Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

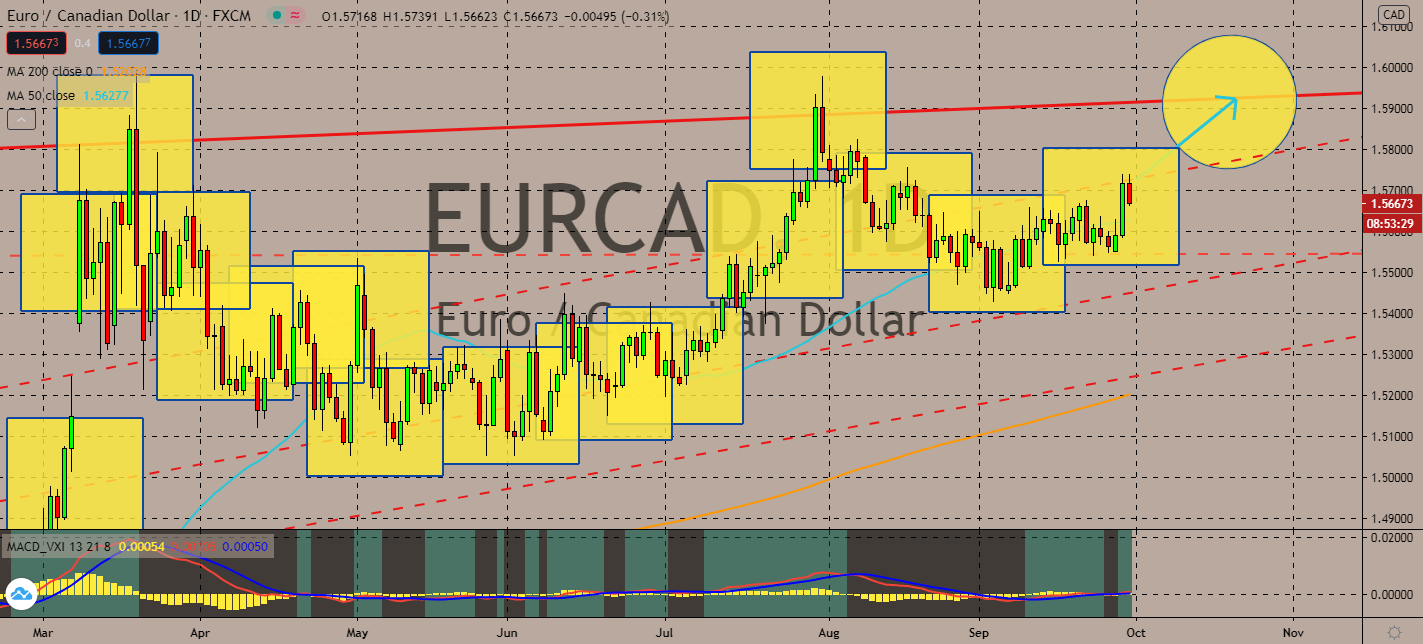

EURCAD

Thanks to a rise in optimism in the eurozone’s services sector as announced on Tuesday, the euro currency is projected to continue its strong bullish track against the Canadian loonie. The European Commission saw a bloc-wide economic sentiment increase for September from -17.2 to -11.11. The figure was also better than the market consensus of a slight increase to -15.7. Risk aversion is still prominent across the currency market, which is helping the pair’s 50-day moving average move further up from its 200-day moving average counterpart. The pair is projected to test its current resistance level and move to its late July high. The euro’s currency counterpart suffers from uncertainty revolving around possible nationwide restrictions in Canada. That said, fears of an uncontrollable skyrocket in coronavirus cases in the country is still running hot, especially after it counted a four-digit spike in Quebec earlier this week.

