Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

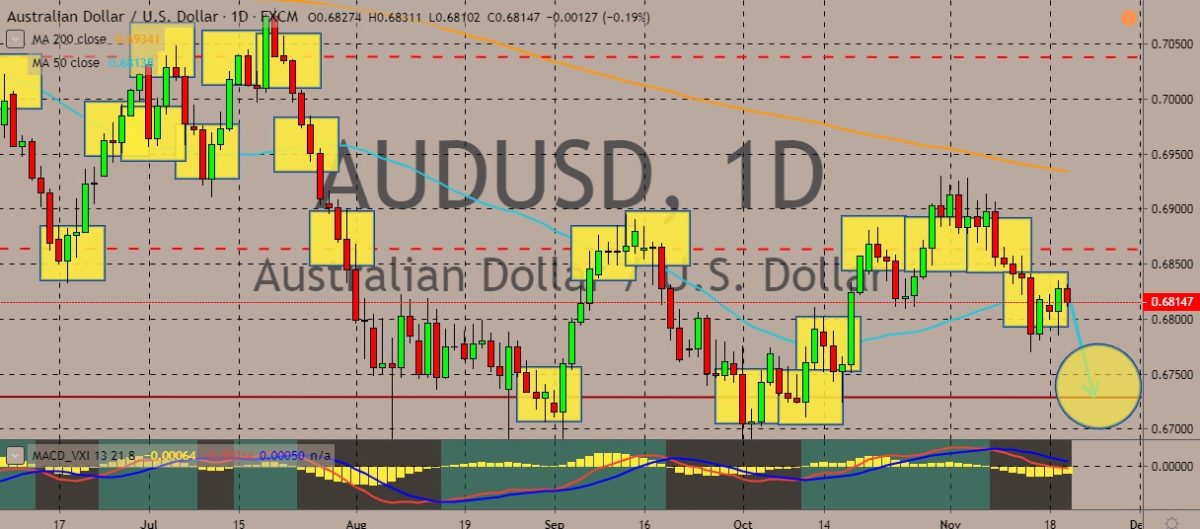

AUDUSD

The pair traded in the red in the latest sessions after pulling up from weekly lows. It’s now experiencing pressure near the 50-day moving average. For central bank news, the Reserve Bank of Australia looked into cutting rates at its latest policy-setting meeting but opted to hold the rates steady instead and keep close tabs on the impact of the earlier easing, the latest policy meeting minutes showed. It also showed that central bankers were concerned that household confidence was diminishing because of the very low borrowing costs. Meanwhile, the dollar’s moves depended largely on the progress of the US-China trade war negotiations—or lack thereof. Markets have been expecting a finalized “phase one” deal between Washington and Beijing this month that would scale back the 16-month long trade war. However, hopes fell back as a reports said China was becoming pessimistic about signing a deal.

AUDCHF

The pair also traded in the red in the latest session as a sign of fleeting strength for the Australian dollar after the minutes of the latest policy meeting was released. According to the RBA, global financial markets are signaling diminishing pessimism. If this is sustained, the bank said it could result in better-than-expected outcomes for the global economy. Meanwhile, wages and employment data have also been weaker. Wages rose 2.2% annually, while unemployment climbed 5.3% as the economy lost jobs for the first time in more than a year. The Australian central bank is also trying to turn back inflation to its 2% to 3% target. Jobless rate also needs to fall, and wages need to rise, and consumer prices need to climb. Traders are pricing in the probability of another rate cut by the first half of next year that would take the official cash rate to 0.5%. The RBA emphasized that a prolonged period of low rates could be expected.

