Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

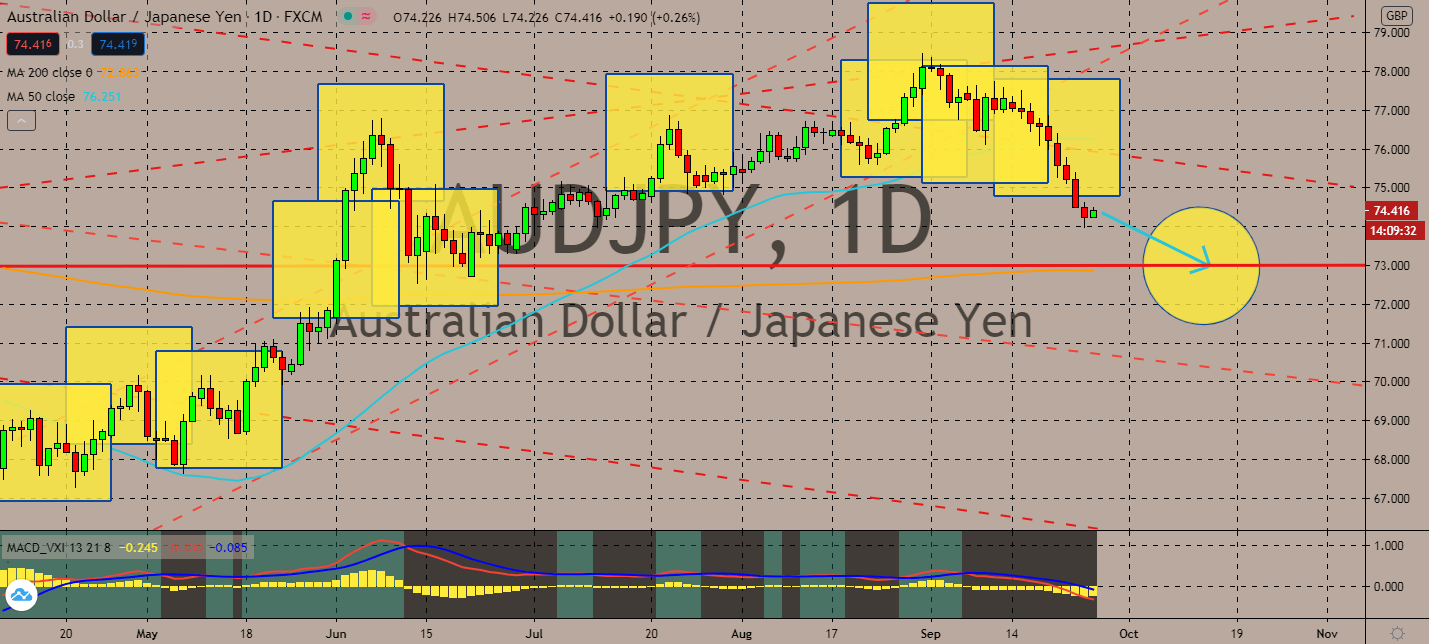

AUDJPY

Strengthening geopolitical situations between Japan and its surrounding countries are helping much of the yen’s increase against its major counterparts. Prime Minister Yoshishide Suga recently called his South Korean counterpart to make amends and fix their strained ties. This was a fixed contrast from his predecessor Shinzo Abe, who was viewed by some as unapologetic towards Japan’s colonial rule of Korea. He has also been working towards trade deals with the United Kingdom and have been working closely with Vietnam, which is now Japan’s top coffee supplier. Japan’s busy fundamentals have been pulling its Australian dollar opposite in the pair, even as its 50-day moving average tests its track up from its 200-day moving average. Risk aversion is projected to offset the pair’s previous bullish record, especially as Japan’s central bank seeks to maintain its current financial aid towards corporates.

