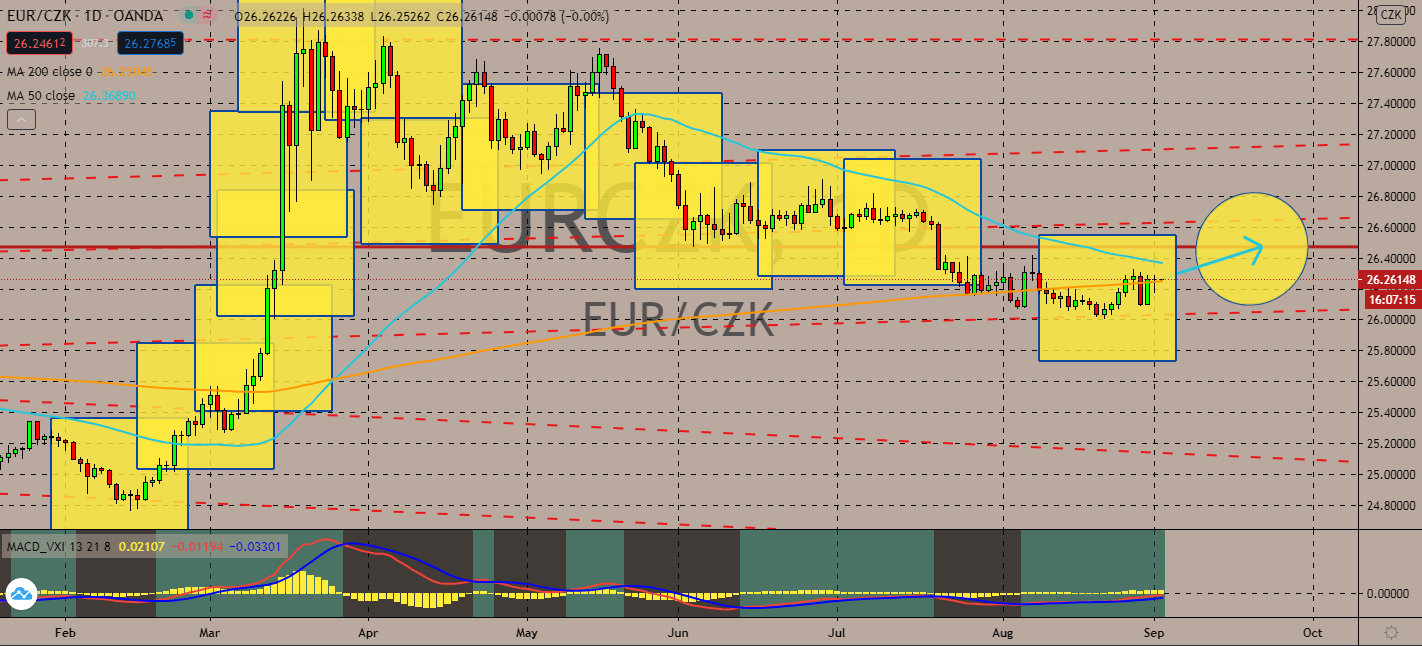

EURCZK

Aided by the European Central Bank’s stimulus measures earlier this year, the eurozone’s inflation is now in negative territories. Typically, the deflation would be negative – but the recession presented a different opportunity. According to key economists, the data had relieved markets. Although this puts the pressure on public spending, it means that the bloc is on the right track for its economy in the long run. The optimistic news will push the pair’s 50-day moving average back upwards, giving its bullish traders a chance to revive their market as the 200-day moving average remains only slightly below it. The pair is projected to gain back some of its losses seen in early August as investors hesitate over recent travel restrictions from the UK for the Czech Republic. The Czech economy’s worst yearly GDP decline was led by foreign demand, which came in with an 11 percent fall in the second quarter of 2020.

