Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

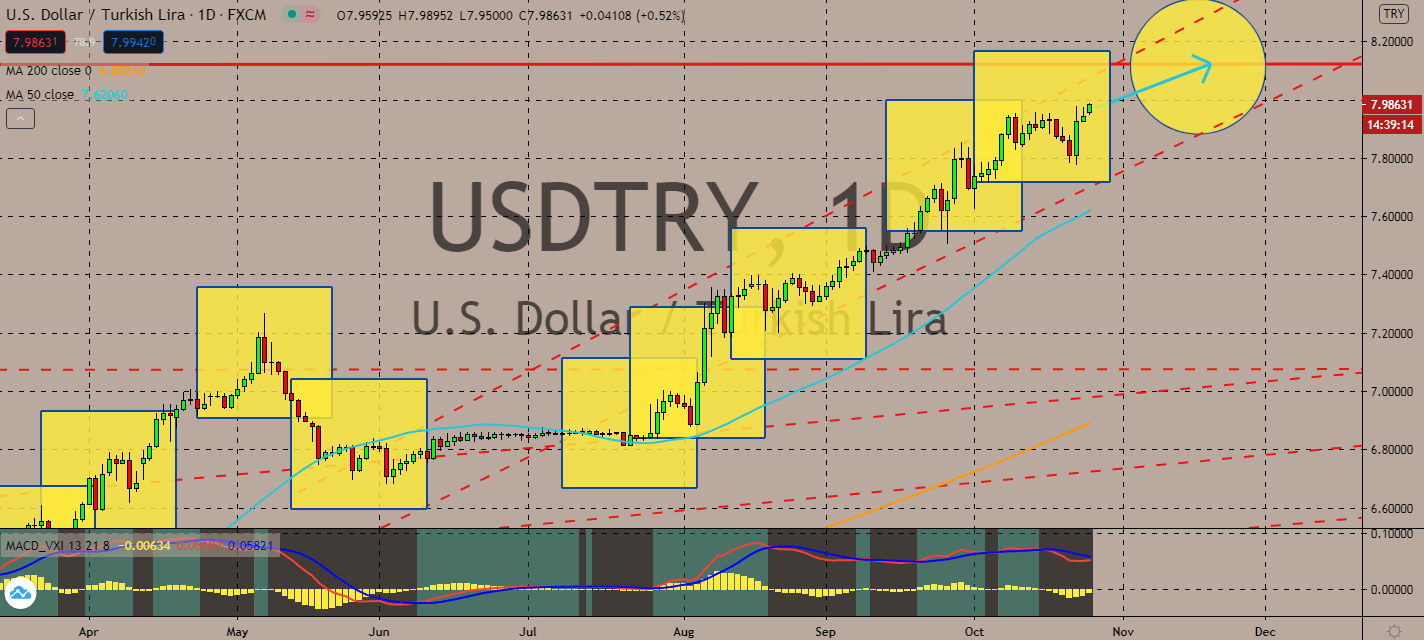

USDTRY

It looks like the lira will continue its weakness due to the surprising decision from Turkey’s central bank made on Friday. Investors have been disappointed over expectations that it would raise its interest rate – now that it kept the rate as it is, investors will keep pushing the dollar up. Geopolitics, as well as the possibility of another coronavirus wave, will also stir pessimism over a deteriorating Turkish economy for a longer time than its government forecasted earlier this year. The pair’s 50-day moving average has been surging above its 200-day moving average, and it will continue to do so until the Turkish economy begins to show workable progress towards its economy. That probability is getting thinner and thinner by the day. Even then, the US stimulus packages are unlikely to pull the greenback down against the lira, even as its value decreases over what could be a 2 trillion US dollar package for suffering businesses and states.