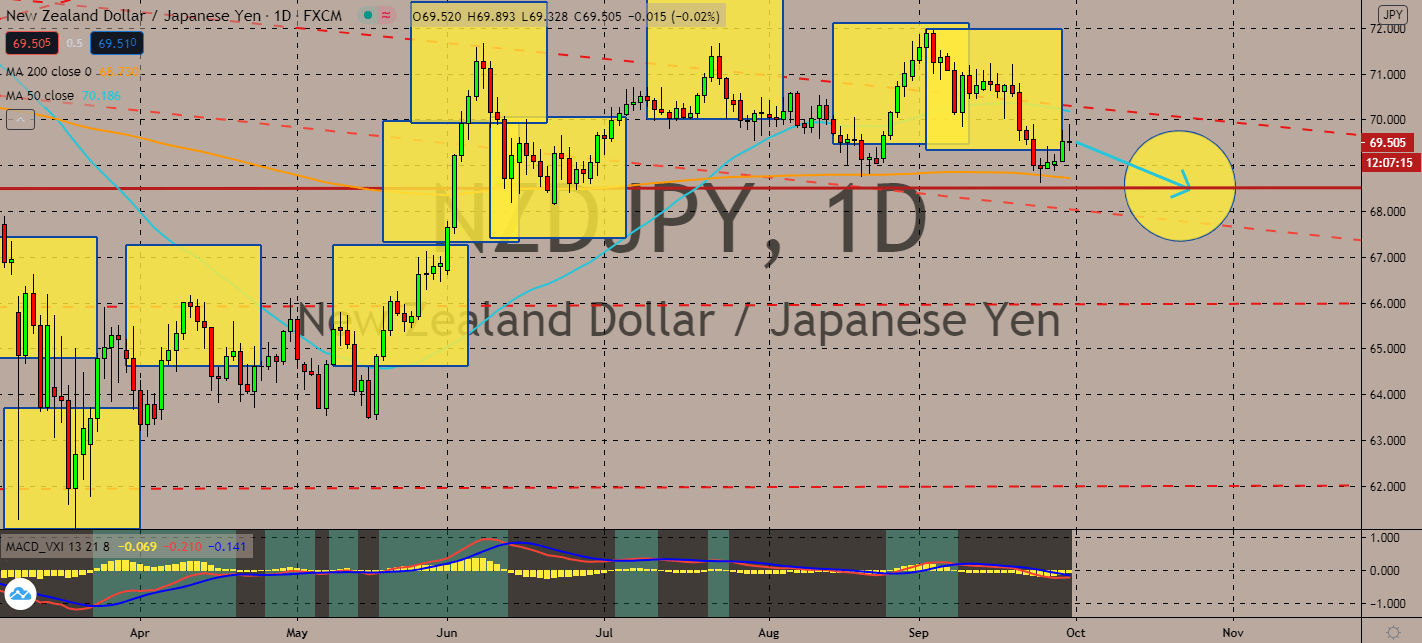

NZDJPY

Factory output rose for the third month in Japan throughout the month of August, showing signs that the country was improving even long before its previous prime minister Shinzo Abe had retired from his position. The transition between his eight-year reign to his predecessor Yoshihide Suga’s introduction into the job has been taken well by JPY investors so far, and the news will help it lift even further. This also comes in the form of its increase against the currency’s safe haven opposite, the kiwi dollar, as the pair’s 50-day moving average begins to fall down toward its 200-day moving average. The pair could test lows last seen in July as the Japanese economy continues its recovery, notably because New Zealand reopened its economic doors only recently. Moreover, NZ’s tourism sector is getting much less likely to see its pre-coronavirus activity. The tourist-reliant economy is projected to have a slower recovery because of this.

