Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

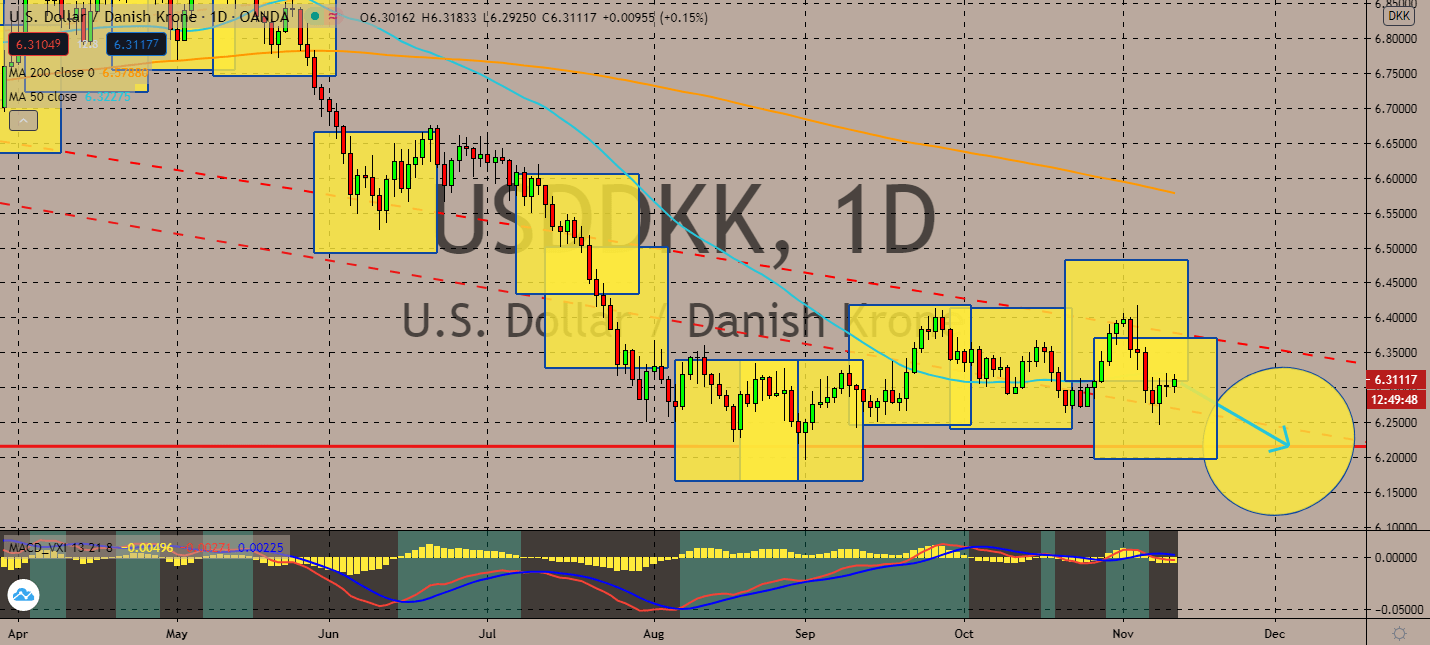

USDDKK

It’s going to be a relatively quiet session today in the US economic calendar, driving the market’s focus towards geopolitics and the progress in the world’s combat against the coronavirus pandemic. The Federal Reserve said Tuesday that the economy will still need another stimulus package to help uplift its economy. The central bank is in discussion with another asset purchase program in consideration. Closed international borders will also result in operations below capacity for an extended period. Key economists have also been increasingly pessimistic over the end-year results of the coronavirus’ effects with both headline and underlying inflation remained below 2 percent. The pair’s 50-day moving average will then remain under its 200-day moving average or until the US begins to report Covid-19 related news in the near-term, including the distribution of millions of vaccines in the US by the end of December.