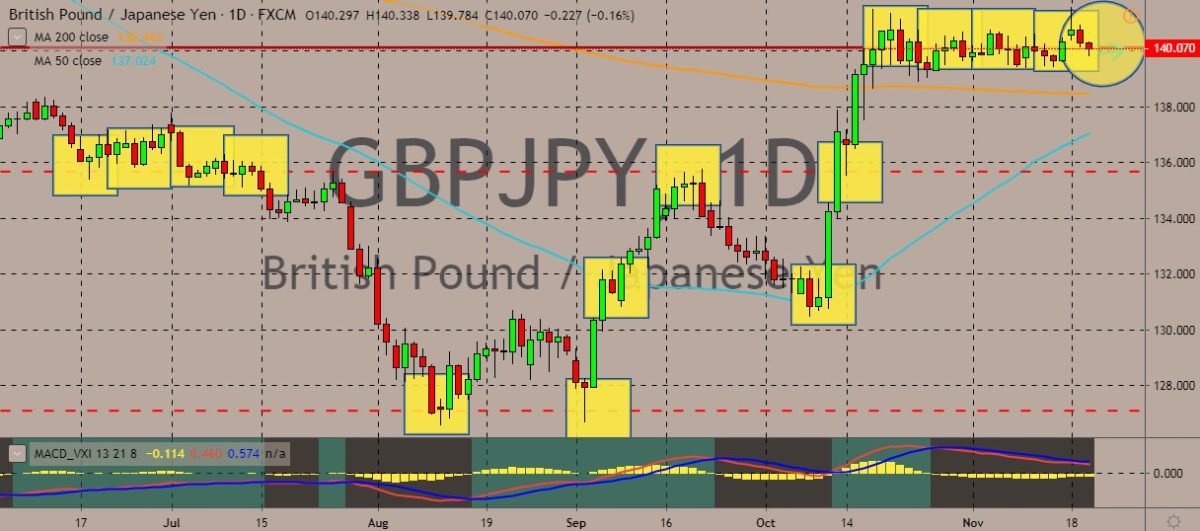

GBPJPY

The pair is going sideways on the daily chart, with no clear directional movement. The 50-day moving average also appears ready to cross above the 200-day counterpart, and if a golden cross is confirmed, longer-term technical traders may join the party and may kick the pair up. Pullbacks for this pair may present buying opportunities for bullish traders, although it may take a while before a more solid bullish move appears. Over in the UK, current British prime minister Boris Johnson won a bruising election TV debate against opposition leader Jeremy Corbyn was jeered by the audience for refusing nine times to spell out his take on Brexit. There are only three weeks before the country goes to the poll in December. Still, the two politicians virtually fought each other to standstill. A snap survey showed that 51% thought Johnson won, while 49% said Corbyn took the victory.

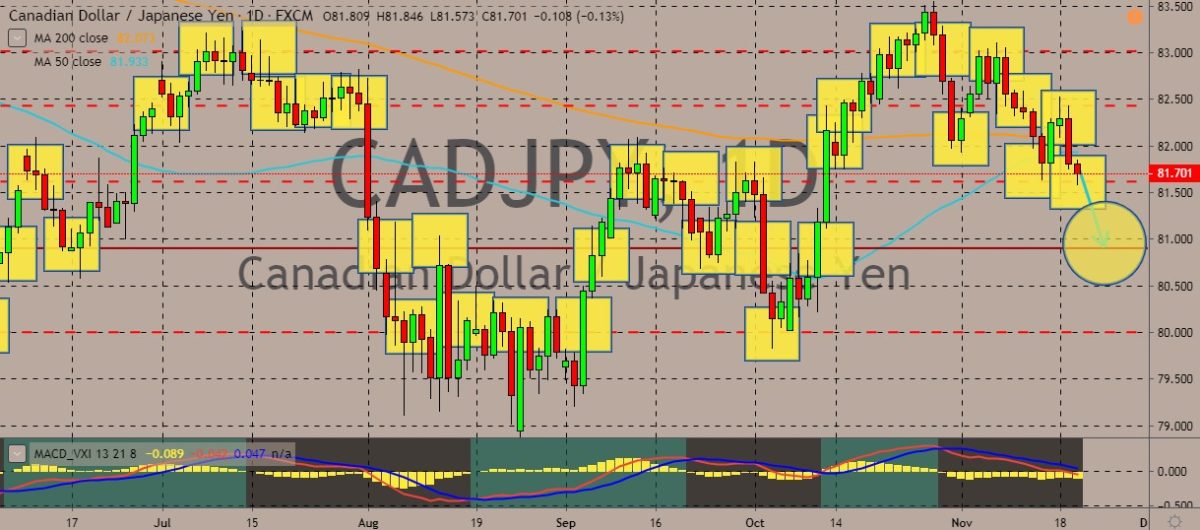

CADJPY

The pair is trading weaker below the 200- and 50-day moving averages, indicating a bearish turn for the pair as the Japanese yen boosted its safe-haven appeal against the Canadian currency. The Canadian dollar has enjoyed being the top dog in this year’s currency market during the first 10 months. However, it started a 180-degree turn and weakened against major peers after the Bank of Canada’s rate decision on October 30, in which Governor Poloz outlined the arguments for possible interest rate cuts. Traders either didn’t expect the decision or expected it to come at a later time, and this probably was the reason why the loonie slipped hugely. The long-term outlook may have also switched gears alongside the turn. Traders will be waiting for more clarity on the value of the loonie through the Canadian CPI to be released this week. A speech from Governor Poloz could also help clarify the pair’s long-term direction.

COMMENTS