Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

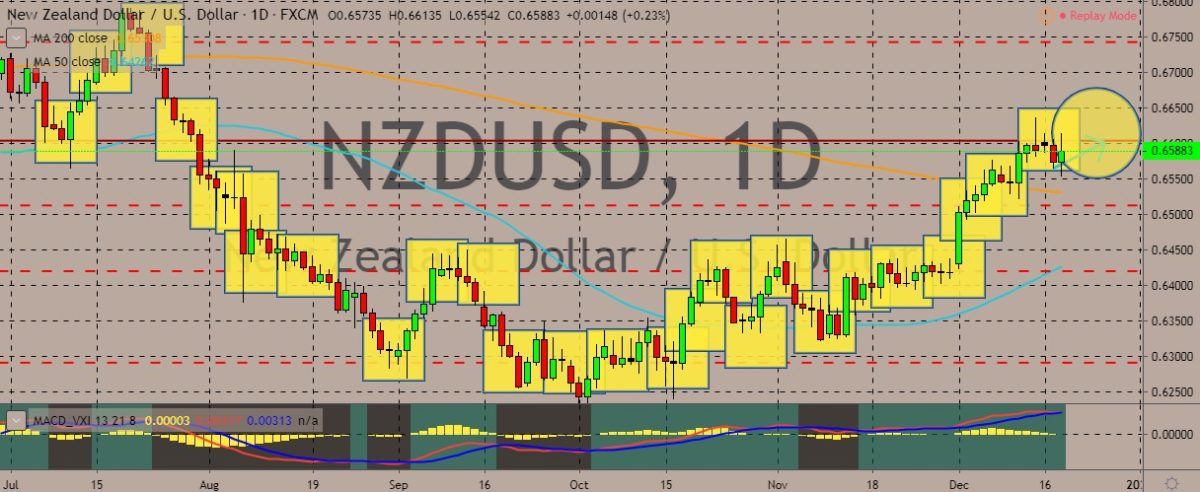

NZDUSD

The pair has trading in the green in the previous trading session after slipping previously near the 200-day moving average. The New Zealand got back up from the weaker trading level after the country’s third quarter economic growth recorded a figure that was stronger than expected. Meanwhile, USD traders kept closed tabs on a vote to impeach US President Donald Trump. New Zealand’s GDP sped up 2.7% in the third quarter, which was much higher than the 2.4% expectations. Kiwi and other risk-sensitive currencies kicked off the month on stronger footing as two main risks pummelling the global markets were apparently starting to weaken. This month features a preliminary US-China trade deal and the election victory in the United Kingdom of Prime Minister Boris Johnson. US Trade Representative Robert Lighthizer said last Tuesday that the United States may increase tariffs on European to shrink its trade deficit with the continent.

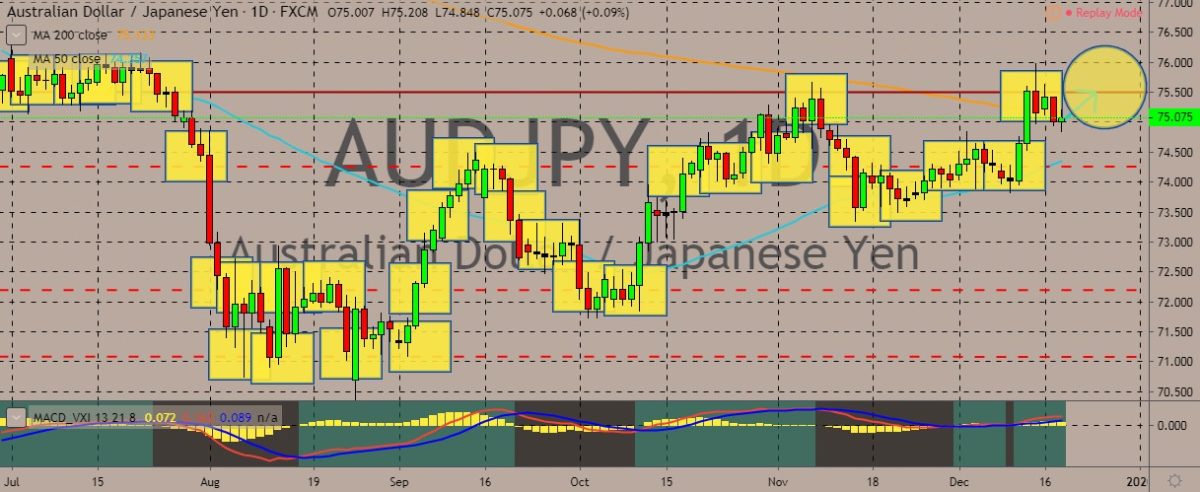

AUDJPY

The pair rose slightly in today’s session, stepping above the 200-day moving average thanks to some positive data regarding the Australian economy. The country’s November month Employment Change increased beyond the 14,000 forecats to 39,900. Meanwhile, the rate for unemployment declined to 5.2%, which was lower than the 5.3% forecast. The participation rate was not changed at 66%. Traders can expect further upward moves on the Australian dollar as traders rush for the currency. There could also be increased risk appetite amid the US-China trade developments. Meanwhile, over in Japan, Koichi Hamada, who is an adviser to Japanese PM Shinzo Abe recently crossed wires saying that the Bank of Japan must avoid super low interest rates. But in spite of that, the market is not expecting the Japanese central bank to change its current monetary policy during today’s meeting.