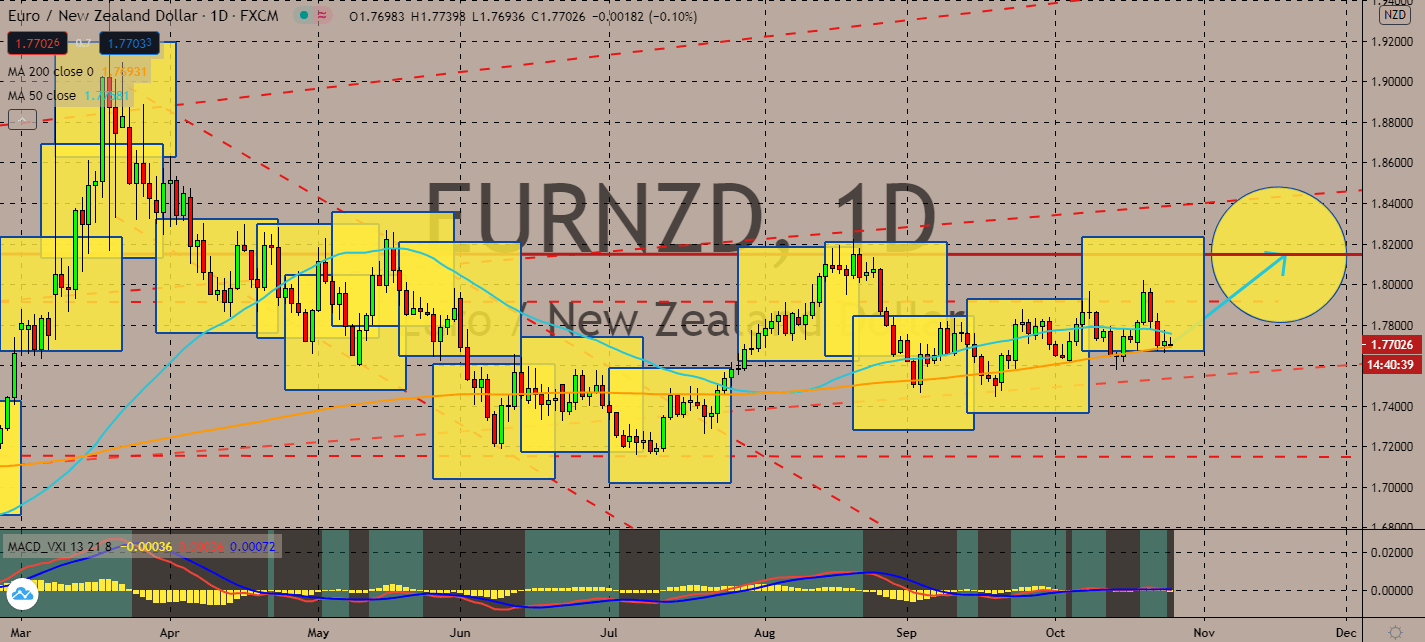

EURNZD

It’s 100 days before the end of the Brexit transition, and economists are bound to put pressure on both sides of the agreement. Despite being a much bigger economy, the eurozone is projected to suffer the consequences if the United Kingdom does choose to walk away from the deal without a proper agreement. In fact, then president of the European council in 2016 Donald Tusk confirmed that it would be fatal to assume that no-deal Brexit will be a Britain-exclusive issue. Any progress, or lack thereof, for these negotiations will be the make-or-break driver for the pair in the long run, hence the rapid rise of the 200-day moving average towards the declining 50-day moving average, but it looks like the New Zealand currency will fare better than its counterpart. Things are looking up in the kiwi economy after Jacinda Ardern won her second term as the country’s prime minister, bringing good economic momentum into the foreign exchange market.