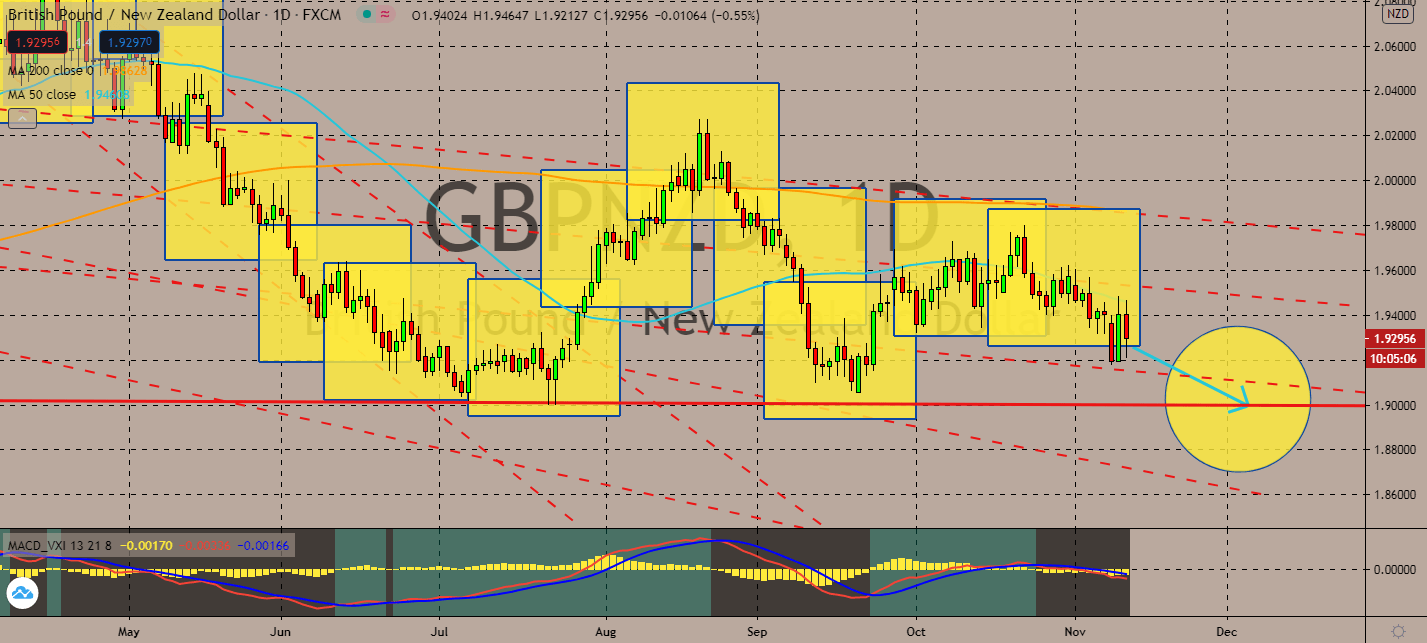

GBPNZD

The Reserve Bank of New Zealand kept interest rates on hold at 0.25 percent in its monetary meeting this week and introduced a new tool to encourage more loans by reducing borrowing costs for banking services to boost its consumer price inflation and employment rates, now that it had successfully recovered from its coronavirus outbreak once again. The central bank’s governor Adrian Orr also said that the country has recovered faster than initially anticipated, boosting the market’s optimism that another interest rate cut within the year is not going to happen. The pair’s 50-day moving average is still under its 200-day moving average. After the central bank’s announcement, the trend is likely to continue in the near-term. Now that the United Kingdom’s unemployment remains at 2 million, investors will also be more unlikely to buy the sterling pound against most of its counterparts as it descends further back into recession.

