Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

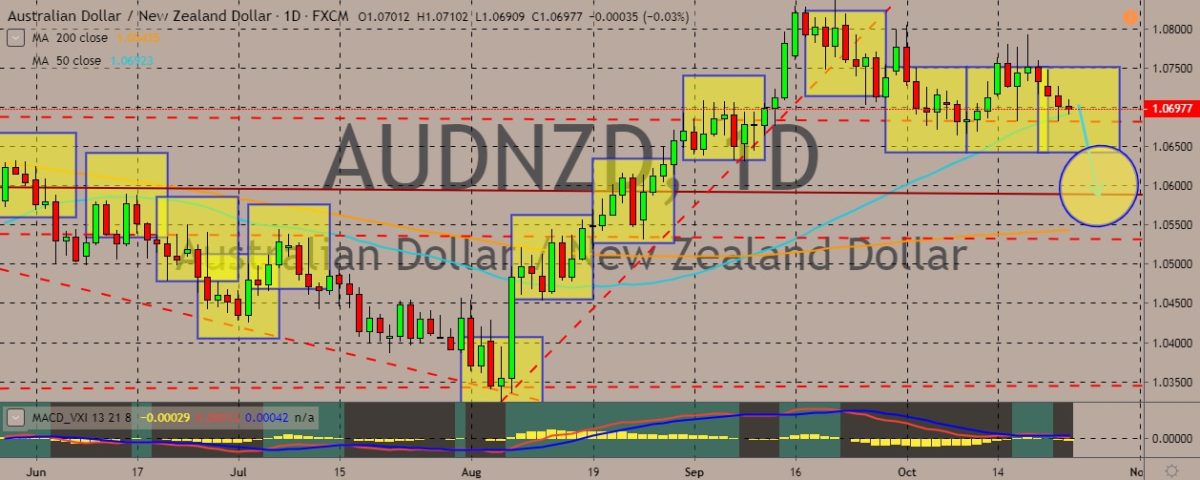

AUDNZD

The pair has traded in the negative for the previous four sessions, slipping down from multi-month highs toward the 50-day moving average, which is now serving as a support line for the prices. Analysts are expecting Australia’s headline inflation to show 0.5% rate on a quarter-on-quarter in the third quarter. They are expecting the annual inflation to remain at 1.6%. The biggest contributor to the headline figure was holiday travel and accommodation. Meanwhile, petrol prices are seen to detract from inflation this quarter after rising steeply in the prior quarter. Meanwhile, the Reserve Bank of New Zealand is showing doubts about the possible effect of further rate cuts. One analyst from a bank says that expectations about inflation are becoming a major concern for central bankers and this could be the reason why consumers are holding off their spending. He noted that since the financial crisis, inflation has failed to rise significantly and continued to drift lower.

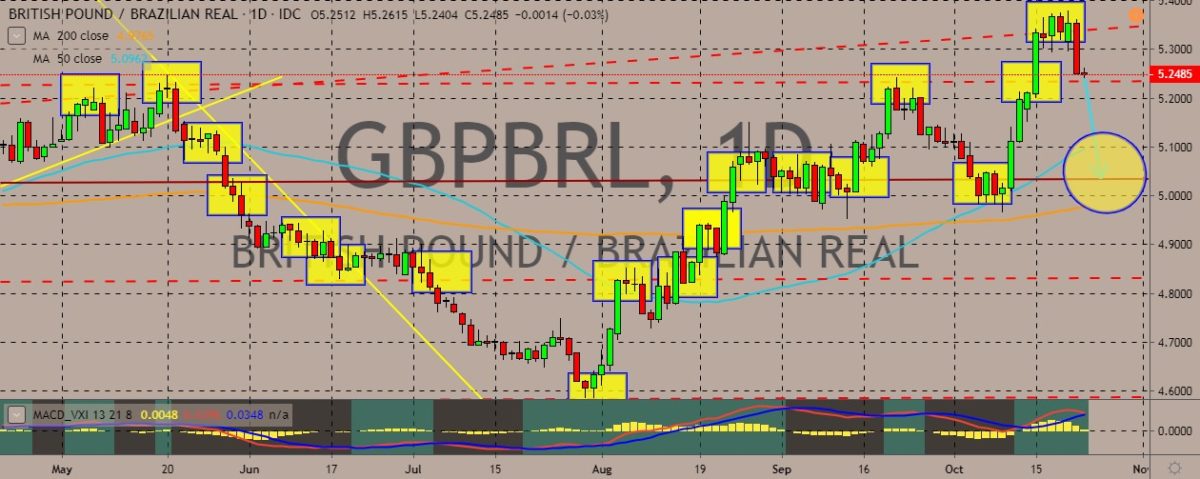

GBPBRL

The pair has suffered a pullback from recent highs, paring back recent gains and slumping to weekly lows. The British pound lost further after British Prime Minister Boris Johnson decided to pause the progress of his Brexit deal through the parliament. In a vote of 308 to 322, the House of Commons rejected the government’s program motion, which is a schedule from the government to push a deal through the parliament. After the rejection, the UK Prime Minister said he will pause any attempts to pass the deal and wait for the European Union’s decision. Over in Brazil, a measure of inflation fell to its lowest in more than 20 years, according to figures on Tuesday. This data solidified the view that the central bank will slash interest rates to a fresh all-time low next week. Consumer prices rose 0.09% from mid-September to mid-October, showcasing the weakest rate of this metric for monthly inflation for any month of October since 1998.

USDRON

The pair is trading back in the green after slipping to monthly lows. It has slipped below the 50-day moving average in previous sessions, indicating that traders have been bearish on the dollar for some time, but are now driving it back up. Over in the US, the housing market appears to be robust, in spite of the softer business spending, a drop in retail sale, and the slowdown in job growth. This is welcome news for a US economy that may need housing to sustain the current recovery. Last week, the National Association of Home Builders reported that builder sentiment in October reached its highest level since February 2008. On top of that, the spike in sentiment so far this year is the largest 10-month change in more than six years. Over in Romania, the country’s consumer price inflation slowed more than expected to 3.5% on the year in September, against the 3.9%, according to the data from the National Statistics Board.

EURNOK

The pair is sustaining an uptrend, with prices now hitting a solid resistance line near its record highs. Over the eurozone, the European Union recently sealed Christine Lagarde’s European Central Bank appointment. Lagarde is set to become the ECB president starting on November 1. Lagarde is the former International Monetary Fund chief and French finance minister, and she will serve a nonrenewable eight-year term as president of the ECB. Meanwhile, Draghi will still oversee one more monetary policy meeting of the ECB this October 24 before he is replaced by Lagarde. Over in Norway, the central bank is expected to keep its policy interest rate on hold. Markets are also not expecting it to implement interest rate hikes anytime soon in the near future. In the last 13 months, the Norges Bank has raised rates four times amid the faster economic expansion since 2012, coming in stark contract to a global slowdown.

COMMENTS