Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

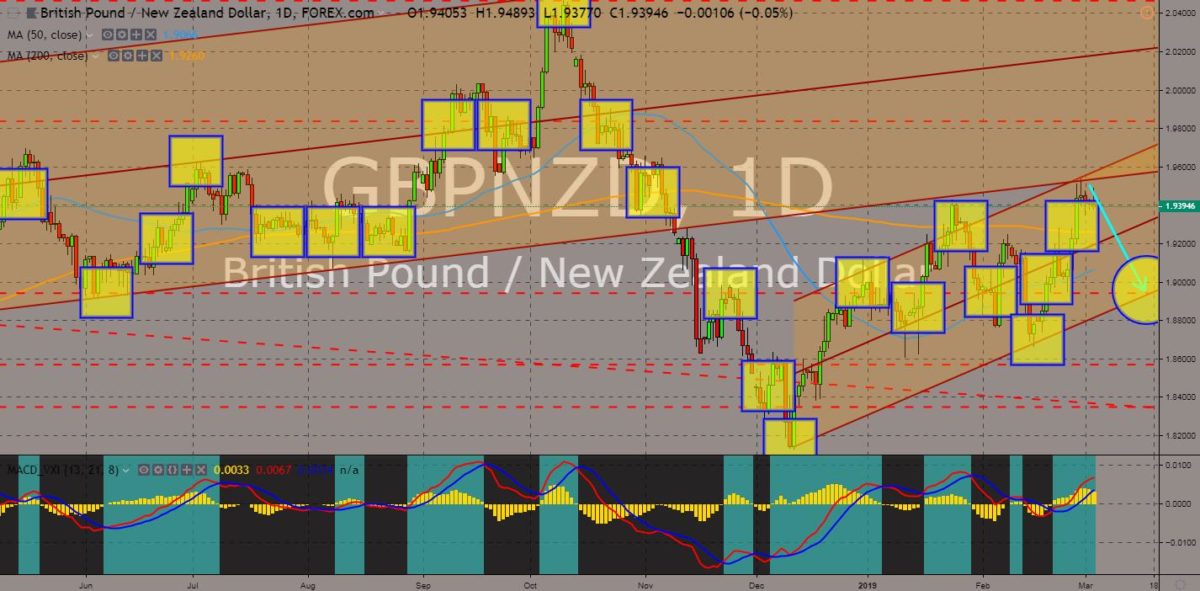

GBPNZD

The pair was expected to further go lower in the following days after failing to break out of the uptrend resistance line and downtrend support line. UK Prime Minister Theresa May is yet to deliver her second attempt to reach a deal that will be approve by the European Union and by the UK Parliament. In line with this, the United Kingdom had already signed several deals with non-EU countries to continue their trading relationship, despite the UK crashing out of the EU without a deal. In the recent months, New Zealand had been making headline with New Zealand Prime Minister Jacinda Ardern being the first female president to give birth while doing her duties, and by seeking independence from Australia. Aside from signing a post-Brexit trading agreement with the UK, it has also a maintaining free trade agreement with the European Union. Histogram and EMAs 13 and 21 was expected to further go lower.

USDCNH

The pair will further go lower in the following days following the creation of the “Death Cross”. US President Donald Trump defer the tariff hikes until further notice, which was supposed to take effect last Friday, March 01, after the trade truce between the United States and China expired last Friday. This move shows Trump’s willingness to proceed with the talks despite the presence of Intellectual Theft issues. This will save China’s slow down and will further spur global growth. Despite the trade truce, however, the United States was still expected to slow in terms of growth. The United Kingdom and New Zealand also opened the possibility that it might work with the Chinese technology company Huawei in building its 5G (Fifth Generation) networks, defying the pressure from the United States. Histogram and EMAs 13 and 21 will reverse back in the following days.

