Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

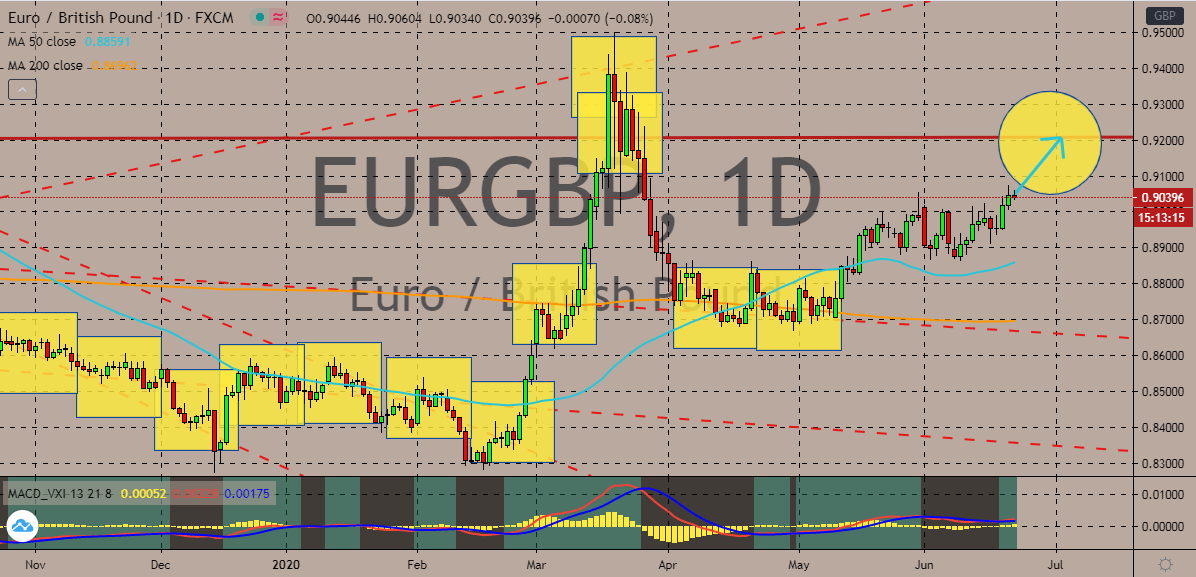

EURGBP

The money printing scheme of the Bank of England is still on. The addition of billions more to the bond-buying program has exposed the British pound to further vulnerability in the foreign exchange scene. The euro to pound trading pair should climb to its resistance level in the coming sessions thanks to the announcement of the Bank of England last week. The move should help the 50-day moving average to climb even higher against the 200-day moving average. As of writing, the pair is seen steadying as investors worry about the increasing number of new cases from Germany, the bloc’s biggest economy. However, the euro’s weakness isn’t expected to last that long, hence, prices should climb eventually. Moreover, the Bank of England announced last week that it will be expanding its bond-buying program by around £100 billion to help stimulate the already struggling economy. And as long as a Brexit deal isn’t settled, the pound remains weak.