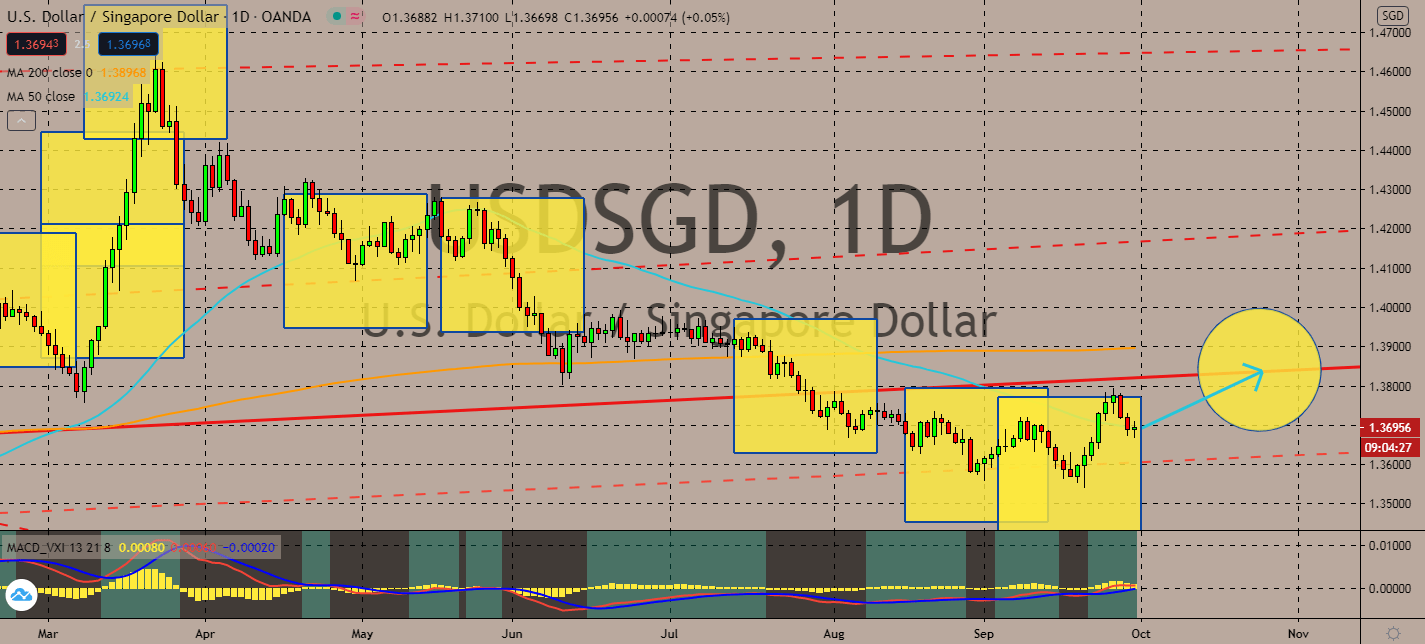

USDSGD

Mixed reactions towards the US presidential debate will help buoy the American dollar against its Singaporean counterpart. Overall, risk aversion is projected to help safe havens as Singapore suffers from its unforeseen population drop, which was reportedly its first in 10 years. The number of Singaporeans abroad had fallen from 217,200 to 203,500. This caused the total population to fall by around 17,800, which could be troubling for its overall economy. The pair’s 50-day moving average is showing signs that the pair could meet its current resistance levels to recover what it had lost since it fell in late July. Its 200-day moving average remains unsure, trading sideways as markets question what to do with the dollar in the long run. In the meantime, the chaotic US presidential debate is projected to seek refuge in the dollar, which is at its best month since July 2019. Greenback’s price still looks cheap thanks to its plummet in earlier months.

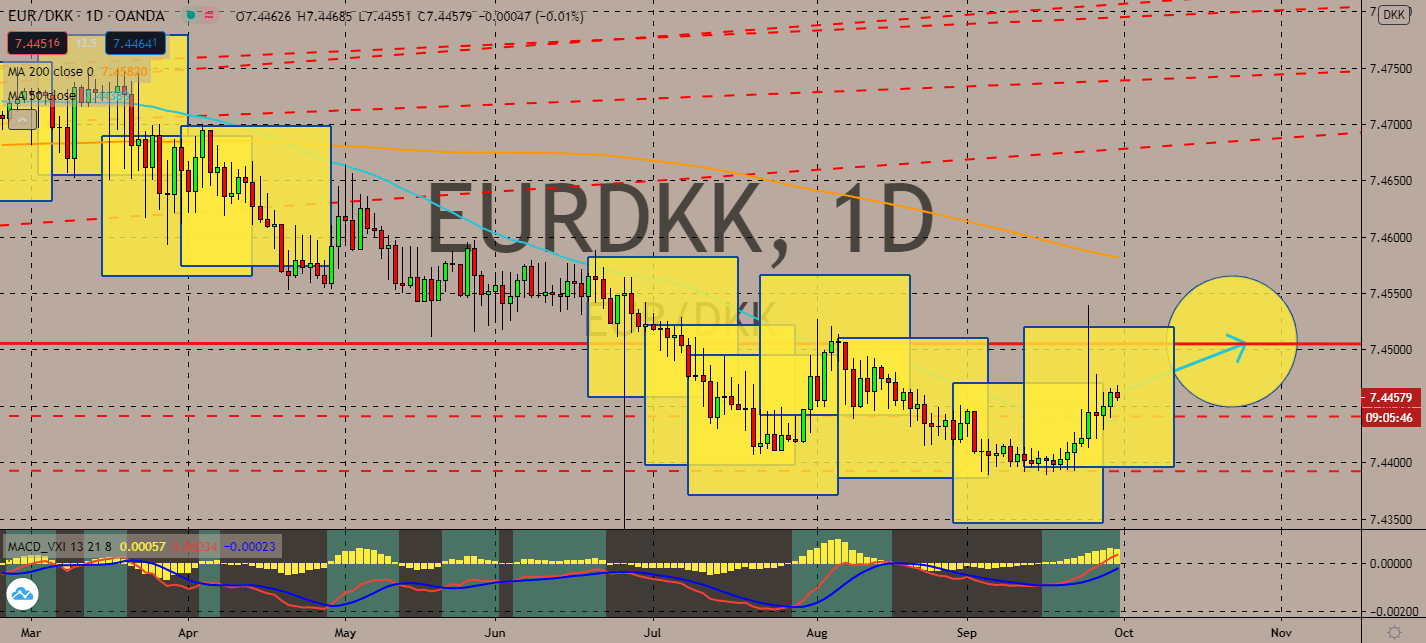

EURDKK

A no-deal Brexit is becoming increasingly unlikely. The European Union is expected to give the bloc more advantages in their trade relationship, which is expected to lead the market into buying more euro. The eurozone’s optimism came with increasing confidence in the market’s outlook on its overall economy from -17.2 to -11.11, up from the market’s expectations of an increase to -15.1 even as coronavirus cases rise in the block. Short-term markets are likely to benefit the euro across the board. The pair’s move downwards could surprise markets, since its 50-day moving average is still behind its 200-day moving average. But it looks like the pair is about to test its current resistance level as Denmark continues to absorb the blow from its coronavirus lockdowns from three weeks ago. The krone is projected to boost only when its slowing daily infection count becomes enough to take away more restrictions on public gatherings.

COMMENTS