Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

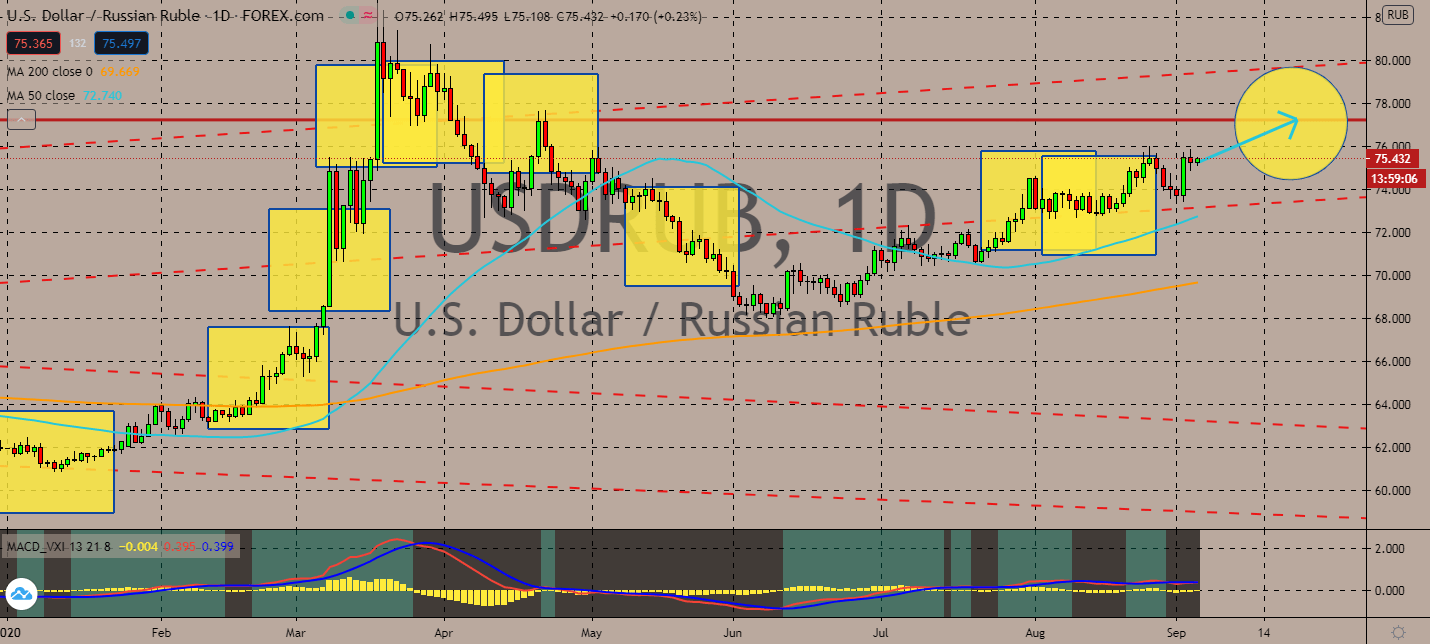

USDRUB

Russia’s opposition leader Alexei Navalny of Germany was poisoned last week, and now the biggest economy in Europe is calling for new economic measures against Moscow. Berlin’s announcement that the poison with a Novichok nerve agent sent the ruble to an unforeseen low, and it’s projected to continue its track down against the US dollar. The table-turning event led the pair’s 50-day moving average to perk up above its 200-day moving average, which means that the bulls will take advantage of the tension between the two economies near-term. German Chancellor Angela Merkel is facing growing pressure to waver her support for Nord Stream 2, a natural gas pipeline from Russia to Germany projected to strengthen both economies’ oil industries in the long run. The US administration has opposed the pipeline earlier on. Any further tension between the deeply tied economies is projected to push the ruble, and its stock, lower.

