Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

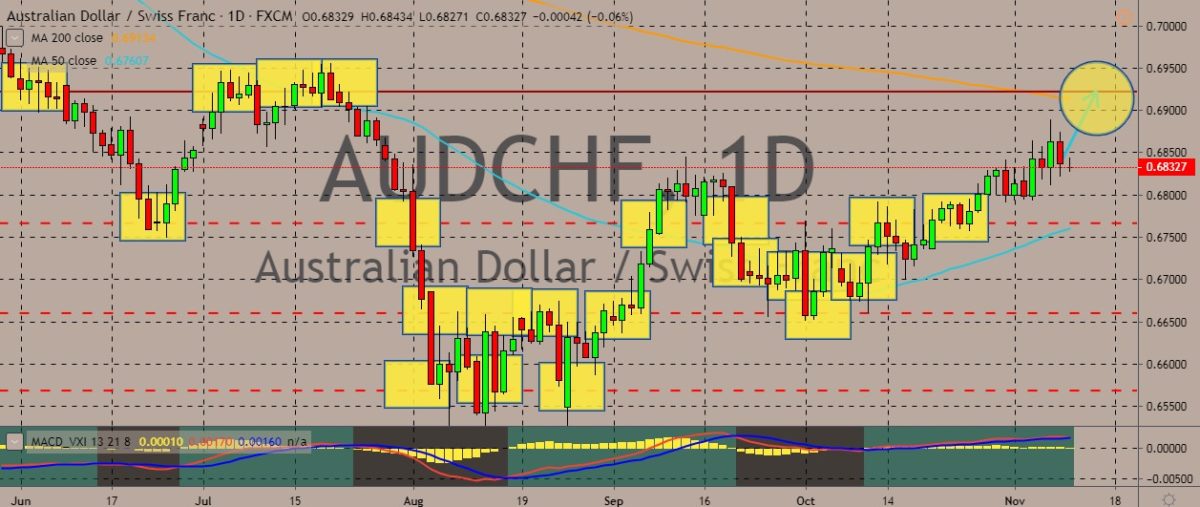

AUDCHF

The pair is trading in the red at present, but the current trend it is traversing is notably upwards, after going down in the month of September. The 50-day moving average is also picking up altitude, while the 200-day counterpart is pointing south. For fundamentals, the Australian dollar feels some pressure after the Reserve Bank of Australia forecasted that the Australian economy is no longer seen to reach the lower bound of the 2% to 3% inflation target within the target period. As for Switzerland, the Organization of Economic Cooperation and Development now predicts that the Swiss economic growth will slow down to 0.8% in 2019 and will stay below the country’s long-term average next year. For the year 2020, the OECD says that Swiss growth will be at 1.4%, lower than the long-term average of 1.7% and the government’s expansion forecast of 1.7% next year. Still, the OECD report said the healthy labor market still supports incomes and consumption.

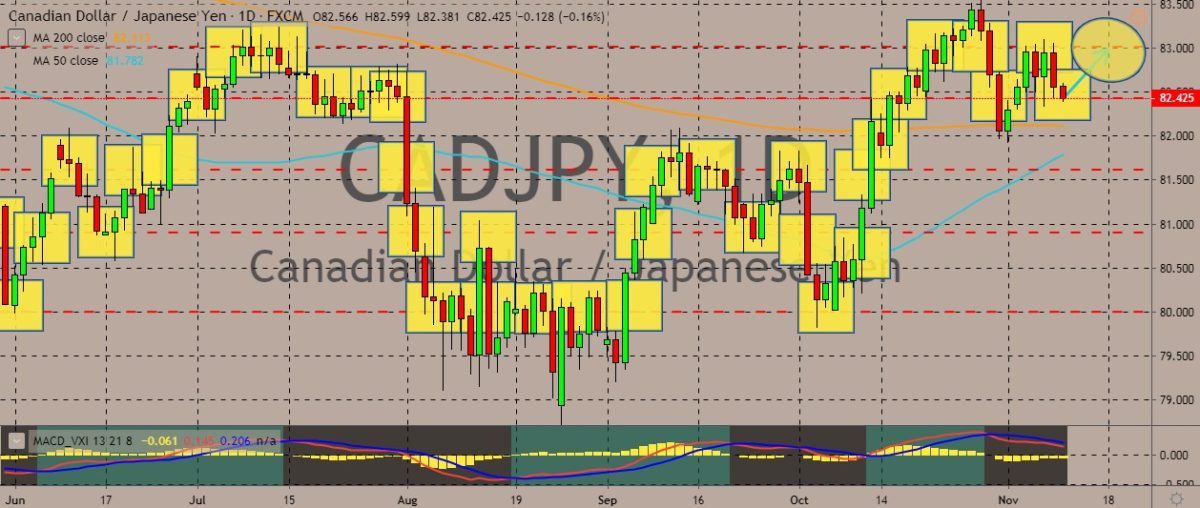

CADJPY

The pair is trading in the red but still above the 200-day MA, while the 50-day MA appears to be closing in to its 200-day counterpart. The price has recovered from the lows recorded in August and September, and it now treads multi-month highs. Over in Japan, machinery orders slipped for a third straight month in September. This increased doubts that business spending will be strong enough to offset external pressures. Such pressures have spurred uncertainty over the future of the export-reliant Asian economy. Meanwhile, in Canada, Statistics Canada said that the economy dropped 1,800 jobs in October, after the gains of 54,000 jobs in September and 81,000 in August. According to Scotiabank deputy chief economist Brett House said that the numbers were the weakest since July. However, House also added that one weak month doesn’t have much impact on the Bank of Canada’s stance.

USDHKD

The pair perked up during the most recent trading session after hitting a support line. Moving averages just confirmed the death cross, in which the 200-day moving average crosses above its 50-day moving average. This suggests that traders are becoming bearish on the outlook for the pair. Over in Hong Kong, tensions flared up after the most recent escalation in violence as protesters continue to shake up the city. Police fired live rounds at protester on the eastern side of Hong Kong island. At least one protester was wounded. Protesters are angry about the police brutality and the interference by Beijing in the former British colony’s freedoms that have been guaranteed by the “one country, two systems” formula put in place when the city returned to Chinese rule in the year 1997. Meanwhile, China denied allegations of meddling and blamed it on the West for stirring up trouble, as it always does.

USDSGD

The pair is trading in the green, but it’s still down from its October high. The 50-day moving average is heading south, while the 200-day MA remains flat. The US dollar’s moves continue to center around the US-China trade war developments. Last week, hopes ignited after Beijing confirmed that the two sides agreed to rollback some of the tariffs imposed by the two sides on each other’s goods. In Singapore, the central bank is getting to extend funding for financial tech initiatives, with the Monetary Authority of Singapore seen to announce the funding plans next year. Meanwhile, Singapore markets also moved on the DBS Group Holdings’ report of higher wealth management fees, which pushed profits to rise 15% in the third quarter, beating expectations and forecasts. However, Southeast Asia’s biggest lender warned that growth will slow down next year because of the lower interest rates.

COMMENTS