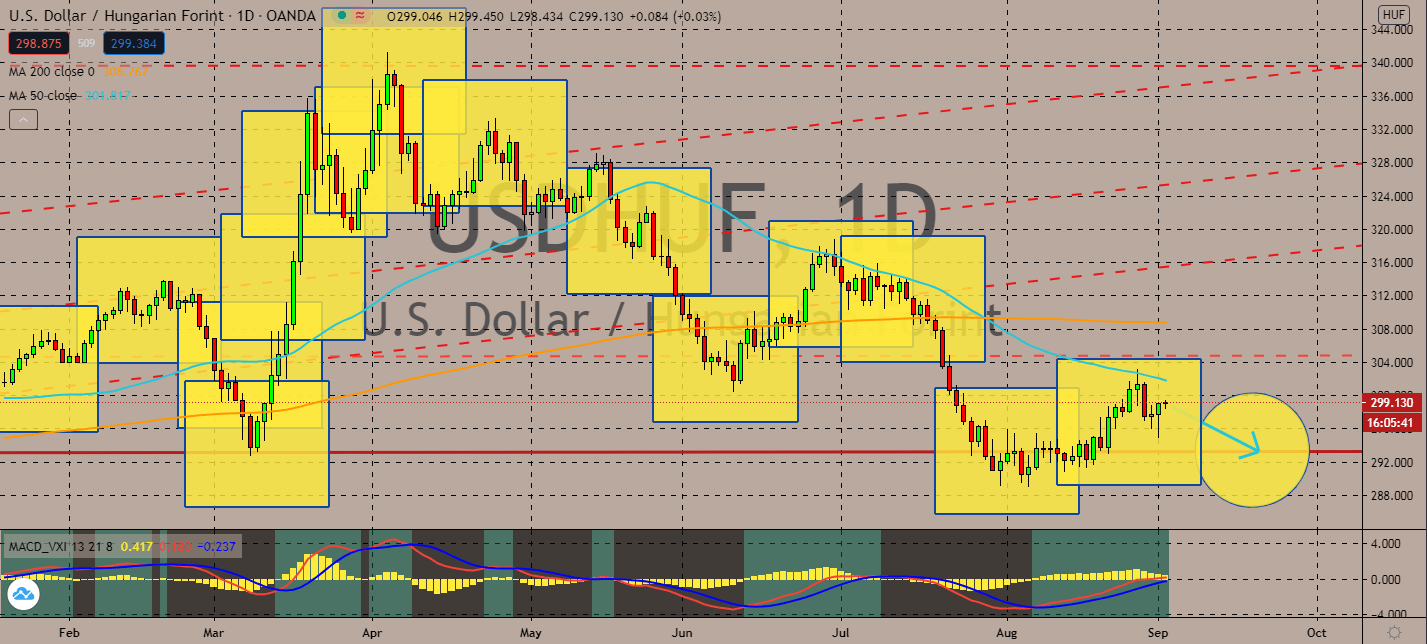

USDHUF

Federal Reserve Governor Lael Brainard said that the US economy will have to face uncertainty in the months ahead. He had called for the central bank and fiscal policymakers to help the country cope. The worries prompted weakness for the dollar and ignited risk sentiment in the market, which consequently drove the pair’s 50-day moving average lower under its 200-day moving average. USDHUF might see itself decline until the central bank finally decides on what it wants to do financially to sustain many families and businesses across the country. Meanwhile, Hungary surprised the market. The second estimate by its Statistical office kept still at -13.6% on a yearly basis, even as the second quarter’s performance was greatly affected by lockdowns in the pandemic. Its services sector, which has greatly affected most economies, only saw a 12% decline. Instead, its entertainment, transportation, and storage sectors saw more than 20% falls.