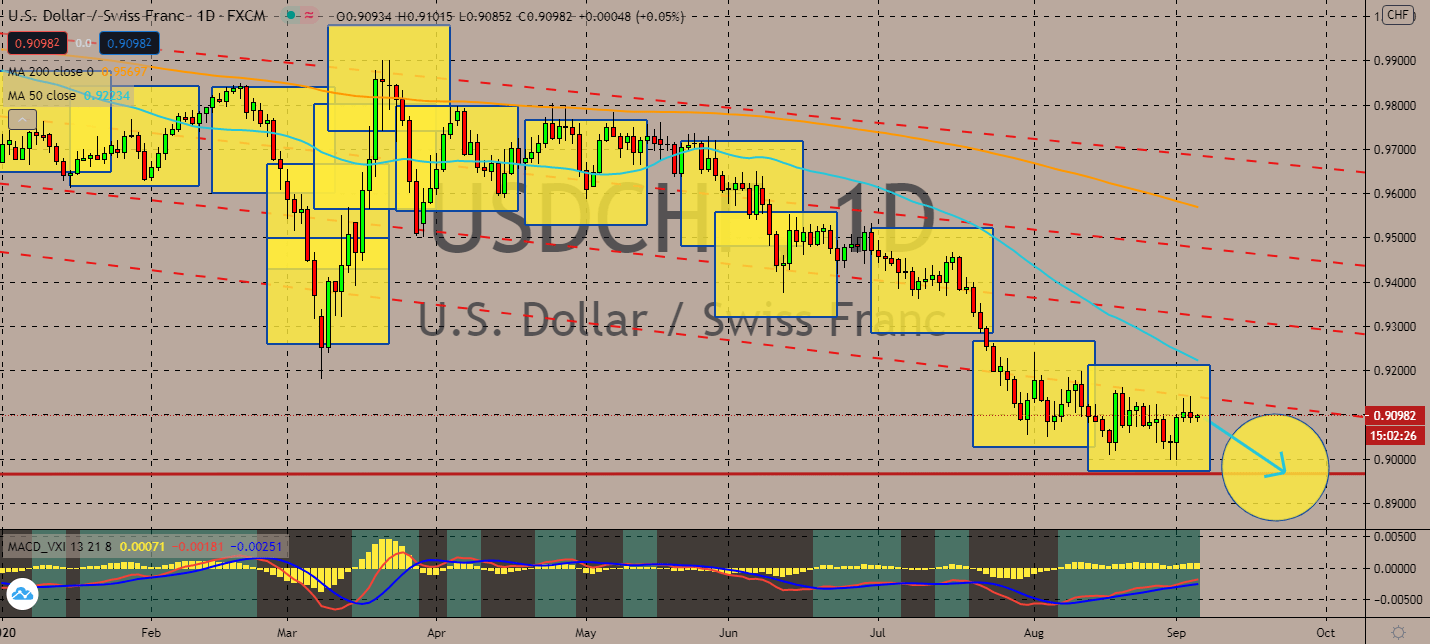

USDCHF

Switzerland still stands as the most resilient country in the world. Research by an insurance and reinsurance company Swiss Re claims that even with an 8.2 percent GDP decline to its biggest since the 1980s, it had still received top marks for monetary policy, low-carbon economy, human capital, and labor market efficiency. The title had come in pessimistic for the US dollar since a month ago when the pair’s 50-day moving average swerved far below its 200-day moving average. Now, the path is set to continue even further as the Federal Reserve’s shift in focus in policy framework pushed down the greenback. Expectations for the US economy sustained its estimate of another deep fall in GDP. The interest rate incentive has fallen as soon as the Fed announced that it would focus on its employment figures instead of fiscal policies. Economists predict that the dollar’s downtrend will continue even to the end of this year.