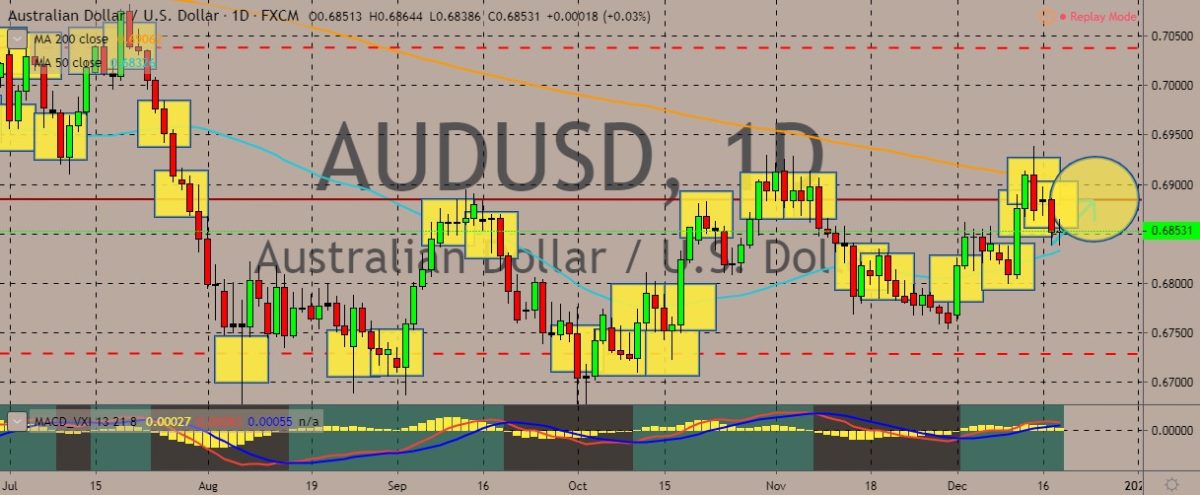

AUDUSD

The AUDUSD pair is expected to move up from its lows now, although it has traded with very minimal volume in the previous session as investors awaited the jobs data. The pair largely moved based on the aforementioned surprise in jobs growth data. However, it pays to take a closer look at the details to know why the pair hasn’t moved tremendously up yet. The economy only created 4,200 full-time positions, while part-time work accounts for the rest of the figure. Meanwhile, although the unemployment rate is lower, it still sits above the Reserve Bank of Australia’s target of 4% level. The market still is uncertain whether this target could be reached in the cycle. At the same time, the minutes of this month’s RBA monetary policy meet highlighted the labor market. Interest rates were held at record lows at that time, with reassessment expected in February. Meanwhile, the Australian dollar could continue moving up with the prevailing trade deal hopes.

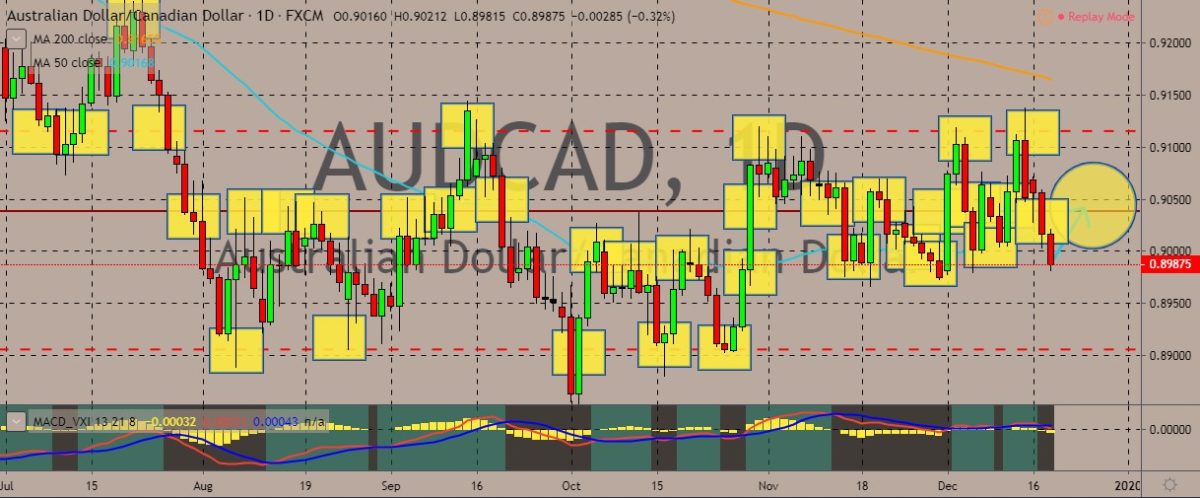

AUDCAD

The pair is poised to jump to a higher level after the release of the unexpectedly positive Australian jobs data, which is the primary driver of the aussie currency in today’s trading sessions. The AUDCAD has recently slipped below the 50-day moving average but continued the sideways chops of the pair. Meanwhile, the Canadian dollar got its previous boost from the underlying inflation figure, which hit a the highest in a decade in November. The data reinforced the policy makers’ decision this month not to cut interest rates in spite of the concerns around slowing growth. Inflation rose 2.2% in November on a year-on-year basis, compared with the 1.9% in October. The annual reading met economists’ expectations. Consumer price index lost 0.1% on a month-on-month basis, also meeting expectations. Core inflation gained 2.2%, the highest reading since 2009, from 2.1% in October.

COMMENTS