Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

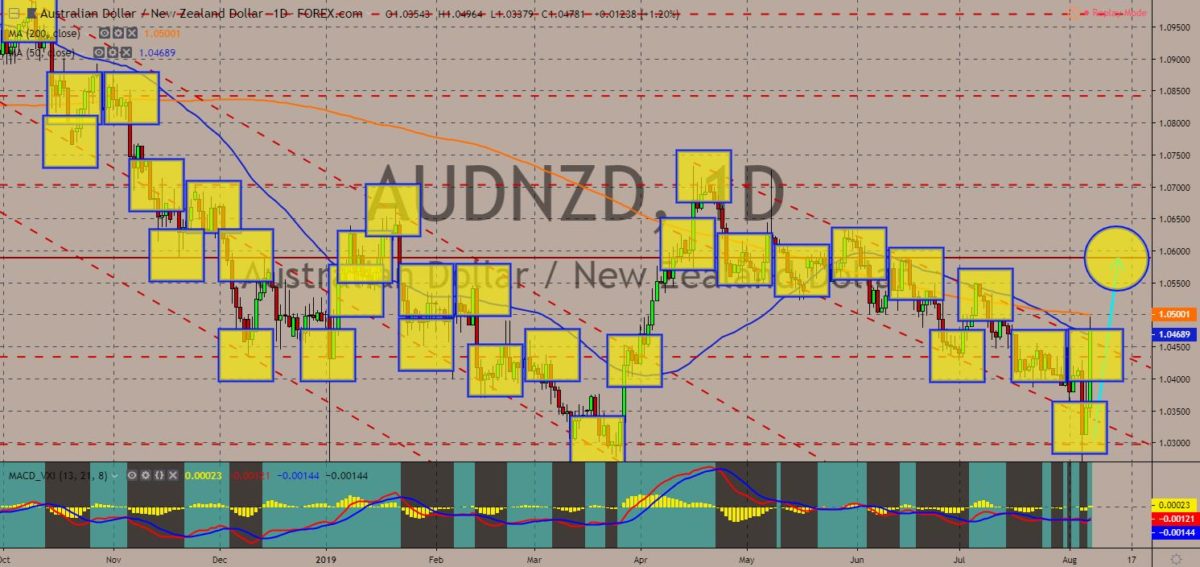

AUDNZD

The pair is expected to breakout from MAs 50 and 200 and head towards a key resistance line. Australia and New Zealand is on a race towards a negative interest. Last June, the Royal Bank of Australia cut its benchmark interest rate by 25-basis points followed by another cut in July, which results to the country having 1% interest rate. But this is not the end. On September and November, another interest rate cut was expected, which could bring its interest rate to zero. The Royal Bank of New Zealand (RBNZ) on the other hand, had surprisingly cut its benchmark interest rate by 25-basis point in response to the escalating trade war between the United States and China. Its decision comes after China devalued its currency in response to the additional tariff imposed by U.S. President Donald Trump and the Fed’s decision to cut its interest rate. Histogram and EMAs 13 and 21 recently crossed over.

