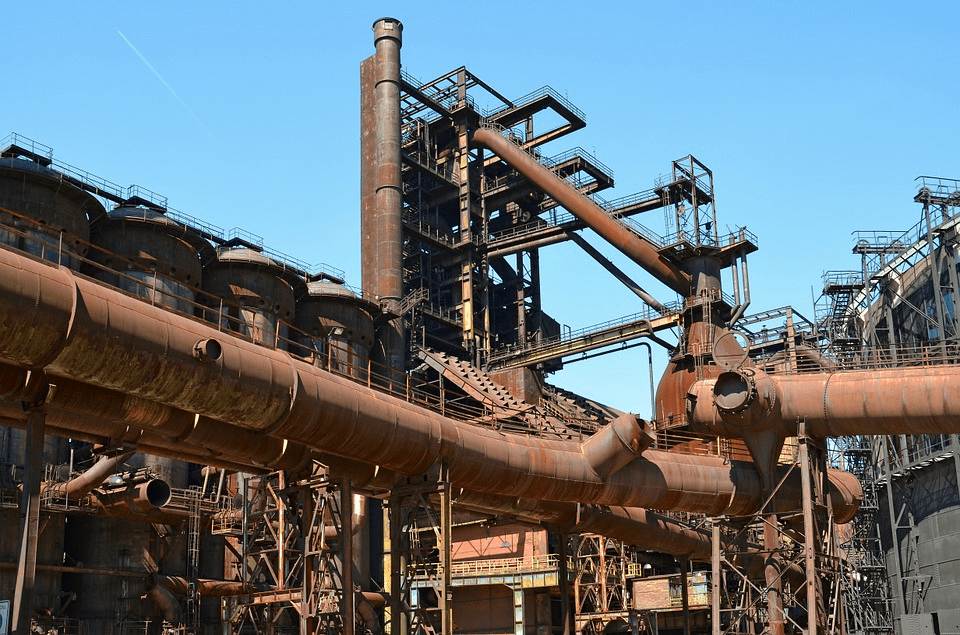

Iron ore prices drop as China examines transactions

Iron ore price dropped on Wednesday following the Shanghai Futures Exchange promised to look into “abnormal transactions,” ranking on the government’s earlier efforts to temper commodity inflation through information. Iron ore price on the Dalian Commodity Exchange fell 6.1% to 994.50 ($155.59) yuan a tonne, just above the day’s low of 992 yuan ($155.20), its …

Iron ore prices drop as China examines transactions Read More »