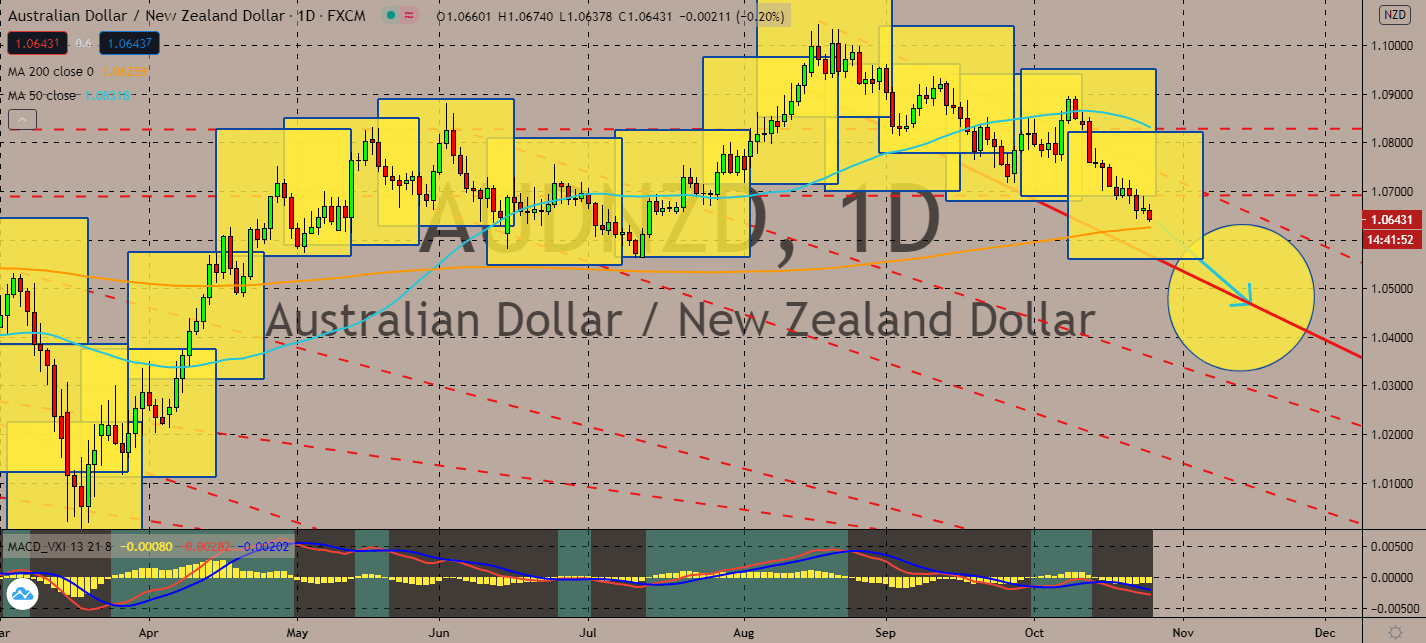

AUDNZD

New Zealand’s cousin had just seen 0 new daily coronavirus cases in its epicenter for the first time in four months. If this goes on, the Aussie dollar might increase long-term, but it looks like its near-term path will likely benefit the kiwi currency. After all, its central bank and government are in discussions that its stimulus packages might continue even longer than the coronavirus crisis in the country. The pair’s 200-day moving average is projected to touch its current levels soon, indicating that the kiwi dollar’s trend can change its resistance and support levels, especially after its 50-day moving average curved lower recently. Markets are projected to wait for more positivity from Australia as it reels over the improving New Zealand economy. Prime Minister Jacinda Ardern’s landslide victory will continue to deliver positive results as she continues to balance wage subsidies and unemployment figures until the end of its crisis.

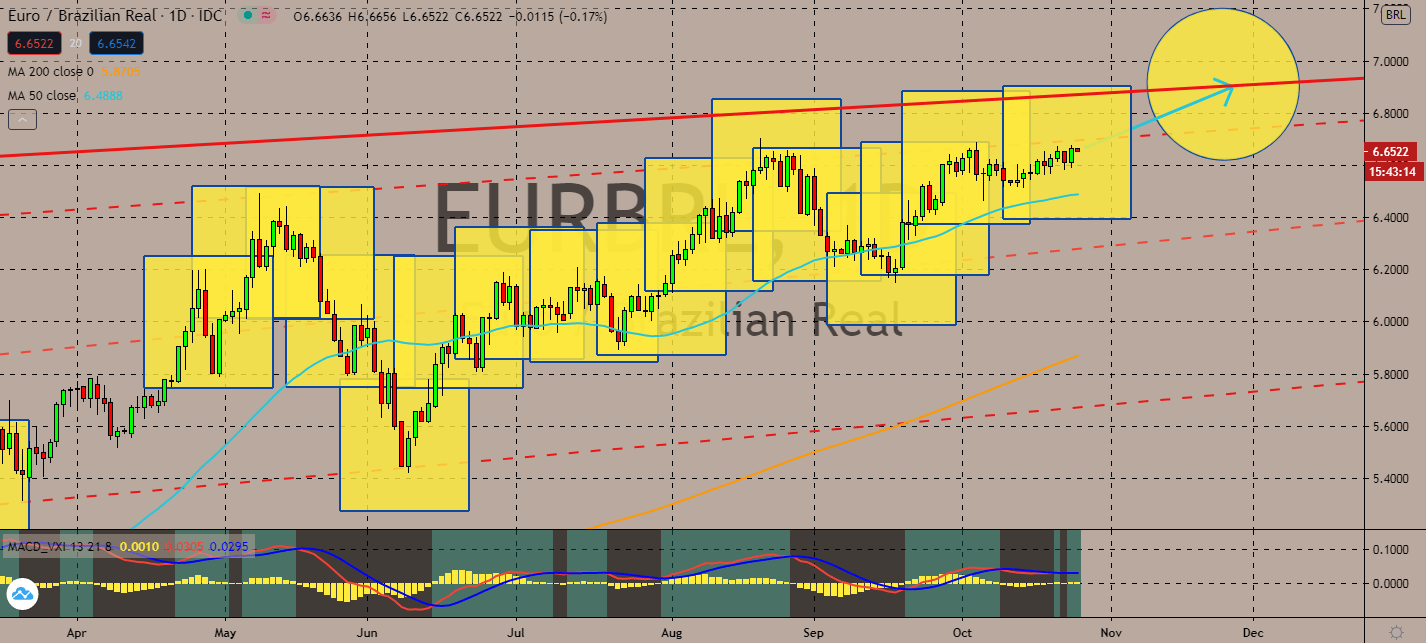

EURBRL

Economy Minister of Brazil Paulo Guedes said that the country is at an inflection point wherein it’s better to spend less than to spend more as its central bank kept its record low of 2.00%. Brazil also reported over 13,000 new coronavirus cases as it keeps its title as the country with the second-most cases in the world only to the United States. Brazil’s president’s opposition to purchasing Sinovac Biotech’s Coronavac for nationwide distribution to deal with the overwhelming spread will also keep the market farther away from the real to its safer currency counterparts. The uncertainty of a possible recovery will pull the real low as the pair’s 50-day moving average remains well above its 200-day moving average. The euro currency is projected to benefit from its busy calendar today, as well as the market’s optimism from Brexit talks over concerns that a no-deal Brexit will also make the eurozone suffer in the long-term.

COMMENTS