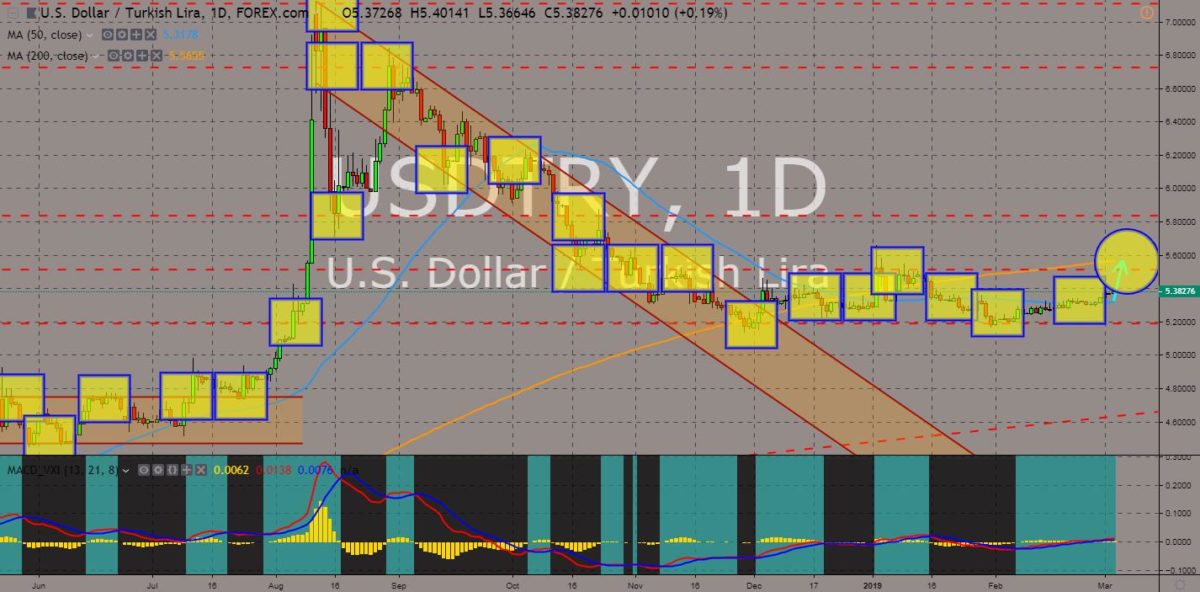

USDTRY

The pair were seen to further go up towards 200 MA after bouncing back from the support line and 50 MA. Two (2) US State Department officials will visit Turkey this month for talks on US-Turkey cooperation in Syria, and Turkey’s decision to buy the Russian S-400 air defense system. The Visegrad Group’s Poland hosted the Middle East Summit to discuss Iran’s role in Syria, Turkey’s ally. Turkey is a member of the US led NATO (North Atlantic Treaty Organization) Alliance, and was applying to become a member of the European Union, but the European Parliament calls to stop Turkey’s accession in the EU amid concerns over the country’s motive in speeding up the accession process. The meeting will be another opportunity for the tow (2) countries to rebuild their relations after the United States choose to take sides with The Kingdom of Saudi Arabia. Histogram and EMAs 13 and 21 will move upwards in the following days.

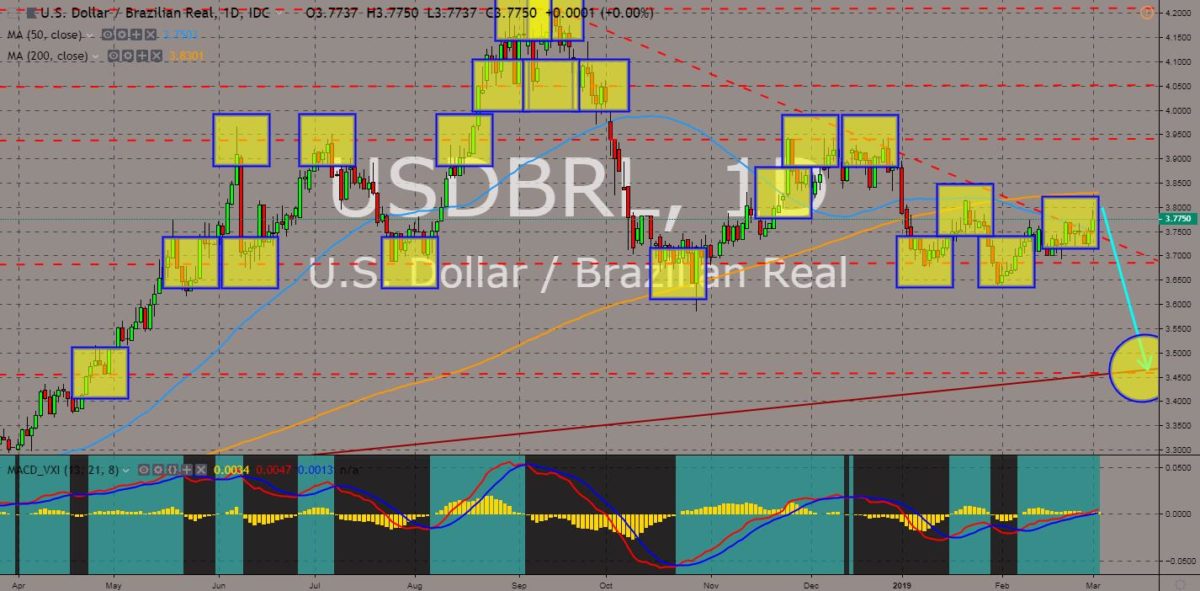

USDBRL

The pair was expected to fail to break out of the downtrend resistance line, sending the pair towards its 11-month low. The European Union backs the United States and Brazil in recognizing Juan Guaido, a self-proclaimed Venezuelan President. However, Brazil ruled out that no military intervention must be done to Venezuela, despite US suggesting to use military force from the United States and from other Latin American countries. Brazilian President Jair Bolsonaro was set to rule South America with the revival of the Mercosur deal, the largest trading bloc in South America, just like how US President Donald Trump ratified the NAFTA (North American Free Trade Agreement) with Canada and Mexico. The future relation between the two (2) countries might change with Brazil pivoting to China, Russia, and Turkey. Histogram and EMAs 13 and 21 will fall in the following days.

COMMENTS