Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

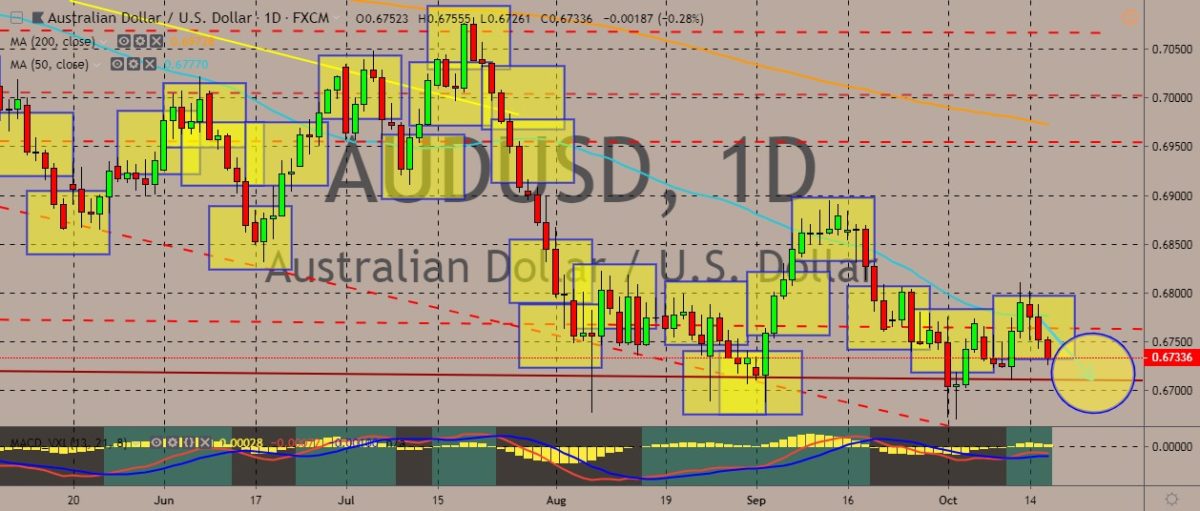

AUDUSD

The pair has been trading in the red in the previous three sessions, with prices going below the 50-day moving average. This indicates a generally bearish sentiment for the pair. Prices have climbed up in weekly high but quickly turned back to trade lower. The weakness in the Australian dollar can be largely attributed to the International Monetary Fund’s downgrading of its growth forecasts, predicting a “synchronized slowdown” with global growth in 2019. The global growth forecast is now at 3%, which is the slowest pace of growth since the global financial crisis. It’s also marked slowdown from 2017’s 3.8%. For Australia, the IMF predicts that the economy will weaken to 1.7% growth this year, down from the 2.7% recorded in 2018. As a result, important names and officials are calling for the government to provide fiscal stimulus and invest in infrastructure to support the economy and prop up productivity.

