Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

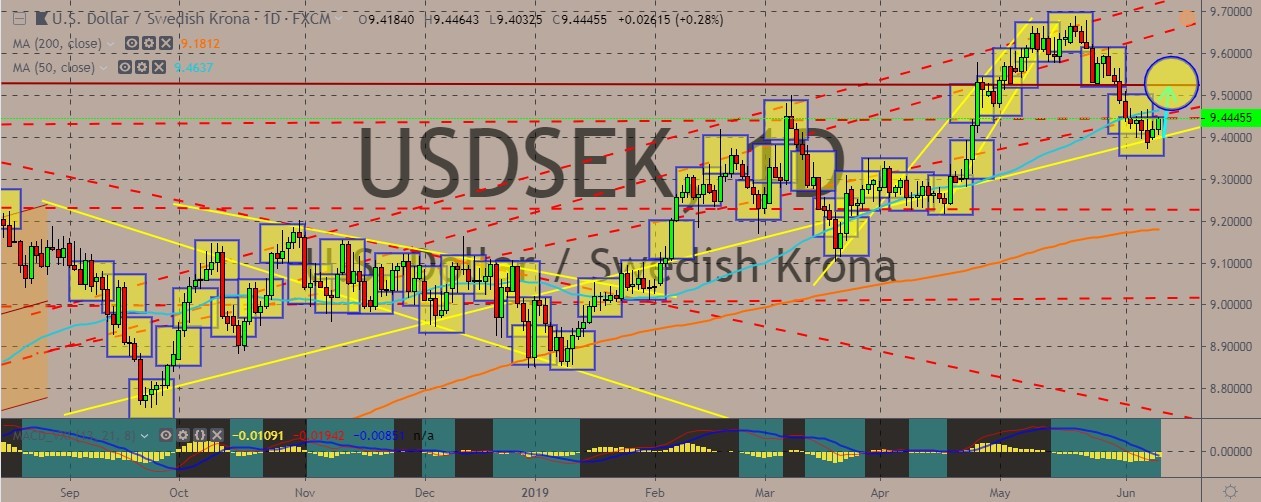

USDSEK

The USDSEK pair is moving in a tight range right now, with the 50-day moving average still higher than the 200-day moving average. The USD is subdued in the day and still carrying various dragging factors behind its back such as the trade war with China, even though US equities experienced some slight reprieve after US President Donald Trump he wouldn’t impose tariffs on Mexico. Meanwhile, the Swedish krona seems weaker as the country’s finance minister says that she wants the central bank to take more factors into considerations (and not just inflation) when setting monetary policies. The Swedish central bank has been targeting inflation since early 1990s but has been recently embroiled in criticisms after establishing a stimulus program aimed to support growth. Overall, the pair is set to move upwards but only slightly as the dollar remains subdued while the krona still tiptoes over monetary policies.

USDZAR

The pair is seen slumping slightly towards a key support level, with the 50- and 200-day moving averages parting ways slightly after diverging so close last month. Still bugged by various factors, the greenback appears unable to sustain a rally against the South African rand even though the latter could have slumped largely due to various reasons. The back-and-forth choppy trading on the currencies now appears leading to more negativity for the ZAR, with the key resistance level at the 15 mark still not broken out again. The decline in the rand is largely because of the bleak GDP figure for the country. Estimates were in themselves already poor, but the actual figure has been worse than expected: South Africa’s economy shrunk a whopping 3.2% in a matter of three months. Despite that, the dollar still wouldn’t be able to drag the rand up to the 15.00 level just because of the looming uncertainties over the dollar’s outlook.

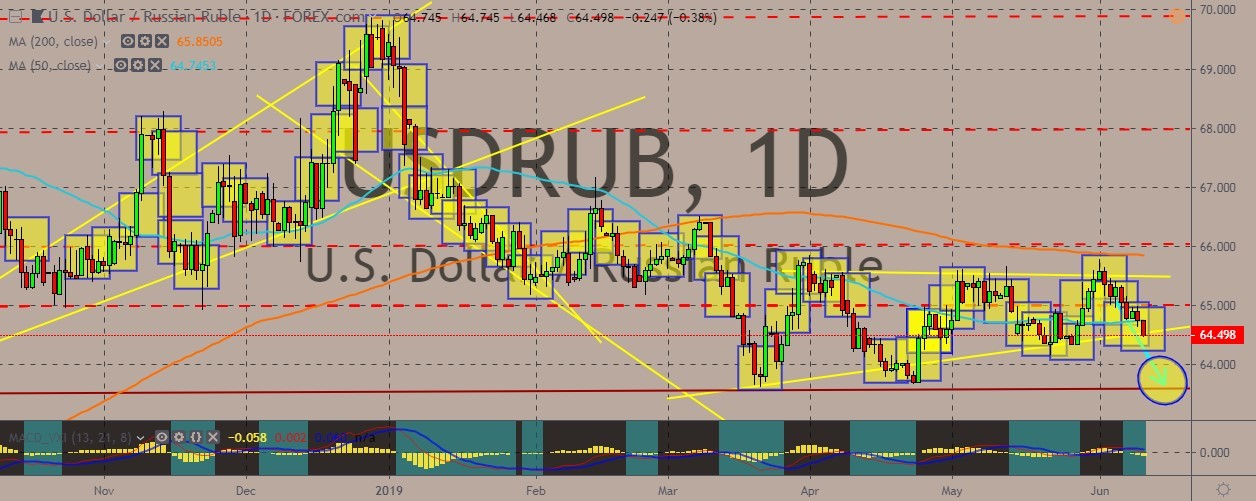

USDRUB

The Russian ruble is demonstrating some strength against the dollar this early, backed by the recovery in oil prices. The 50- and 200-day moving averages are sustaining a wide gap between them after the Golden Cross last February. More on the fundamental side, the ruble is benefitting from the relatively higher demand for risky assets after the easing in the US-Mexico trade tensions. The pair would be further affected by the expectations of the Friday meeting of the Bank of Russia, with declines already priced in by many traders. On the commodities front, the Russian ruble is also affected by prices in crude oil. Saudi Arabia Minister of Energy Khalid al-Falih said that the Organization of Petroleum Exporting Countries is favoring an extension of an agreement to reduce production at the planned OPEC+ meeting to be held in June. MACD indicator on the chart shows further weakening for the pair.

USDCZK

The pair has showed yet another test of the lower channel of the parallel channel it is currently trading within. The lower channel also obviously serves as a resistance level for the pair, indicating that the current rise in the pair could continue upwards until it reaches the upper channel. The dollar proves to be stubborn in that the Czech koruna failed to get a booster from the expected rise in inflation in the Czech Republic. Inflation sped up 2.9% thanks to the stronger food and alcohol prices. According to the CNB, Czech’s central bank, the rise in inflation could be more optimal if it is followed up by more interest rate growth. Although this could have been enough to boost the CZK, the dollar managed to subdue it after the buck started to consolidate. Overall, traders of the pair ought to consider looking at the technical support levels on which the dollar could bank to sustain an upward momentum.

COMMENTS