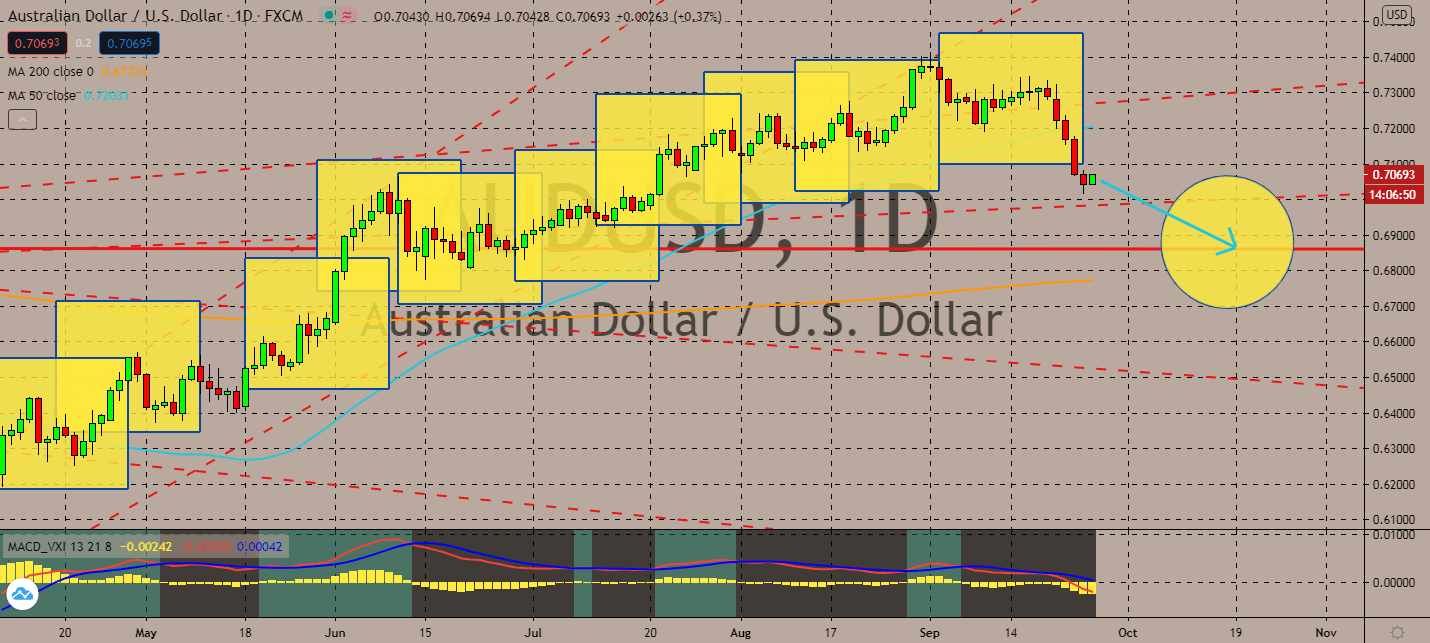

AUDUSD

The Australian dollar is projected to lose its momentum against its US counterpart with risk aversion. Despite having seen a slight decline in initial jobless claims yesterday, the US economy managed to redirect investors with an increase in New Home Sales for the month of August. US Federal Reserve chair Jerome Powell said that the agency won’t increase its benchmark interest rate for years, or at least until it reaches back to its inflation goal. The agency will continue its focus on employment rates and small businesses near-term, as well. The Reserve Bank of Australia’s recent decision to loosen its lending standards for banks to revive its spending activity won’t be able to stop the pair from testing its current support levels, even as its 50-day moving average is still well above its 200-day moving average. Uncertainty toward either economy is expected to continue the market’s greenback rally.