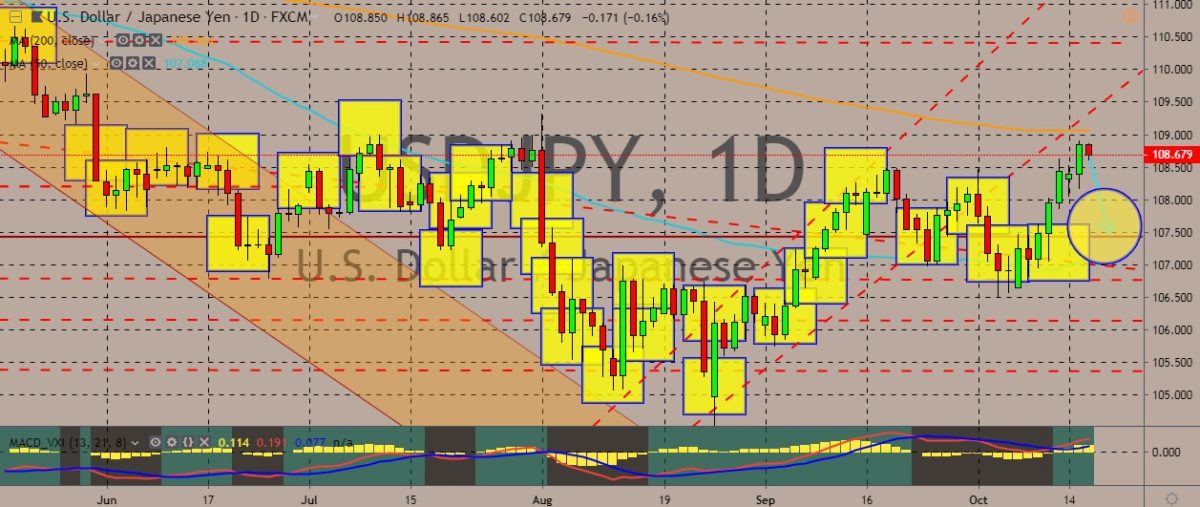

USDJPY

The pair recently broke its uptrend which has seen the dollar rallying against the yen, approaching the 200-day moving average. However, prices have turned the other way around, apparently pressured by the nearing resistance line and fundamentals. Over in Japan, most economists are betting in favor of an easing from the Bank of Japan in October. As the for the dollar, traders are being cautious over the lack of details in the Phase One agreement between the US and China. According to some reports, China wants to have another high-level meeting this month in order to finalize the partial trade deal hammered out last week. This indicates that not all details and key points have been sealed within the trade deal. At the same time, participants are quite aware that previous “agreements” have eventually broken down due to the rhetoric and misunderstanding between the negotiating sides.

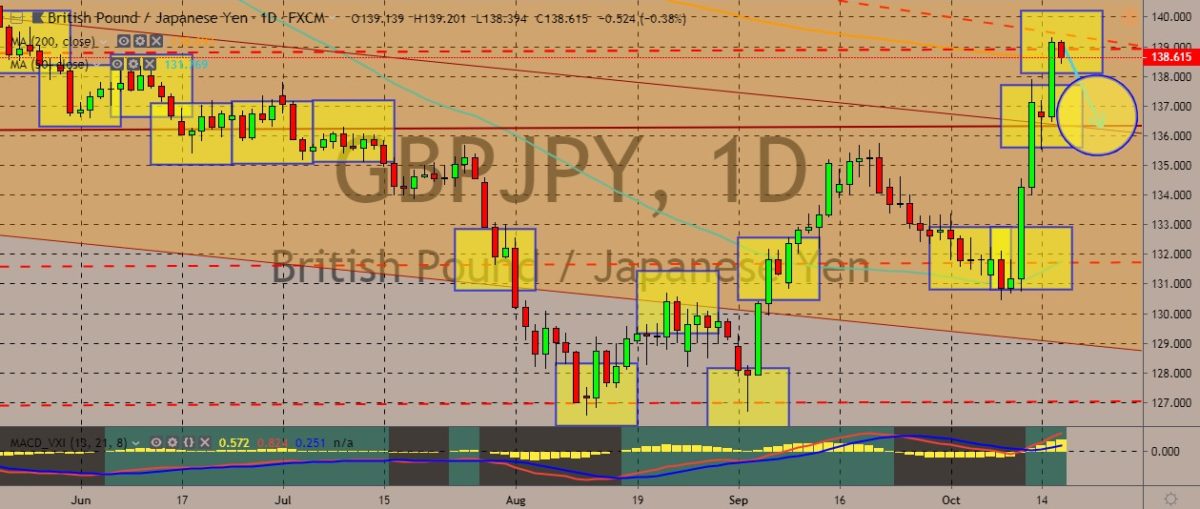

GBPJPY

The pair has struck a solid resistance line near the 200-day moving average on the daily chart after rallying for sessions and soaring to five-month highs following months of slumps. The resistance line pummeled the price down, but the pair refused to pare its gains entirely. For traders, this might mean only a slight pause in the British pound’s strength, though if bad Brexit news breaks out, it might continue going down against the Japanese yen. Traders are preparing for the make-or-break meeting between the UK and the European Union this coming Thursday and Friday. Last ditch efforts are being made as followers await whether Britain and the EU can hammer out an agreement on Brexit before the summit. Overnight, the pound strengthened on reports that the two sides are close to reaching a deal. However, some traders are saying that even if they seal a deal, it’s still unclear whether they could stick with the Brexit deadline at the end of the month.

EURAUD

The pair has traded in the green for the previous three sessions, with prices going above the 50-day moving average. The trend appears slightly askew to the upside, which is an improvement after it down-trended in August and September. The Australian dollar weakened following the IMF’s downward revision of growth for the country. The IMF also cut its growth estimates for the eurozone, which has been dragged down by the weakness in its powerhouse economy, Germany. According to the IMF, the eurozone was one of the driving forces behind the faltering global economy. On the flip side, traders saw some silver lining for the euro as it benefits from the news of a possible trade deal with the United Kingdom over the Brexit. The UK’s painful divorce from the trading bloc has pummeled the currencies and the European economy, which has already been suffering from the catastrophe that was the US-China trade war.

COMMENTS