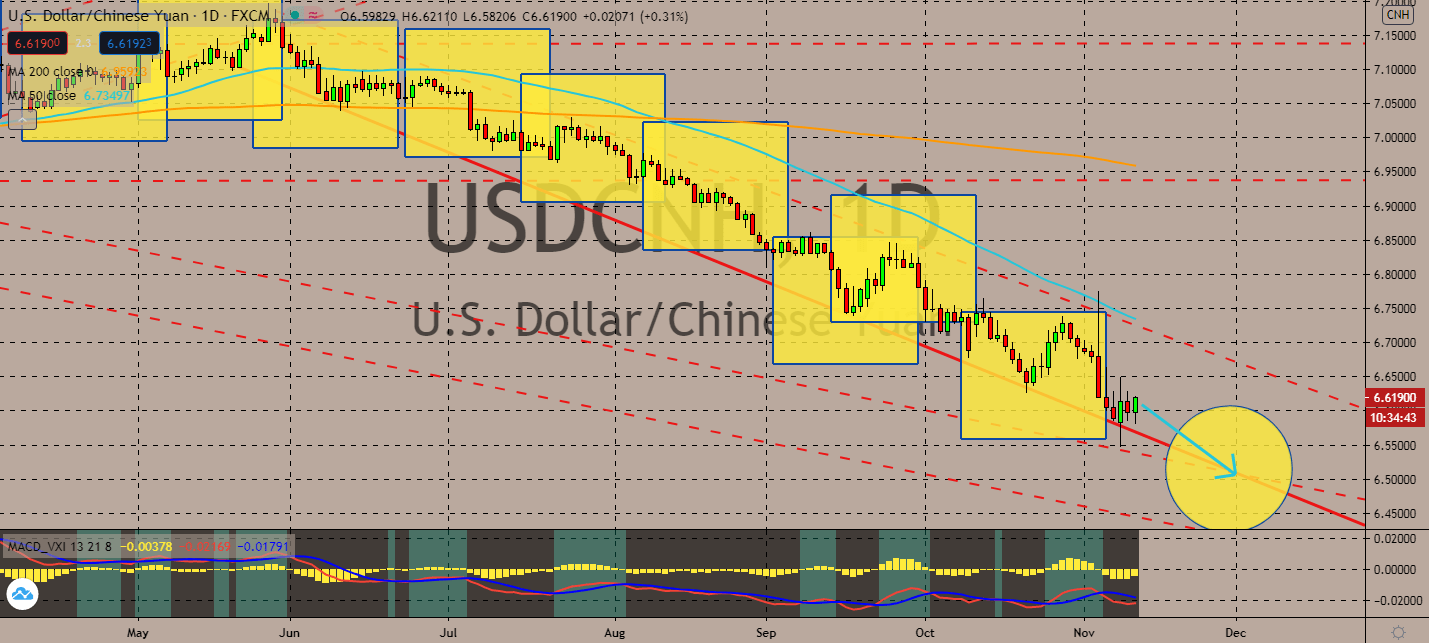

USDCNH

The Chinese economy is expected to continue its surprisingly rapid recovery from its coronavirus recession throughout the year. Economists claim that China’s economic slump in the earlier days this year was only a stagnation than a recession. Now that its pre-existing economic growth had resumed, the shock of the pandemic is expected to fade away like it never happened. As its improvement continues and the US economy fails to catch up, the yen and its Asian counterparts will be more likely to witness increases against the greenback within the year. The pair’s 50-day moving average will keep going down below its 200-day moving average as long as the US continues to struggle with its own recovery. Greenback investors will likely hesitate to trade while the Federal Reserve is in discussion about another coronavirus stimulus package before the president-elect Biden’s term begins in the first quarter next year.

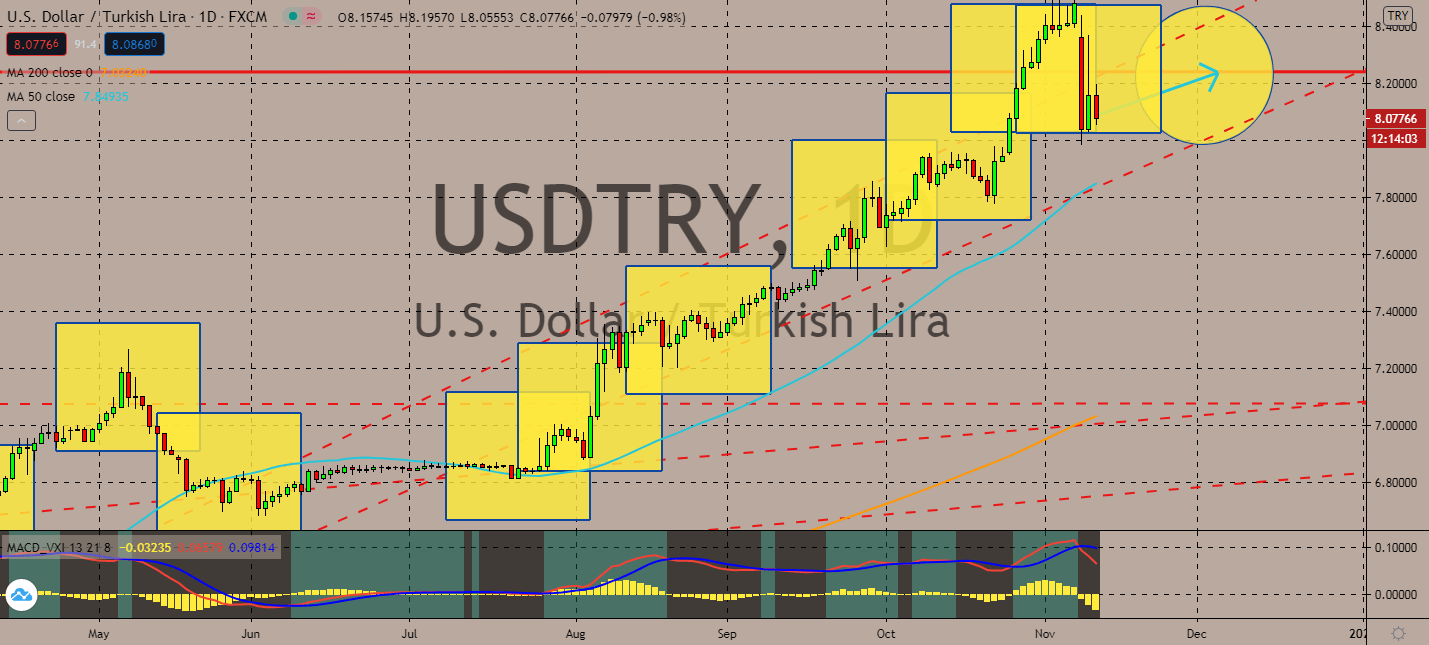

USDTRY

Turkish President Recep Tayyip Erdogan has implemented economic policy over the past year over claims that high interest rates will lead to high inflation. As a result, the Turkish lira is projected to continue its crash even further down 128 billion US dollars as he keeps the country’s inflation to a double-digit inflation. He also fired now-former central bank governor Murat Uysal over the weekend before reaching two years in his term. Finance minister and presidential son-in-law Berat Albayrak then resigned the day later. The chaos that is the Turkish economy will be the main driver for the pair despite good news in vaccine progress, which could have millions of doses distributed shortly after the holiday season. The pair’s 50-day moving average will continue its climb way above its 200-day moving average as the US prepares for another stimulus package before the president-elect Joe Biden gets inaugurated in January 2021.

COMMENTS