Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

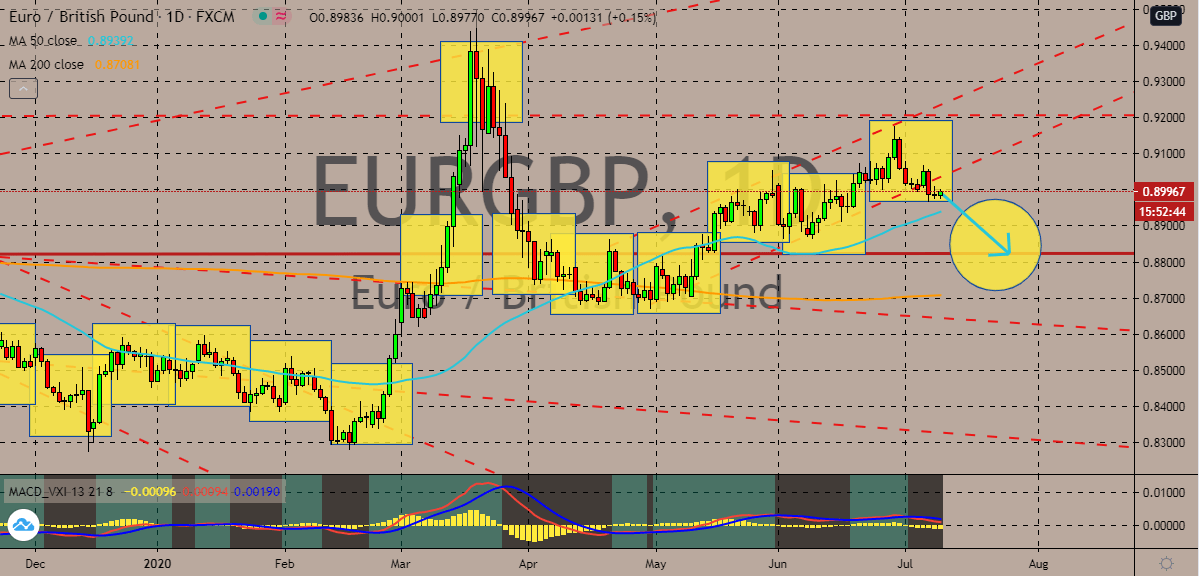

EURGBP

The euro to British pound exchange rate should continue its bearish decline despite the euro’s slight recovery this Thursday. The pair should hit its support by the latter half of the month, forcing the 50-day moving average lower and closer the 200-day moving average. The main reason why the British pound struggled today is the recent announcement of British Chancellor Rishi Sunak about a £30 billion plan to help the United Kingdom lessen the unemployment jump. According to reports, the British government will pay local companies about £1,000 bonus for every employee it keeps for three months. Aside from that, the British official also said that the scheme will give people who dine out a 50% discount in August. The plan momentarily slowed down the momentum of the British pound against the euro. Meanwhile, the single currency has a lot of turbulence ahead of it, hence, the prices are widely projected to remain on a bearish trajectory.

