Here are the most recent market charts and analysis for today. Check them out!

USDSAR

The pair is seen to further go low, which signals price stability. The influence of the United States towards the Kingdom of Saudi Arabia was fading as evident during the G20 Leaders Summit in Buenos Aires, Argentina. Saudi Arabia’s de facto leader and Crown Prince Mohammed bin Salman (MbS) was seen having a good time with Russian President Vladimir Putin. US President Donald Trump refused to sanction Saudi Arabia regarding the killing of Saudi Arabia citizen and US resident Jamal Khashoggi amid pressure, citing the importance of US-SA relationship. Saudi Arabia was the first country that Trump visited as a US President. The growing relationship between Saudi Arabia and Russia is seen as a threat to the US. The United States, Saudi Arabia, and Russia are the three biggest oil producer of fossil fuel and liquified natural gas. Saudi Arabia is the default leader of OPEC (Organization of Petroleum Exporting Countries). Histogram and EMAs 13 and 21 is expected to continue to go down.

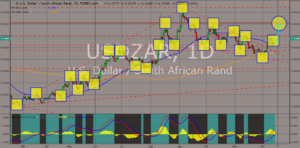

USDZAR

The pair is expected to continue its rally after it broke the “Falling Wedge” pattern. The United States unveiled its new strategy in Africa by providing aid to make the continent self-reliant. This was a counter effort by the US as China was seen extending its influence over the region through grants and loans as part of its “One Belt, One Road Initiative”, that put the countries into a debt trap. US National Security Advisor John Bolton denounced China for its aggressive quest for natural resources and its rising military and maritime presence, warning that the balance of power in the horn of Africa could shift to Beijing. Histogram was gaining strength, while EMAs 13 and 21 was poised to extend its uptrend.

USDRUB

The pair is seen to go lower in the following days to complete the “Descending Triangle” formation. The relationship between Saudi Arabia and Russia was getting better, as evident during the recent G20 Leaders Summit held in Argentina. Saudi Arabia, Russia and the United States comprised 1/3 of global oil production. Saudi Arabia was the default leader of OPEC (Organization of Petroleum Exporting Countries) and was critical to Trump’s success as it recently overtook the Kingdom as the largest global crude oil producer. Trump will need Saudi Arabia in its plan to overthrow Russia by keeping the oil prices low, since Russia is an oil dependent economy.

GBPUSD

The pair will continue its decline as the price enters its 20-month low. In 2019, the struggle to save Democracy will face its key test. Brazil is the latest country to elect a Nationalist with the win of Jair Bolonaro. President Bolsonaro plans to lead and integrate Latin America. In Europe, the group of CEE (Central and Eastern Europe), a group with most of its members as Nationalists, is seen pivoting to China. While German Chancellor Angela Merkel lost his power due to her immigration policies, French President Emmanuel Macron was facing a “Yello-Vest” protest, and the United Kingdom was divided with Brexit and its government teeters with the nation’s future. The United States was more stable as the US Congress is composed of Democrats in the House of Representative and Republican in the House of Senate. Histogram and EMAs 13 and 21 is about to continue to go down.

COMMENTS