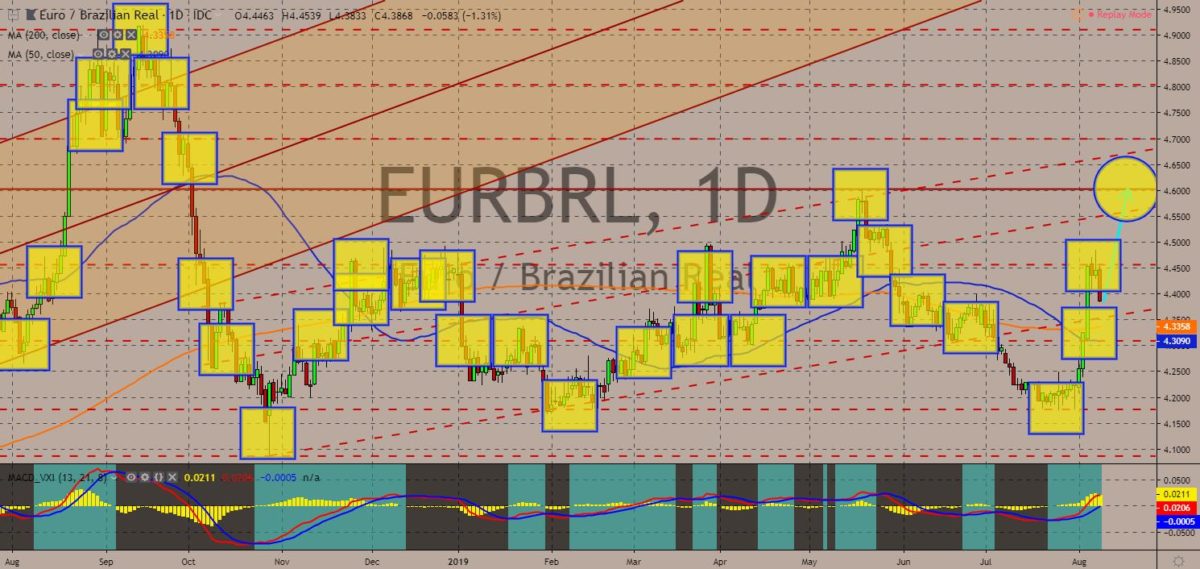

EURBRL

The pair is seen to continue its rally, sending the pair higher in the following days to retest its previous high. Brazilian President Jair Bolsonaro’s Amazon policies could sink Brazil’s trade ambitions. Last June, Brazil and the European Union finally agreed to a trading agreement that took the two (2) economies 20 years to make. However, the deal might come to end following President Bolsonaro’s neglect of the Amazon rainforest. Deforestation in Brazil has grown steadily since President Bolsonaro’s election in October, spiking by 88% in June and reaching record highs according to both official and independent reports published in July. Invasions by loggers and gold miners on indigenous lands have also become more common – with sometimes lethal consequences. The EU on the other hand, has been increasingly active in climate change initiative. Histogram and EMAs 13 and 21 will continue to go up.