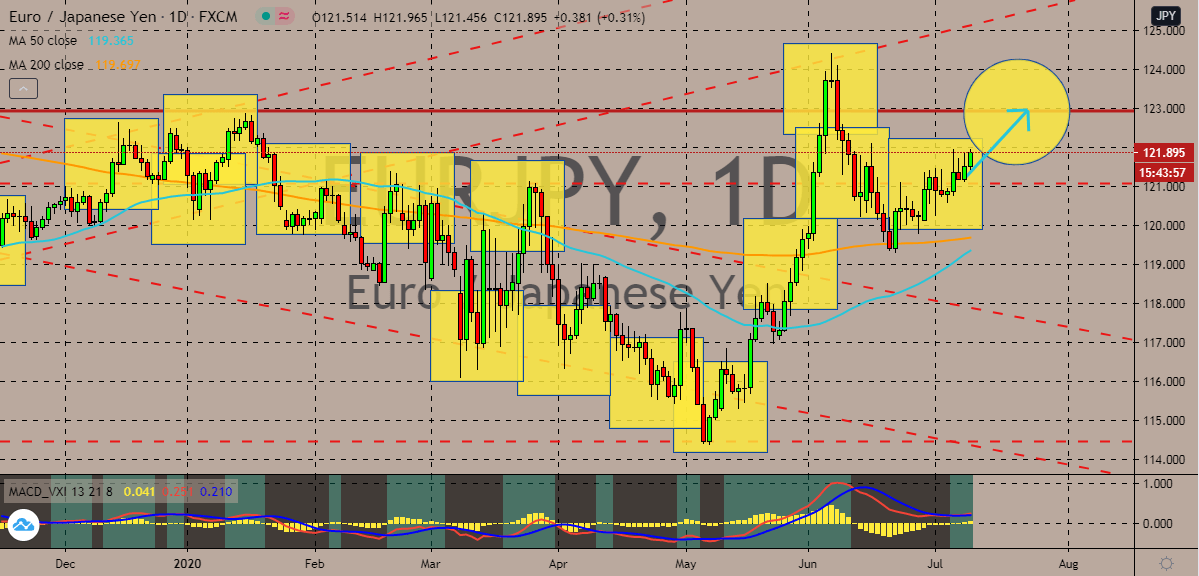

EURJPY

The Japanese yen lost its steam against the euro, and bulls are taking advantage of the situation. The euro to Japanese yen trading pair’s price is heading towards its resistance which it should reach this July. The move should help bullish investors push the 50-day moving average above the 200-day moving average, signaling an upward momentum. The safe-haven appeal of the Japanese yen is no match for the good news brought by drug-making companies producing coronavirus vaccines. The news caused a shift in the global market’s mood, causing the risk appetite to strengthen thus strengthening the euro. On the other hand, the boost in risk appetite was further supported by the recent news that eurozone’s economy may have contracted slightly better than projected. Earlier reports say that European Central Bank Vice President Luis de Guindos said that the bloc may have shrunk less than the 13% contraction forecast.