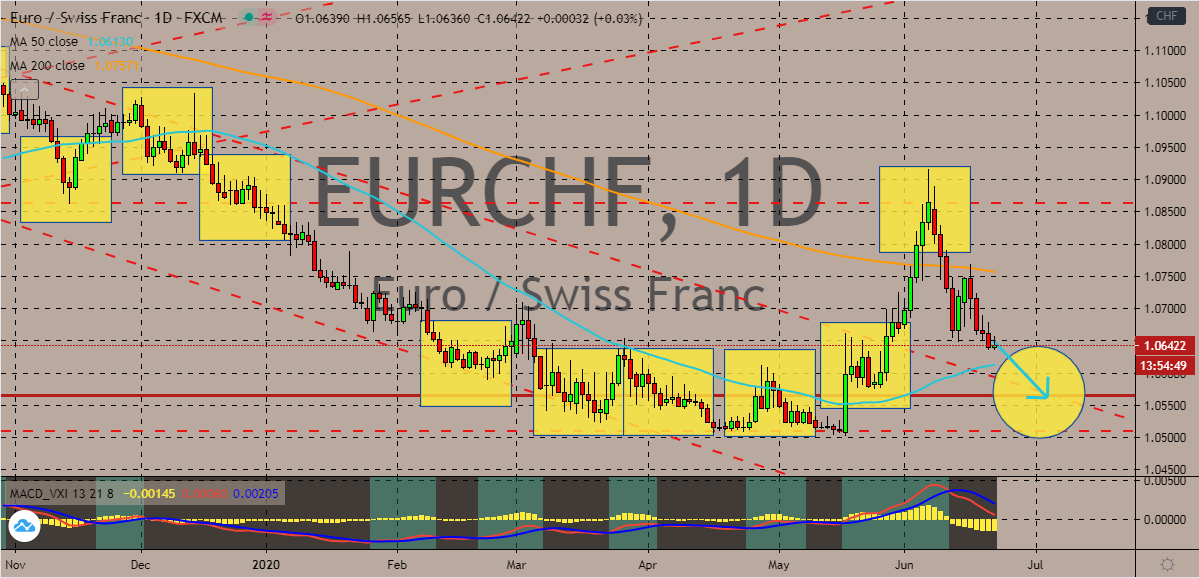

EURCHF

The Swiss National Bank’s decision last week to leave its official interest rates unmoved at negative levels isn’t enough to prevent the Swiss franc from taking the euro down. In fact, the pair is widely projected to crash to its support level in the coming session. However, the pair is seen trading in green territories this Monday, starting the week with gains. With that said, the momentum is still widely expected to remain bearish thanks to the safe-haven appeal of the Swiss franc. Late last week, the Swiss National Bank said that it needs to maintain its famous negative rates which are currently the lowest in the globe. The bank looks to help protect the economy from a major economic slump as the coronavirus continues to pressure major industries and economies around the globe. In fact, the European country is seeing its sharpest economic fall in decades because of the unforgiving pandemic, pushing the unemployment to alarming figures.

