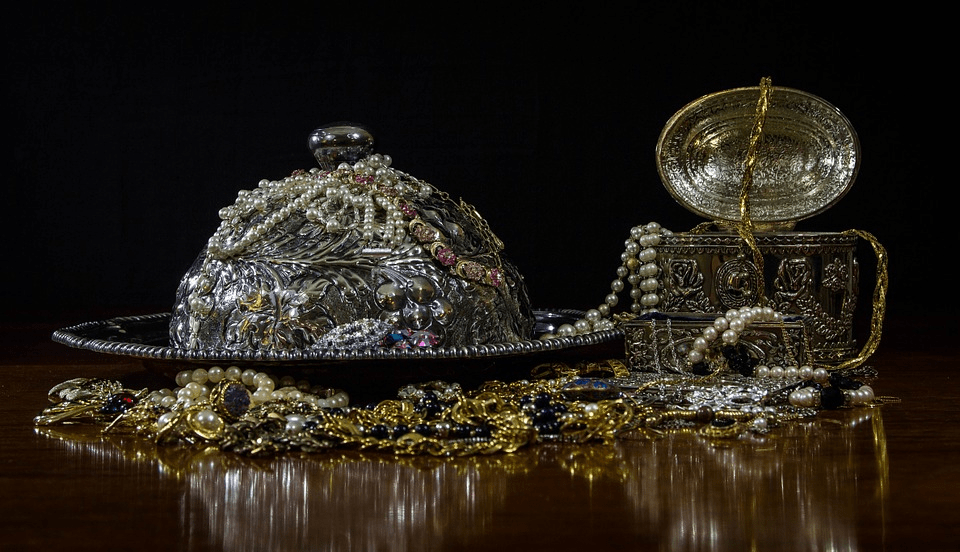

Silver Soared On Inflation Woes, While Gold Retested $1,900

This pointed to a greater risk appetite in the wider financial markets, reducing the dollar and making metal commodities more affordable for foreign investors. February gold futures climbed $13.20, or 0.7%, to $1,896.40 per ounce at 13:43 GMT on Monday on the New York Mercantile Exchange’s COMEX division. Gold prices are getting off a weekly …

Silver Soared On Inflation Woes, While Gold Retested $1,900 Read More »