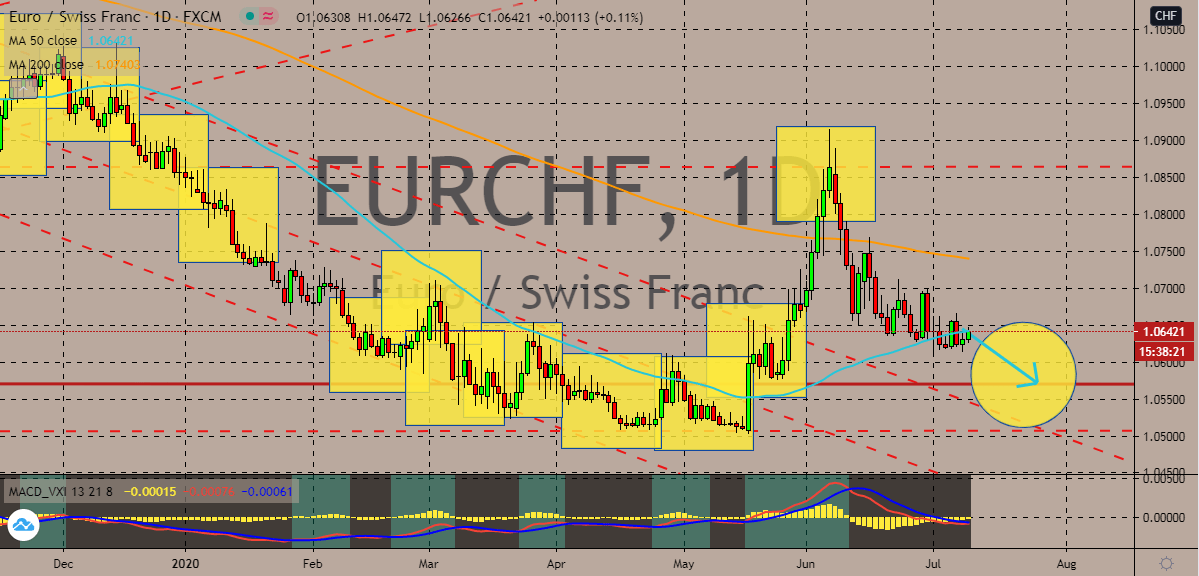

EURCHF

The Swiss franc extends its losses from yesterday’s trading. The euro to Swiss France trading pair is seen climbing up this Thursday as the euro regains its momentum. However, the trading pair is still widely projected to remain bearish and should soon reach its support levels in the trading sessions. The Swiss franc lost its momentum yesterday after Switzerland’s unemployment rate was announced. According to the Swiss State Secretariat for Economic Affairs country’s n.s.a. unemployment rate for June eased from 3.4% to just 3.2%, a slight improvement for the European nation. Looking at it, the Swiss franc lost some of its steam what the Swiss National bank announced that it will be stepping up its liquidity provision. And as for the euro, the recent comment of the European Central Bank’s vice president about a smaller-than-expected contraction is helping it keep its poise against the Swiss franc today.

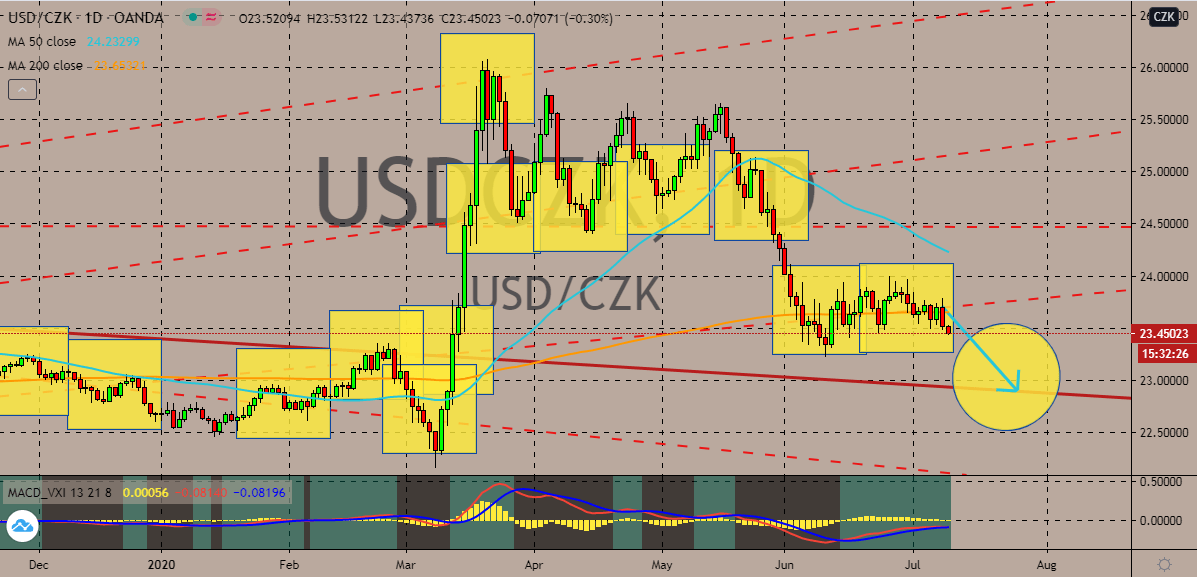

USDCZK

Considering that Prague officially ended its lockdown measures and finally reopened its economy, the Czech koruna is looking strong than the US dollar. The US dollar to Czech koruna trading pair’s prices are projected to go down towards its support levels soon. That should help Czech koruna get even with beloved greenback and reel in the 50-day moving average lower towards the 200-day moving average, signaling a bearish market for investors. See, the domestic demand in the Czech Republic for safe-haven assets should significantly go down, hence, more bearish for the USDCZK pair. Just yesterday, official figures from the country show that its May retail sales report significantly improved from about -10.5% to just -0.7%, crushing prior estimates of about -6.5%. However, that sentiment was slightly countered by the slight increase in the Czech Republic’s unemployment rate from 3.6% to approximately 3.7%.

COMMENTS