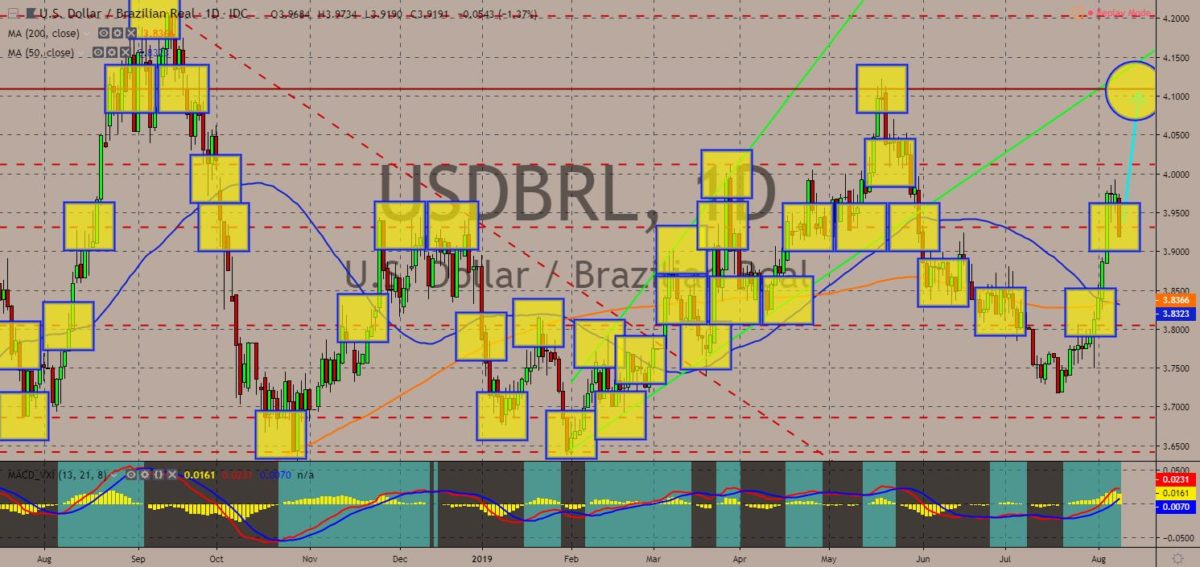

USDBRL

The pair found a strong support from a support line, sending the pair higher towards its previous high. The trade war between the United States and China had made Brazil a winner after the country covers exports that were given a higher tariff. During the trade war, Brazil accounted for 80% of China’s total soybean export. However, Brazil President Jair Bolsonaro was pro-America, which leads to the country to begin negotiating a trade agreement with the United States after Brazil was able to close a deal with the European Union back in June. Despite this economic success, Brazil has been struggling inside, including Venezuela’s economic and humanitarian crisis, which has been dragging South America. The gain of Brazil is also a gain of the U.S. following a closer relationship between the two (2) countries since the election of President Bolsonaro. Histogram and EMAs 13 and 21 will continue to go up.

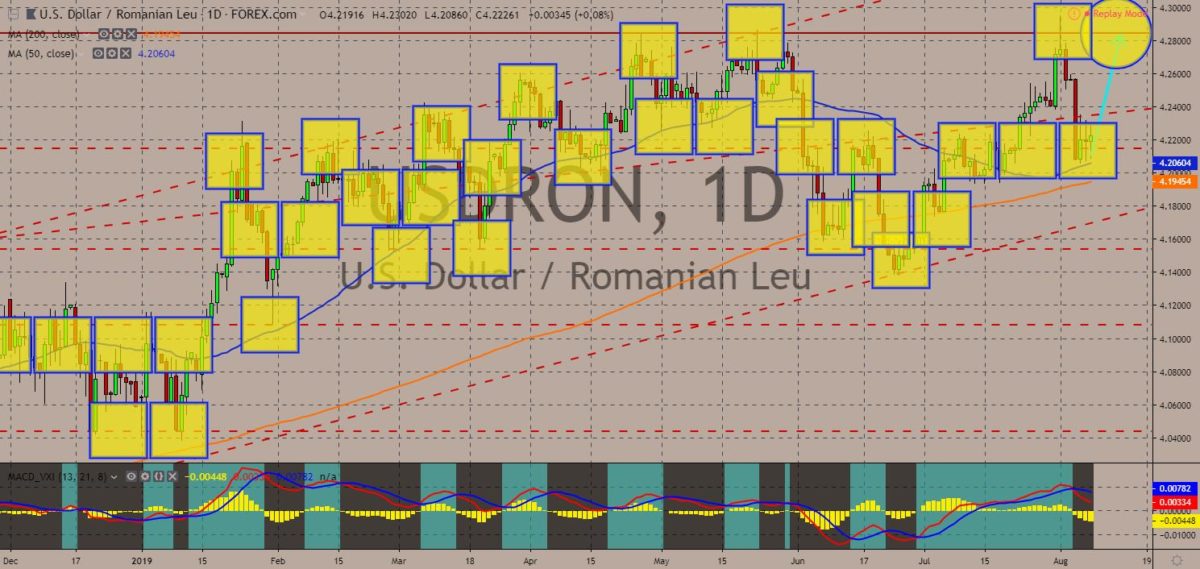

USDRON

The pair is seen to bounce back from its support line and from 50 MA, sending the pair higher toward its previous high. Romanian President Klaus Iohannis is expected to visit the White House of August 20 to meet his counterpart U.S. President Donald Trump. The two leaders will discuss shared security challenges facing the United States and Romania and ways to advance fair and reciprocal trade and energy partnerships. The visit will occur as Romania marks 30 years since the fall of communism and 15 years since the country joined the North Atlantic Treaty Organization (NATO). In the past few months, eastern European countries was seen exchanging dialogues with their U.S. counterpart as America expands its influence in Europe following the weakening U.S.-E.U. relationship and the uprising of Russia’s military. Histogram and EMAs 13 and 21 will bounce back in the following days.

COMMENTS