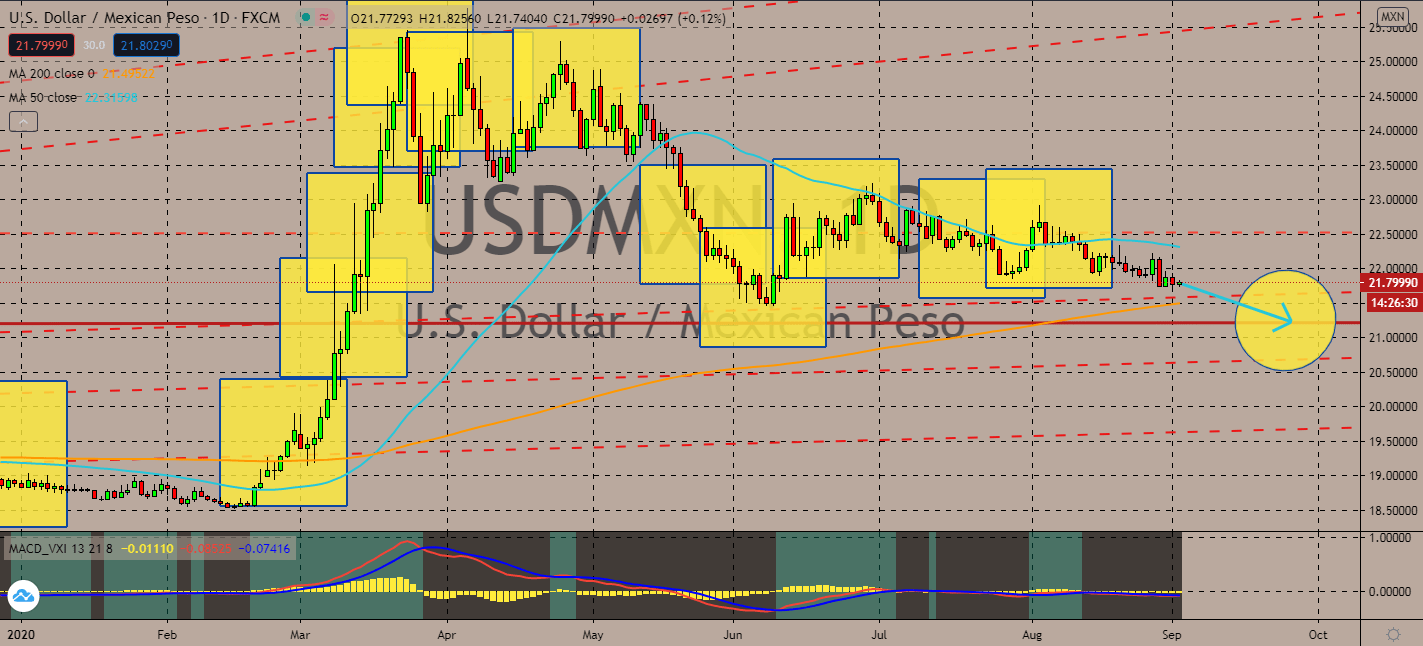

USDMXN

The main driver for the USDMXN pair will have to be the direction of crude oil in upcoming terms. The greenback has been declining against the Mexican peso for the past months, but now the 50-day moving average might be going further downward and possibly under its 200-day moving average. Crude oil inventories are projected to increase from -4.689 million to -1.887 million this week, indicating that markets have been increasingly worried about the recent unprecedented storm that affected supply last week. If an increase in oil prices in Mexico takes place, it will be beneficial for its currency. But notably, the Mexican president Andres Manuel Lopez Obrador claimed that the country has handled the economic fallout from the coronavirus pandemic better than some of its peers. Investors are expected to benefit the Mexican peso thanks to risk-oriented markets hesitant to settle with rendering news from the Federal Reserve.

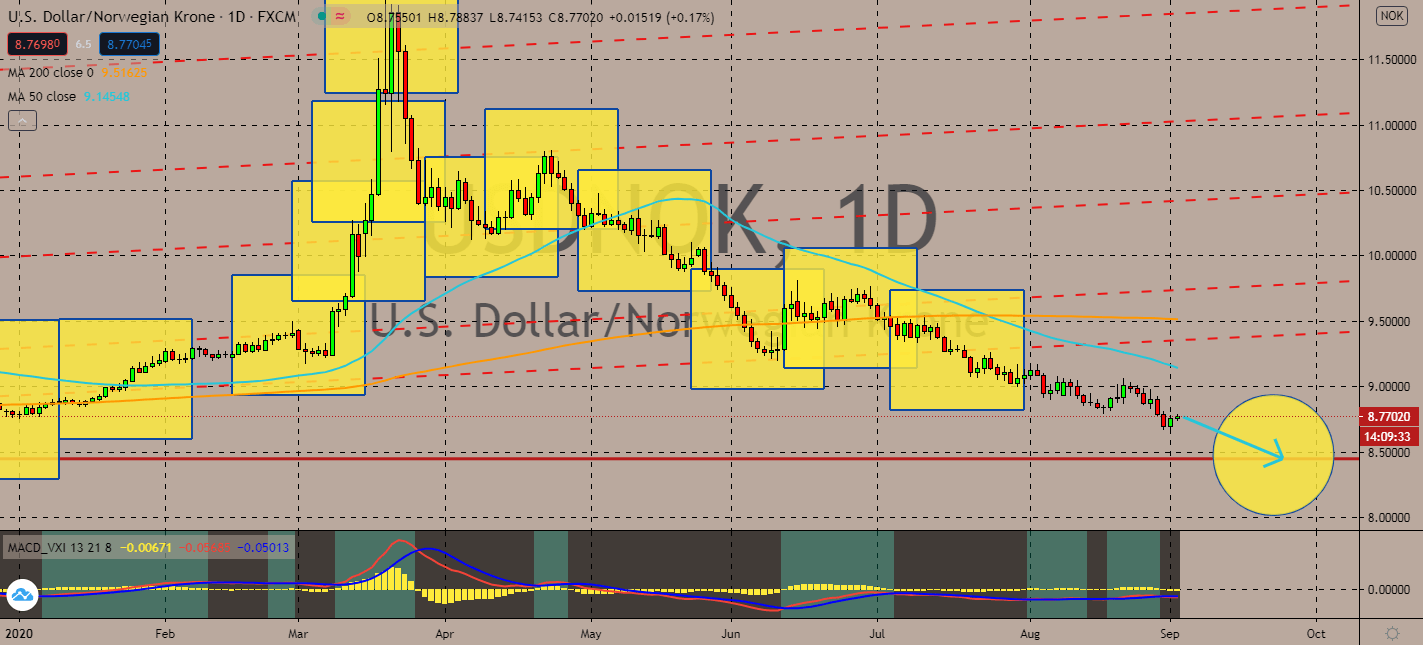

USDNOK

Norway has been quiet since it announced that its GDP fell by 6.3 in the second quarter. The pair is anticipated to go down largely thanks to risk sentiment in the market from conflicts in the US Federal Reserve. Current and former Fed officials say that its interest rate decisions in the past were wrong and that it was a major factor in today’s recession. The rethink brought great uncertainty in the central banks at critical times, considering that many officials already confirmed that its economy might experience a W-shaped recovery instead of the V-shape they had anticipated prior. The pair’s 50-day moving average had already crossed its 200-day moving average and moved downward, and now that the Fed is stuck in place with rising unemployment rates lurking behind its back and another decline is set to arrive as it remains as the coronavirus epicenter with thousands of new cases on a daily basis.

COMMENTS