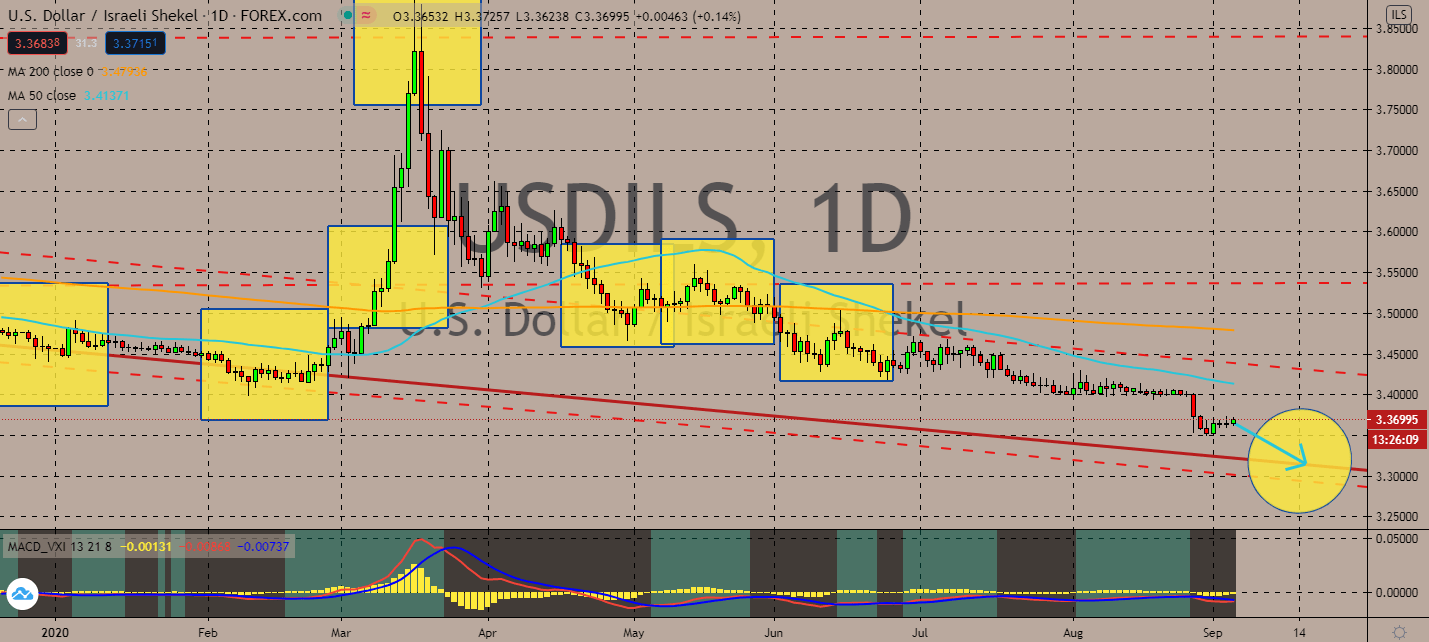

USDINR

The Reserve Bank of India’s Operation Twist is now underway, and is stimulating optimism in the forex market. In a statement, RBI said it would conduct two more tranches of 100 billion rupees or 1.3 billion USD-worth of simultaneous sale and bond purchases in September. The move typically instigates a bearish market for the rupee, but considering that the world is in an economic crisis, it will instead help its currency in the long term. That’s not the only driver for the exchange pair – economists predict that the dollar’s downtrend will continue into next year. Lower yields on US assets reflected the downtrend after the US Federal Reserve claimed it would tolerate higher inflation and redirect its focus on employment rates. The pair’s 50-day average is still above its 200-day moving average, but its sharp downturn in late August drove the pair into what could be an irreversible bearish market in the near-term.

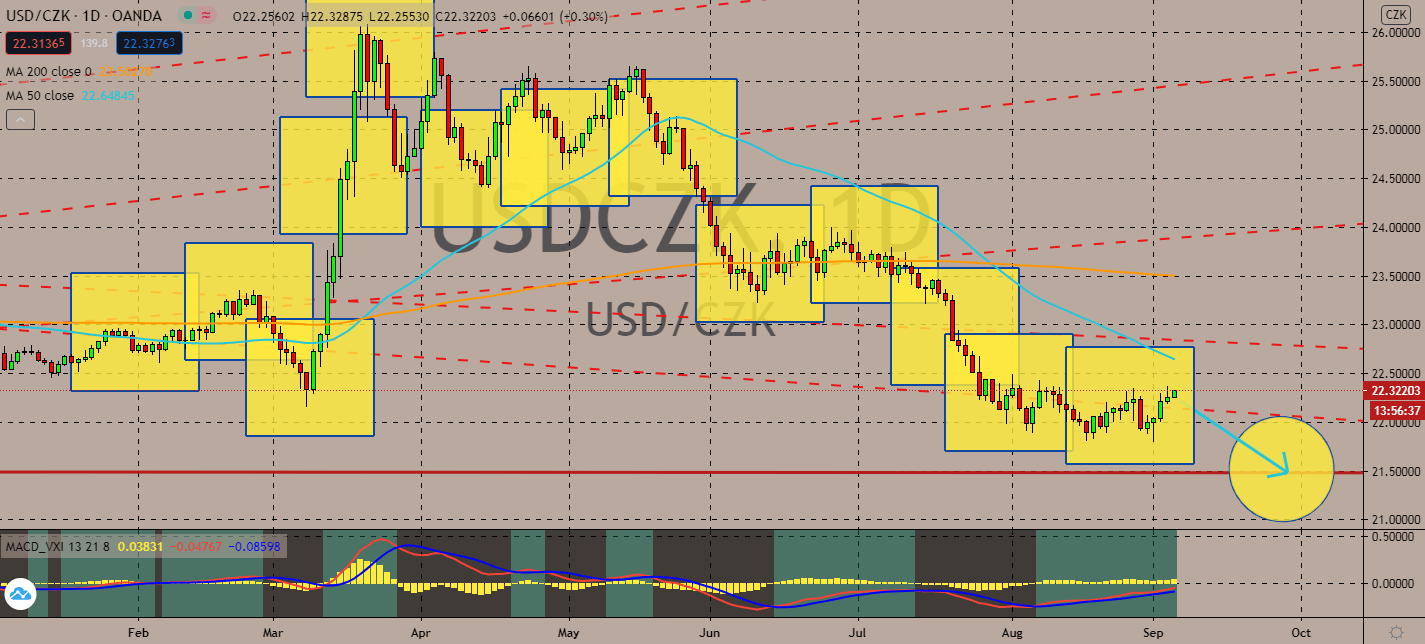

USDCZK

The Czech Republic is on high inflation, but also on a stagnant unemployment rate. Markit PMI for August stood at 49.1, up against both expectations and previous records of 49.0 and 47.0, respectively. Meanwhile, its unemployment rate remained the same at 3.8% as recorded prior. Like many countries, its GDP also went further down in the second quarter at -8.7% on a quarterly basis. This shows that the Czech National Bank should shift its focus not on its benchmark rates and stimulus packages, but now on its economy and its unemployment rates in particular. The longer-term outlook is siding with the franc as the forex pair’s 50-day moving average moves further down below its 200-day moving average. This is further proven by more economists claiming that the dollar’s downtrend will continue throughout the rest of this year due to questionable US yields and its falling benchmark interest rate

COMMENTS