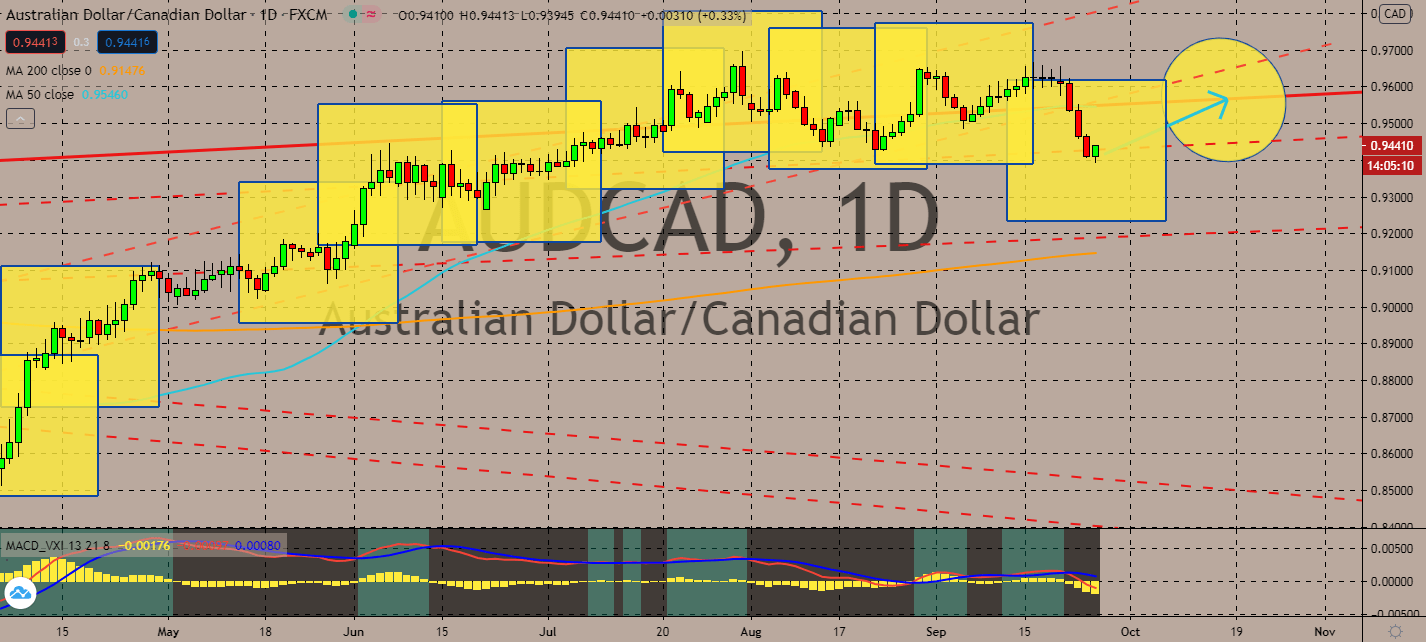

AUDCAD

Prime Minister of Canada, Justin Trudeau, warned that the country might have already been on its second wave of coronavirus infections. Although this was proven wrong by the country’s top health minister, daily case counts are still increasing in more populous states. Meanwhile, Australia’s own infection rates are decreasing – in fact, it recorded 10 new coronavirus cases today, which is much lower than its more than 700 peak seen in its second wave around the end of July. The Aussie dollar’s trend upward is further proven by the improving 50-day moving average, which is projected to test an increase to the support level seen in late September. Its 200-day moving average has been increasing however, which could cause hesitance to buy the Aussie since Canada previously saw one of the best fiscal recoveries in the coronavirus economy, but the newly ignited worries for the risk-oriented loonie will pull it lower than the comparably safer counterpart.

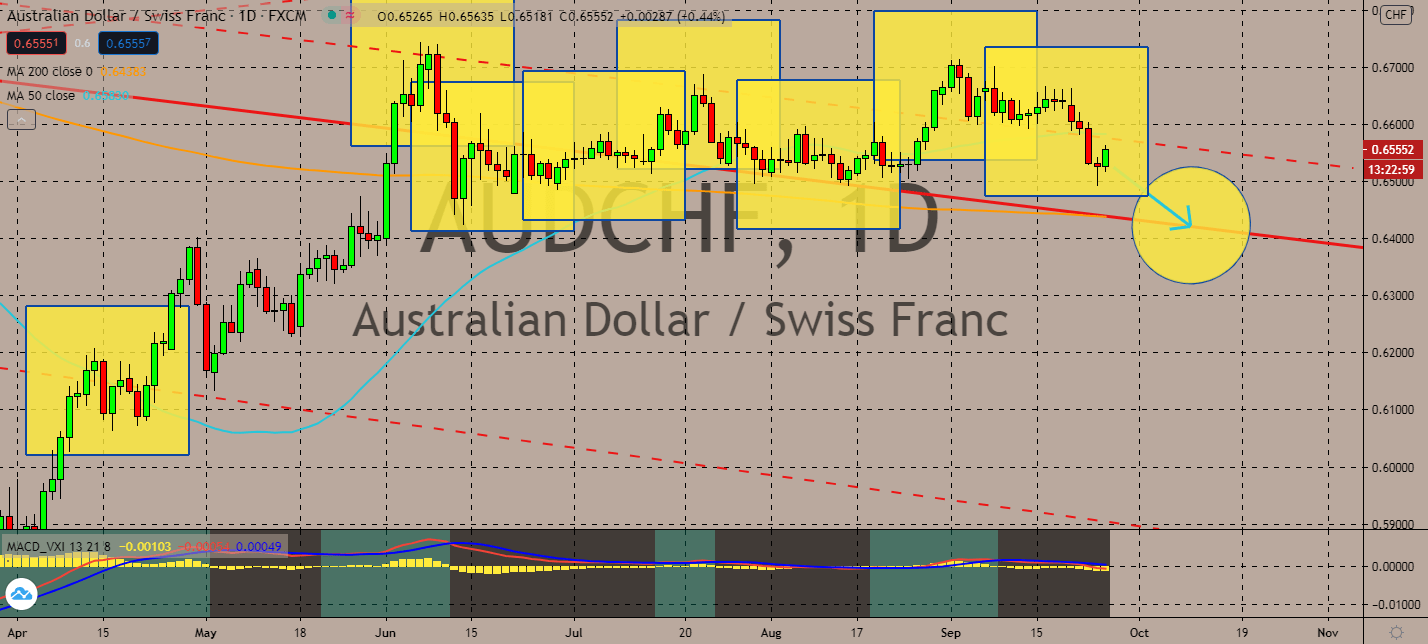

AUDCHF

The Swiss National Bank gets a knack on its intervention on the forex market. The central bank will continue its twin-track approach, as well as its low interest rates to heap appreciation pressure for its safe haven status. The move is projected to assist its currency to lift against key opposites in the market, such as the Australian dollar. The pair’s 50-day moving average has also met its current resistance level, which could mean that the pair could possibly test its support levels soon. In fact, it looks like the central bank’s move could drift the pair closer to mid-year correction. Risk aversion is likely to benefit the safety of the franc as its current financial stimulus continues to benefit its economic activity. It looks like Australia’s recovery from its second coronavirus peak is still raising certain brows in the market as the SNB anticipates that it will maintain control of the pandemic’s effect without an unsurmountable fall or the need for another stimulus package.

COMMENTS