Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

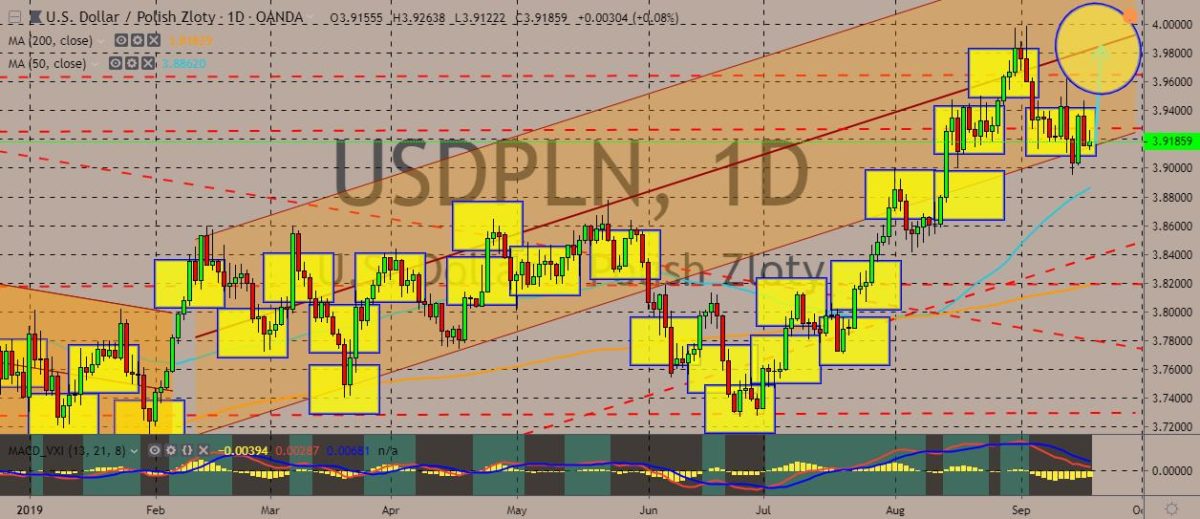

USDPLN

The pair has recently pulled back from highs set in late August and has since traded in tight ranges above the lower band of the trading channel in an uptrend. The the 50-day moving average still appears to be going up, indicating bullish sentiment among the traders of the pair. Over in Poland, the second-quarter gross domestic product (GDP) was recently revised slightly upwards. CPI decelerated in August, but there was a huge risk of overshooting the National Bank of Poland’s target in the first quarter of 2020. At the same time, the ruling PiS decided to raise the minimum wage about approximately 15% in 2020 and 2021. That means the CPI can be expected to reach 3.2% to 3.5% year over year in 2020. The investment dynamics will probably be adversely affected, but negative impacts on GDP can be offset by more pledges in investing. However, concerns over inflation and investment still exist.

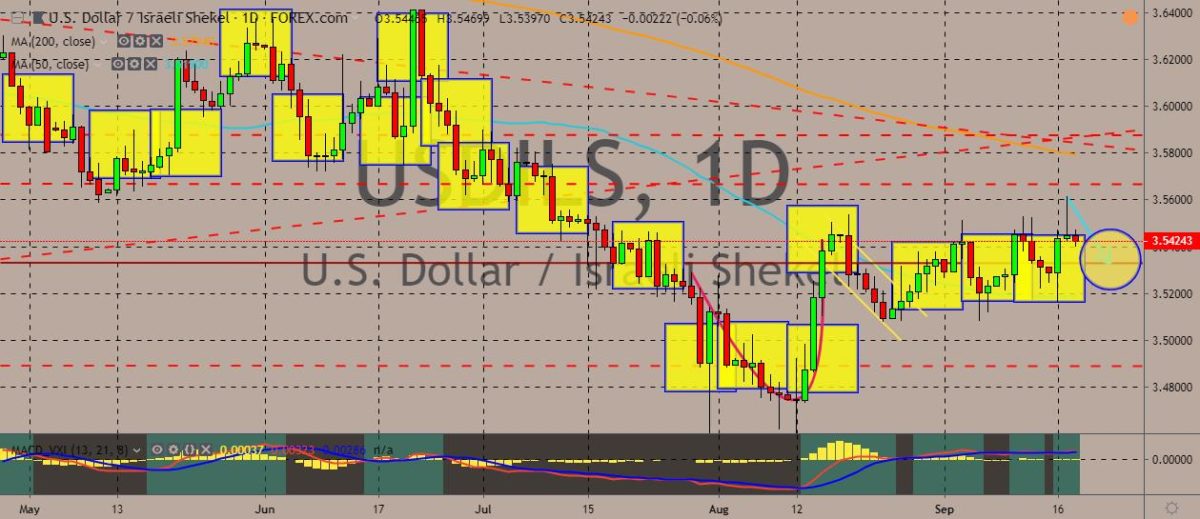

USDILS

The pair still treads tight ranges after the cup-and-handle formation last August. Traders appear to be finding a solid support above the 50-day MA on the daily chart. In the previous trading session, the pair reached near two months high before settling only slightly higher from the session before. The moving averages still indicate largely bearish sentiment for the pair. Over in Israel, election news makes the headlines. Local television stations showed unofficial results that indicated Prime Minister Benjamin Netanhayu was tied with former military chief Benny Gantz, his main rival. Additionally, with no single-party majority in the 120-seat Knesset, the country can expect weeks coalition talks before a new government is hatched. Netanhayu has touted his close relationship with US President Donald Trump and said he intended to establish a “strong Zionist government” reflecting the view of the nation’s people.

USDSEK

The pair has rebounded from recent lows and is appearing to attempt an upward move, having dropped to levels almost touching the 50-day MA. Should the price continue going up, the next resistance still lies further up, giving the pair more room to rise. The Swedish krona is suffering some weakness after data showed that unemployment rate rose to 7.1% in August from 6.9% in July, coming far above analyst expectations. Riksbank released the minutes of its monetary policy meeting that happened earlier in the math. During the meeting, the central bank decided not to change the main interest rate at negative 0.25%. The minutes also showed that the central bank will probably not be able to tighten its monetary policy as fast as it previously wanted. Meanwhile, concerns over the bank’s plan also weigh the krona, with some criticizing the central bank’s plan to raise interest rates.

USDZAR

The pair has converged and then broken through the 50-day moving average on the daily chart, indicating a continuing bearish sentiment for the pair, although recent movements indicate that the traders are searching for a stable level above the moving average to anchor on. The South African rand strengthened against the dollar in recent sessions, in line with the trend among emerging market currencies, thanks to the increased level of risk appetite. On the broader, markets, geopolitical risks continue to bug the market. Over in Saudi Arabia, some crude oil production facilities went up in flames after an attack. The perpetrator of the attack hasn’t yet been determined, but the US has already suggested that it could be Iran. Should geopolitical risks continue, the USDZAR pair could reverse track and move upward, as investors will be ditching off riskier currencies for the safe-haven appeal of the US dollar.

COMMENTS