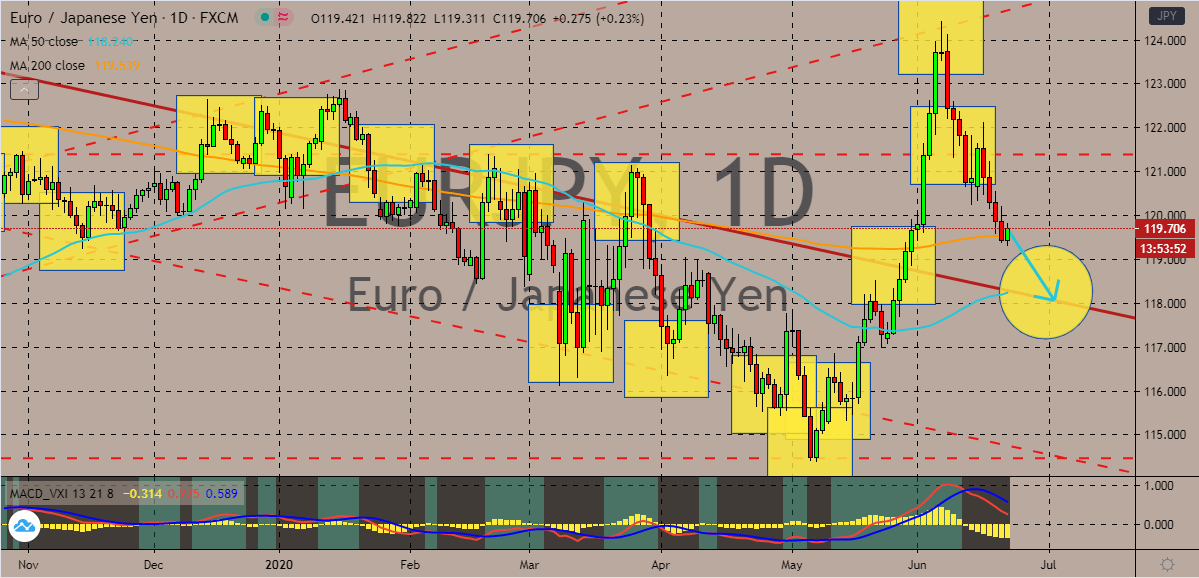

EURJPY

The single currency manages to prevent a sharp fall against the Japanese yen this Monday, entering this week’s trading sessions on a positive note. However, the Japanese yen is still projected to force the trading pair soon as the safe-haven asset thrives thanks to the intense concerns around the globe. If prices continue to drop down to its support, the 200-day moving average will maintain its dominance against the 50-day moving average, signaling that the momentum is still bearish. The Japanese yen is holding its own against the euro thanks to the global collapse of interest rates. Looking at it, central banks across the globe have slashed their interest rates to record lows to help support their respective economies recover from the major slump. Earlier last week, the Japanese central bank also announced a massive loan package in light of the coronavirus pandemic. The Bank of Japan pledged a massive $1 trillion o help the struggling economy to bounce back.

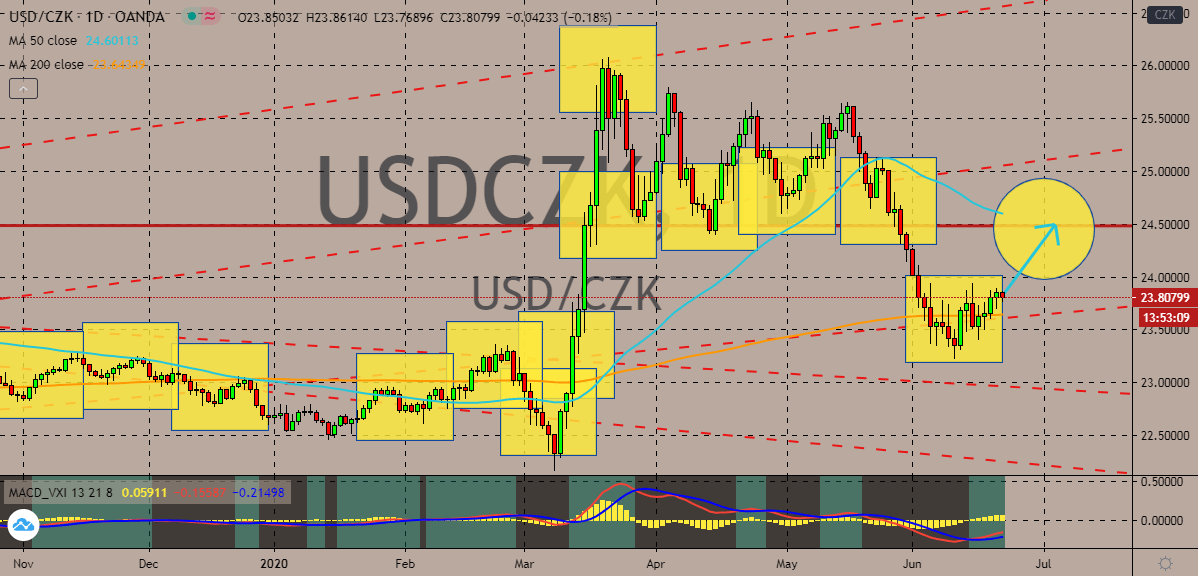

USDCZK

The pair is seen easing earlier this Monday. However, thanks to the latest decision of the Czech National Bank, the pair should continue its climb towards its resistance level. That should help the 50-day moving average, which recently took a dramatic shift in direction, to remain significantly dominant against the 200-day moving average. Late last week, it was reported that the Czech National Bank opted to unleash another rate cut to help the economy bounce back, easing its countercyclical capital buffer rate from 1% to just 0.5%. The bank even added that it’s willing to remove the buffer rate if deemed necessary, but it’s not in a hurry to do it. The buffer helps shield the economy from the crisis, and if the Czech National Bank removes it, it will leave the koruna very vulnerable. And as for the greenback, it’s safe-haven appeal should help it rally even further against most currencies as the demand hikes thanks to the second wave of infections.

COMMENTS